Image Source: Chesapeake Energy Media Relations.

If you have been a shareholder in Magnum Hunter Resources (NYSE: MHR) over the past year or so, you have been a very happy investor. In that short time, the company's shares have more than doubled as revenue and EBITDA have grown at almost the same pace. However, all the growth has taken a toll on company finances, and Magnum Hunter's recent acquisition of acreage in Australia is a head-scratcher. That is, unless the company is setting itself up for a buyout by a bigger player like Chevron (CVX +1.10%). Let's look at why the company's finances and its land grab hint at its desire to sell.

Breaking the balance sheet

Nobody can argue that Magnum Hunter's production and revenue growth have been anything less than spectacular over the past couple years. Unfortunately, that growth has not come cheap: Spending has outpaced the amount of cash brought in from operations in the past two years, and today Magnum Hunter's operational cash flow only covers 7% of the company's capital budget.

This means the company is carrying a pretty hefty debt profile that is becoming rather prohibitive. Magnum Hunter's EBITDA-to-interest ratio today is a frighteningly low 1.22, meaning its EBITDA is only 22% more than what goes out the door to service its debt. Since the company's operational cash flow is nowhere near its capital expenditures, it will likely need to either take on debt or sell some assets to cover the difference. With a CCC credit rating from Standard & Poor's -- junk status -- and coupon rates on debt approaching the double digits, any more debt will be very costly. However, a much larger player could retire most of this bad debt, more than cover Magnum Hunter's capital shortfalls, and reap the rewards of its fast-growing production.

Also, this wouldn't be the first time that Magnum Hunter's management has dealt with a buyout. CEO and Chairman Gary C. Evans sold his former company -- also named Magnum Hunter Resources -- to Cimarex Energy (XEC +0.00%) in 2005.

The giveaway: Australia

There is no shortage of independent oil and gas companies that employ executives who have sold a company at some point in their careers or that have less than desirable balance sheets. However, Magnum Hunter's moves recently in Australia really distinguish the company as one setting itself up for a buyout.

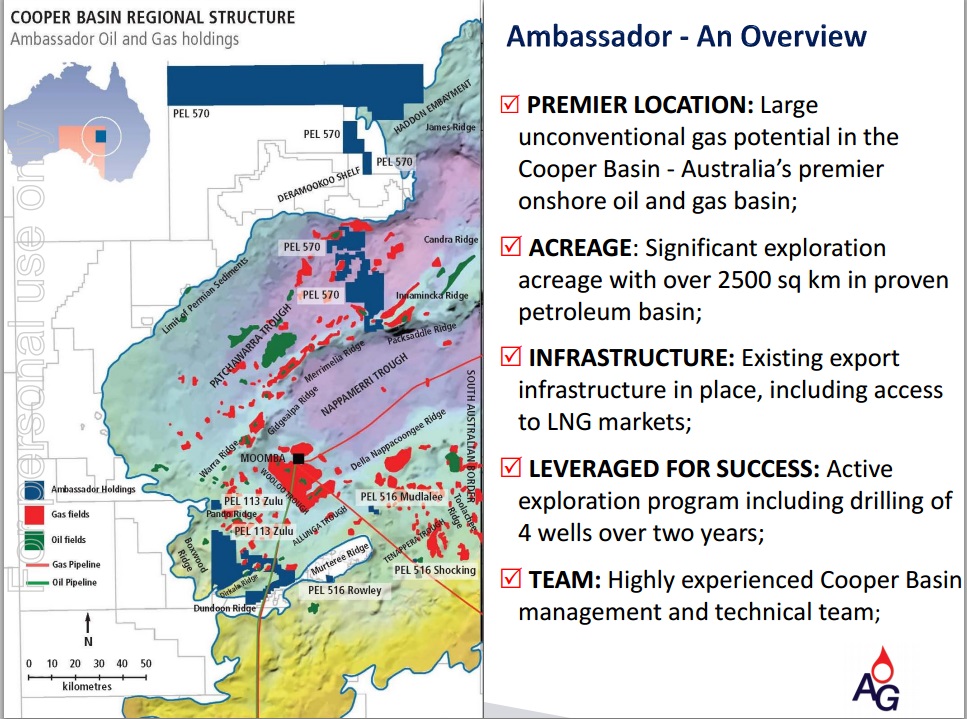

This past week, we learned that Magnum Hunter is in the middle of a bidding war for Australian oil and gas producer Ambassador Oil & Gas with another Australian exploration and production company. This particular company is in Magnum Hunter's sights because it shares an exploration license on a very large tract of land in the Cooper Basin with New Standard Energy, a company in which Magnum Hunter holds a 17% equity stake.

If Magnum Hunter completes this deal, it will own rights to 620,000 acres in the Cooper Basin, which is greater than all of its acreage positions in the U.S. combined.

