If you're invested in 3D Systems (DDD 3.03%), Stratasys (SSYS 4.80%), one of their smaller peers, or just following the disruptive 3-D printing space, you know that this technology is growing like gangbusters. According to the Wohlers Report 2014, the global 3-D printing industry grew 34.9% in 2013, to $3.1 billion.

Even more exciting is what lies in the front-view mirror, as we're still in the early innings of the 3-D printing story. With this in mind, let's explore this question from several angles: How big is the potential 3-D printing market?

Wohlers' growth and market-size estimates

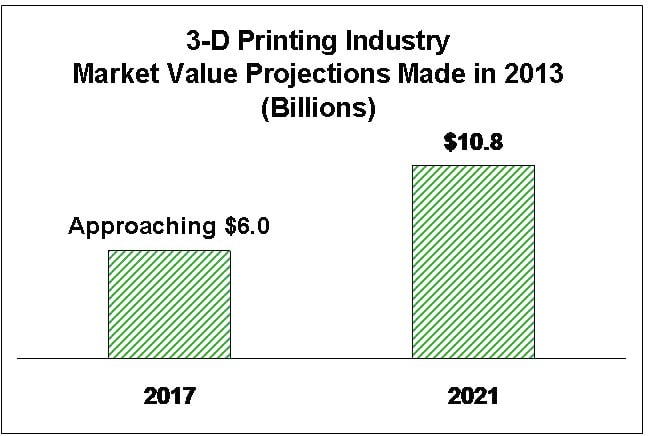

Wohlers Associates -- widely considered the authority on the industry -- believes that the worldwide sale of 3-D printing products and services will jump from last year's $3.1 billion to nearly $6 billion in 2017, and reach $10.8 billion by 2021. This translates to a compounded annual growth rate of about 20% through 2021.

I think, however, that we could see considerably faster growth. Wohlers' recent projections have proven to be extremely conservative, which leads me to believe that the current ones will also prove to be considerably too low. This isn't a knock on Wohlers; when a revolutionary technology takes hold, it's not possible for any expert to accurately foresee all of its potential future uses.

Chart by author. Data source: Wohlers.

Canalys' growth and market-size estimates Research firm Canalys pegged the global market for 3-D printing at $2.5 billion in 2013, which is smaller than Wohlers' $3.1 billion estimate. However, the firm's growth projections are much stronger than those of Wohlers, as it predicts the industry will reach $16.2 billion by 2018, which translates to growth of more than 500%, and a CAGR of 45.7%.

Source: Canalys.

Market-size estimates as a percentage of manufacturing sector

Estimates by the various consulting firms only go five to eight years out. But what's the longer-term potential market size for 3-D printing? We can look to the size of the global manufacturing sector to help us answer this question.

3-D printing is in the very early stages of disrupting manufacturing, just as it has disrupted prototyping. It has already made solid inroads into short-run production, and is on the cusp of starting to be used for larger-run manufacturing. The high-speed, continuous, fabrication-grade 3-D printing platform that 3D Systems is developing for Google's Project Ara to mass produce customizable, modular cell phones has the potential to greatly expand the use of 3-D printing in manufacturing settings. (Here's the latest news about, and a view of, the platform.) This platform, assuming it will function well, appears to be a great fit for producing smaller-sized, customizable products.

I'm not suggesting 3-D printing will ever be used for the bulk of manufacturing applications, as traditional "subtractive" manufacturing is extremely well suited for many, even most, applications. However, as we see more significant advances in 3-D printing -- namely, in speed, build-box size, and materials capable of being printed -- we should see a gradual increase in 3-D printing chipping away at conventional manufacturing's domain. The beauty of the 3-D printing story is that the technology only needs to displace a small percentage of conventional manufacturing to be massively successful.

The global manufacturing sector contributed $10.1 trillion to the world's GDP in 2010, according to consulting behemoth McKinsey. Here's how huge the 3-D printing market would be based upon what percentage of global manufacturing it displaces:

- 1% -- about $100 billion (plus revenue from prototyping)

- 5% -- about $500 billion-plus

- 10% -- about $1 trillion-plus

- 20% -- about $2 trillion-plus

- 30% -- about $3 trillion-plus

Wohlers' estimated that the global 3-D printing market was worth $3.1 billion in 2013. So, even if this technology snatches away only 1% of the world's total manufacturing dollars, it will be a $100 billion-plus market – or about 33 times as large as it is today! (This calculation doesn't account for growth in the manufacturing sector, so we're talking in today's dollars.) It seems to me that 3-D printing could eventually realistically account for at least 5% or 10% of total manufacturing -- this type of growth would be in the astounding range of about 16,000% to 33,000%!

I went as high as 30% because Wilfried Vancraen, CEO of Belgium-based Materialise -- which went public today -- has been quoted as saying that 3-D printing could eventually represent up to 30% of the manufacturing sector.

The "double plus" factor

We also need to consider what I'll call the "double plus factor" that I've not seen explored. First, 3-D printing allows for certain products to be made that can't be produced using traditional manufacturing techniques, so the technology should help to expand the size of the manufacturing sector. Additionally, 3-D printing is capturing some dollars outside of the "manufacturing" classification. These two phenomenon will surely accelerate as further advances are made, resulting in the technology becoming more widespread.

One example is the use of 3-D printing for "bioprinting" applications. Development-stage company Organovo, for instance, has recently announced it bioprinted 3-D liver assays that were able to retain key liver functions for more than 40 days. These same liver assays reportedly would not have been able to be produced using other techniques, so 3-D printing technology has created a new product category here.

As another example, 3-D printing is now being explored as a method of constructing buildings. This nascent application mostly involves printing concrete using large-scale 3-D printers. If this use pans out, 3-D printing would be "stealing" some market share from the "construction" classification.

Foolish final thoughts

It appears very likely that the market size for 3-D printing is going to eventually be considerably larger than even optimistic forecasters believe. One can't help but cover this space and marvel at the innovative and unique uses that are continuously popping up.

While this doesn't necessarily mean that every publicly traded 3-D printing company will be a winner, the rising growth tide should surely help lift some of the stocks. 3D Systems and Stratasys should have an advantage, given they were the early movers in this industry.