It's widely understood that Warren Buffett's favorite economic indicator is freight car loadings. While the reasoning is obvious -- more industrial activity equals more rail traffic -- all indicators are subject to changing circumstances, and rail traffic data is no different. The question is whether the data is still important, and what is it saying about the U.S.industrial economy? In addition, what does the make-up of the data say for the railroad companies like CSX Corp. (CSX +4.47%), Union Pacific (UNP +0.32%) and Norfolk Southern (NSC +0.47%)?

All about coal

Buffett's acquisition of Burlington Northern in 2009 was a classic purchase of a highly cash generative business, that has a strong competitive moat, operating in an industry set for steady long-term growth. Throw in Buffett's predilection for freight car data, and it appears to be an obvious play on U.S. GDP growth. While, all of this is true, readers should note that the rail traffic data has been somewhat skewed in recent years by the tail-off in coal demand.

This chart demonstrates the issue:

U.S. Coal Rail Traffic data by YCharts

I've included chemicals because they are the second-biggest contributor to commodity carloads in North America, and aren't exposed to the kind of thematic declines facing the coal industry in North America. In other words, it's probably a better proxy for economic conditions than coal rail traffic or even total U.S. rail traffic -- with the latter being Buffett's favorite indicator. Coal makes up 17.6% of carload mix by volume in North America

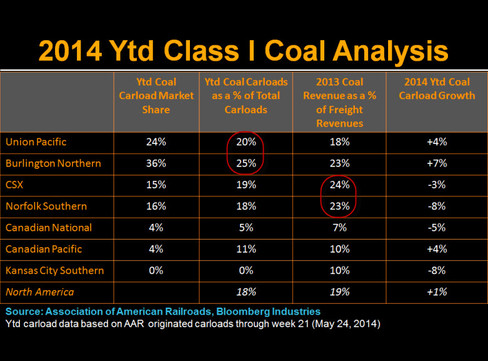

In fact, the demise of coal has a disproportionate effect on the railway companies. For example, this chart outlines the importance of coal to the leading players in the industry:

Source: Bloomberg Research

The third column demonstrates that CSX and Norfolk Southern have a 23% and 24% exposure to coal within their respective freight revenues. Interestingly, Union Pacific has only 18%, suggesting that Union Pacific is the "go-to" stock if you are worried about future coal demand.

Coal making a comeback?

Despite the doom and gloom around the industry -- in part due to the inexorable rise of natural gas as a substitute fuel -- there are some signs indicating a bounce could occur this year. Perhaps the most telling indication was when Joy Global's CEO, Edward Doheny, noted that U.S coal production is expected to incrementally increase this year.

However, the bigger picture is far less clear. Regulatory clouds are forming, and according to a Reuters article, the U.S. Environmental Protection Agency, recently issued federal regulations dictating that the power sector reduce its carbon dioxide emissions from 2005 levels by 30% by 2030. Moreover, earlier this year, China brought forward an aim to reduce its reliance on coal to account for 65% of its energy usage. China's moves are somewhat problematic for the major U.S. coal miners, because they have been looking to China as a source of long-term export demand.

It's also problematic for the railway companies, because Union Pacific, CSX, and Norfolk Southern respectively have 24%, 15%, and 16% of the market for U.S. coal carloads.

The bottom line

The decline in coal rail traffic in recent years means that Buffett's favorite indicator is not as representative as it once was, and Fools should look at the data in context. In particular, focusing on the rail traffic data for chemicals is probably a more accurate way to follow the cyclicality of the U.S. economy. The good news is that the data on chemicals indicates stronger ongoing growth than that of overall rail traffic data.

The future of coal demand is problematic. Not only does this mean that overall rail traffic data is not entirely reflective of the economy, it also means that CSX, Norfolk Southern, and Union Pacific are not entirely the GDP growth plays that they used to be. Food for thought.