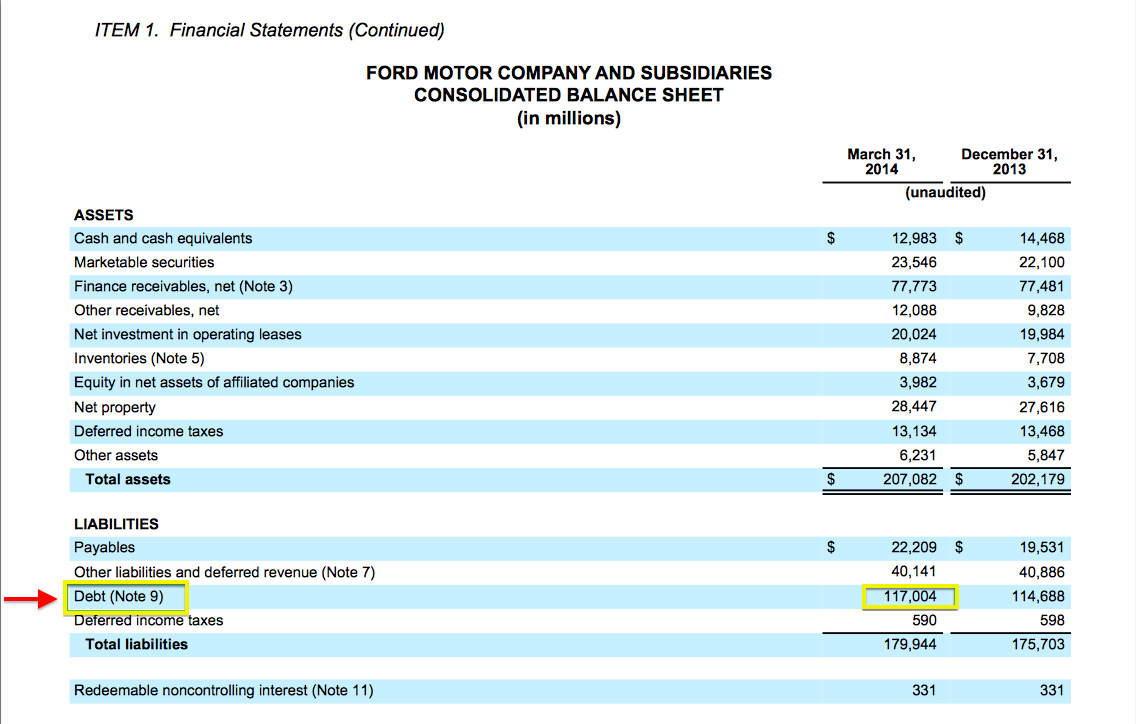

Yeah, you read that right. Ford Motor Company (F 0.50%) has amassed roughly $117 billion in debt, as of its financial reporting in the latest earnings quarter (link opens a PDF). So where does all of that debt come from, and is that a company you really want to be putting your hard-earned money into?

The short answer to that two-part question is simply, yes. But the rationale behind that answer cannot be explained until we tackle part-one of the question: Where does all of that debt come from?

To answer that question, it's imperative to know that, for all intents and purposes, Ford functions like two separate entities molded into one company. There is Ford Automotive -- the one that you are likely most familiar with -- that produces and builds vehicles. Then there is Ford Credit, which acts as sort of a middleman between car buyers and loan lenders.

Breaking down the balance sheet

When eyeing the balance sheet, it would simply appear that Ford is carrying a burdensome load of debt. And to the untrained eye, it is. But with a little digging, you can quickly uncover why the balance sheet looks like this and what it means for the company:

Source: Ford Motor Company first-quarter earnings release

There it is, right on the balance sheet. $117 billion. But, it's not what you think. Typically, debt is viewed as a bad thing. Especially when you look at companies like Apple, Microsoft, or Google, all three of which are absolutely loaded with cash.

And in fact, the only reason some of those companies have debt is because it's cheaper to issue debt and buy back stock than it is to repatriate its foreign cash from overseas (thus paying a steep tax rate of 35%) to buy back stock.

But in Ford's case, this is not why the company has debt. Rather, it comes from the financing that it extends to customers -- which are both individual buyers and dealerships -- when they purchase Ford vehicles.

In other words, Ford Credit acts much like a bank does. And its increasing debt is actually a good thing, because it shows that vehicle demand is increasing as well. Of the $117 billion in debt, over $100 billion of it belongs to Ford Credit. Have a look below where the debt is spread out:

Source: Ford Motor Company first-quarter earnings release

Ford Credit falls under "Financial Services," which is outlined in red in the image above, while Ford Automotive is highlighted in yellow.

Okay so Ford Credit has a lot of debt, is that a bad thing?

We've cleared up which division owns that massive-looking load of debt, but that doesn't change the fact that it belongs to Ford... right?

Well, that's sort of true. But when you peel back the layers and take a closer look, investors will soon realize that Ford Credit's debt isn't debt in the traditional sense.

Normally, a company borrows funds (debt) and pays it back over time. And not just companies do it. Normal, everyday people who want to buy a car or a house do so with a loan or a mortgage.

Ford is a little different. Instead of borrowing debt and using it for corporate purposes, the automaker actually lends the money it borrows -- at a higher rate -- to those seeking to buy a vehicle. Sometimes, Ford Automotive is actually the borrower from Ford Credit. Other times, it's dealerships looking to fill their lots and sometimes its an individual looking to get a new car.

And until that loan is paid back, the car being paid for is collateral. Should the borrower (AKA customer) fail to repay the loan obligations, Ford will simply repossess the car and sell it to offset the remainder of the loan. This keeps Ford's credit risk relatively low. (There is also an insurance that auto dealers can sell, offsetting any difference between the repossessed car value and the remaining loan balance).

Ford Automotive business

Ford Automotive looks relatively healthy when you look at the balance sheet in the image above. Although I didn't highlight it, you can see the Automotive segment has $4.5 billion in cash and $20.7 billion in marketable securities.

This leaves the Automotive segment with a net-cash position of $9.5 billion, as short-term debt (payable within one year) stands at $2.1 billion and with long-term debt equal to $13.6 billion.

Don't discount the greatness of Ford Credit

Source: Ford Motor Company

Do not simply conclude that Ford Credit is this stagnant, boring, debt-ridden machine. To me, things that make money aren't boring, and Ford Credit makes plenty of money.

In fiscal 2013, Ford Credit made $1.75 billion in pre-tax profits on revenues of $7.5 billion. In the first quarter of 2014, Ford Credit brought in pre-tax profits of $499 million on $2 billion in revenues. In the latest quarter, that represents operating margins of 25%. Pretty darn good for a "boring" company, huh?

Concluding thoughts

It doesn't take long for fundamental investors to pull up the balance sheet when scoping out new companies to invest their hard earned dollars in. And one of the first things I look for when I hit that balance sheet is the debt.

However, if investors -- perhaps even you! -- are looking at Ford as a prospective investment, do not, I repeat, do not instantly dismiss the company based on the level of debt that it appears to be straddled with. Sometimes looks can be deceiving.