Source: Magnum Hunter Resources Investor Presentation.

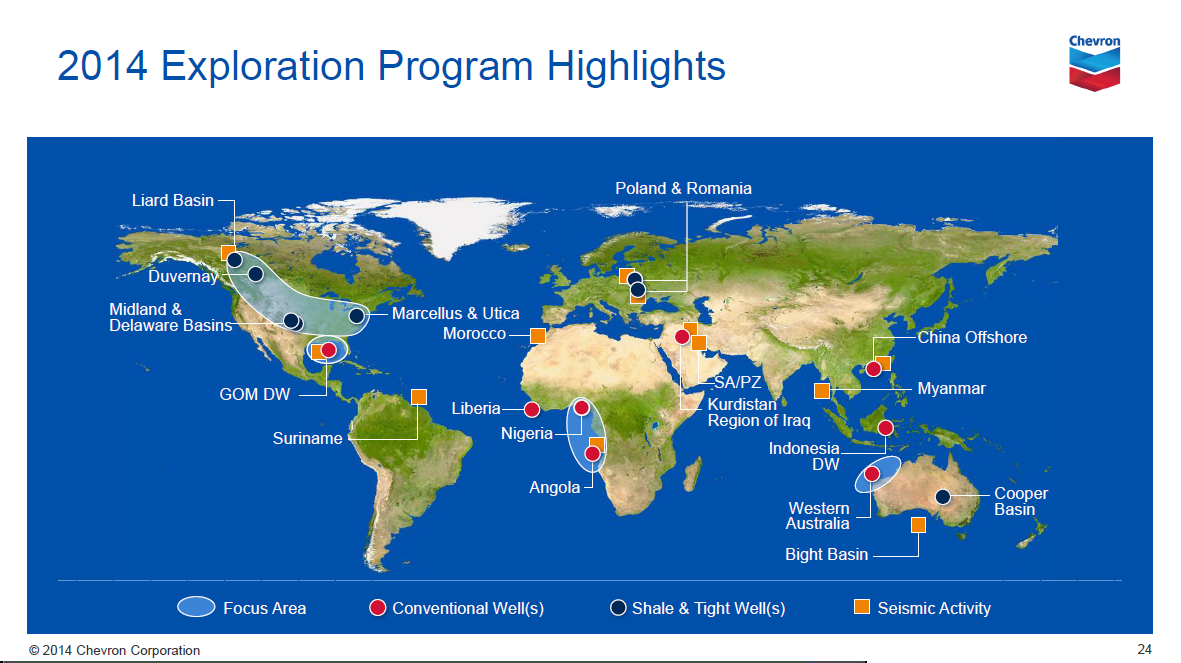

According to Magnum Hunter's executive vice president for exploration, Kip Ferguson, the company hopes to get out in front of an anticipated land rush in the Cooper Basin with the acquisition of Ambassador and its equity stake in New Standard Energy. Both Chevron and ConocoPhillips (NYSE: COP) have been making big moves into gas development in Australia to ensure an ample supply for their massive LNG projects there. Chevron has already stated its desire to develop the Cooper Basin in coming years.

Source: Chevron management presentation.

Here's the issue for Magnum Hunter, though: it's not cheap to drill in Australia right now. The average cost to drill a shale well in Australia is three times the expense in the U.S., and development Down Under will be capital intensive because of the pipeline infrastructure required to monetize that gas. Frankly, based on Magnum Hunter's finances today, the company doesn't have the ability to take on a major exploration project.

Drawing a big bullseye on its chest

Let's add it all up. We have a company that isn't in the best financial health and that has a CEO who has already built an oil and gas producer and then sold it to the highest bidder. This same company is trying to load up on a prospective shale play abroad that it has no hope of financing on its own. These three things suggest Magnum Hunter is getting ready to sell to a bigger player.

This is speculation, but Magnum Hunter would seem to be an ideal fit for Chevron. It would add about 840 million barrels of proved, probable, and possible reserves to Chevron, mostly in the Marcellus and Utica shales, where Chevron has a very strong presence. Add the Cooper Basin connection and Chevron's monstrous LNG projects in Australia, and it's not hard to see Magnum Hunter fitting well into the Chevron portfolio. Also, Chevron has enough cash on hand to buy Magnum Hunter 10 times over.

What a Fool believes

If Magnum Hunter is setting itself up to be bought out, then it makes total sense to lock up its position in the Cooper Basin. Gobbling up a large position in a prospective shale play would be one intangible that could help garner a premium for shares if it were to be acquired by a company such as Chevron. However, if Magnum Hunter is making these moves with the intention of developing the Australian acreage by itself, then the company could be making a mistake. It's hard to see Magnum Hunter having the capital to take on another project that large anytime soon.