walmart.com

You might love or hate Wal-Mart Stores (WMT 0.41%), but if you're an investor, then you should show it some love since it has a track record of taking care of its shareholders. Wal-Mart would like to keep this trend intact, and it has three priorities for doing so: growth, operating leverage, and returns.

WMT Free Cash Flow (Annual) data by YCharts

Breaking that number down, the Walmart U.S. segment suffered a comps decline of 0.4% year over year, and Sam's Club suffered a comps decline of 1.2%. Sam's Club only represents 12.3% of the company's net sales, but this is still an important role. Sam's Club must compete with Costco Wholesale (COST 0.21%), which isn't easy. If Wal-Mart is blaming the poor winter weather for a comps sales decline at Sam's Club, then why wasn't Costco negatively affected by that same weather?

For the 39-week period ended on June 1, Costco delivered a solid comps gain of 4%. This included a comps gain of 4% in the United States, where severe winter weather should have played a role.

The point here is that Costco is a stronger brand than Sam's Club. Wal-Mart is relying on a national rollout of Sam's Club Cash Rewards and the launch of its new industry cash-back credit card to help drive comps growth at Sam's Club. For the 13-week period ending on Aug. 1, comps at Sam's Club are expected to be flat. Comps improved 1.7% for the same period last year. Therefore, this is a negative.

Fortunately, there is good news. Wal-Mart expects its Walmart U.S. segment to report flat comps for the 13-week period ending on Aug. 1, which is an improvement over the 0.3% decline for the same 13-week period last year. On top of that, Neighborhood Market comps increased approximately 5% for the quarter, representing 46 consecutive months of comps growth. Wal-Mart's small-box strategy appears to be paying off and should become more of a focus going forward since it's likely to be a key growth driver for the company. E-commerce also delivered double-digit comps growth year over year.

Overall, while Sam's Club has its challenges, Wal-Mart should be capable of delivering free cash flow and comps growth for investors in the future.

Operating leverage

Operating leverage is different than financial leverage (i.e. debt). Investopedia defines operating leverage as: "A measurement of the degree to which a firm or project incurs a combination of fixed and variable costs."

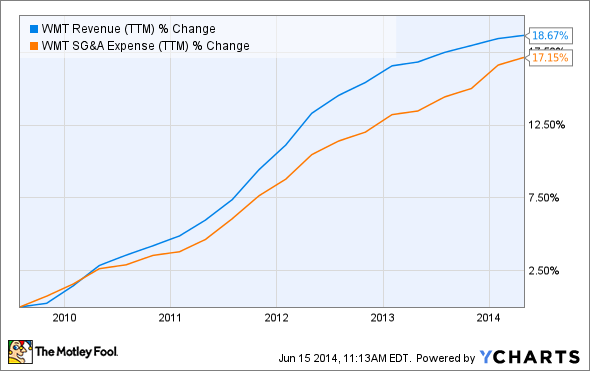

If that still sounds confusing, it basically comes down to Wal-Mart wanting its revenue growth to outpace the growth of its selling, general, and administrative expenses. When a company's revenue outpaces its expenses, it's often the sign of a healthy and well-managed company, and it could provide a hint at long-term success despite what the stock price is doing today.

Wal-Mart's operating expenses grew at a 1.9% clip in its first quarter, outpacing new sales growth of 0.8%. This was a failure. However, Wal-Mart attributed this failure to severe winter weather and higher health-care costs.

Severe winter weather is a temporary event, and Wal-Mart can reduce headcount if necessary in order to reduce health-care costs. Plus, Foolish investors prefer to look at long-term trends, not one quarter. If anything, a poor quarterly result for a strong company can present an investment opportunity. Consider Wal-Mart's long-term performance for revenue growth versus the growth of selling, general, and administrative expenses:

Wal-Mart revenue (trailing-12 months) data by YCharts

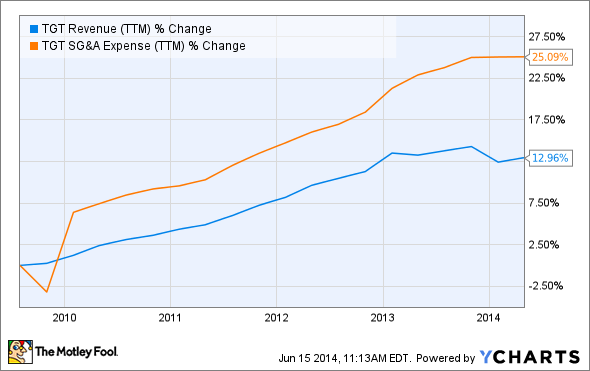

One of Wal-Mart's biggest competitors is Target (TGT 1.05%). We all know about Target's data breach, and you might be tempted to use that as an excuse for Target's lack of efficiency (selling, general, and administrative expense growth outpacing revenue growth); but if you look a little closer, you will see that Target lagged Wal-Mart for this metric well before the data breach. This, by the way, has affected Target's profit margin. For instance, over the past five years, Target's profit margin peaked just north of 4.25% in early 2011, but it has consistently declined since then, and profit margin now stands at 2.71%. When you look at the efficiency chart below, notice that the gap widens in 2013. That's exactly when profit margin really began to take a hit.

Target revenue (trailing-12 months) data by YCharts

Returns

Wal-Mart's return on investment (i.e. the profit Wal-Mart generates from the money it invests in its business) of 16.7% for the first quarter lagged the 17.8% ROI delivered in the year-ago quarter. This was primarily due to a decline in operating income, which was related to continued capital investments in new store growth and e-commerce. Therefore, there's no need to panic. If you look at Wal-Mart's return on invested capital throughout its history, it's not in 1990s territory, but it has been a very consistent performance for many years:

WMT Return on Invested Capital (TTM) data by YCharts

As mentioned above, Wal-Mart's Neighborhood Market is growing. And e-commerce had a 0.3% positive impact on Walmart U.S comps and a 0.2% positive impact on Sam's Club comps. In other words, these capital investments are worthwhile.

The Foolish bottom line

Those who think Wal-Mart is dying are misinformed. Not many mature companies are capable of delivering stellar results every quarter. There are headwinds that lead to required adjustments for continued success. Wal-Mart appears to have its priorities in line with growth, operating leverage, and returns. This should lead to long-term rewards for shareholders.