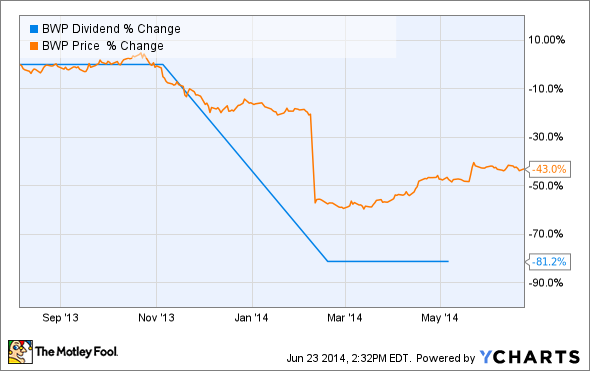

In February, Boardwalk Pipeline Partners slashed its distribution by 81% and the unit price collapsed by 55%.

BWP Dividend data by YCharts

The small recovery since has been based on the investment thesis of a turnaround which management explained was based on a two pronged strategy of debt reduction (debt/adjusted EBITDA over 4.5 results in S&P downgrading one's credit rating) and capital investment in several major projects. These projects included the Bluegrass Pipeline joint venture with Williams Companies, which would have transported 400,000 barrels/day of natural gas liquids from the Marcellus Shale to the Gulf Coast's booming petrochemical industry.

Williams recently pulled out of the venture "primarily in response to an insufficient level of firm customer commitments."

While Boardwalk's management has stated the project is not dead, the fact is without Williams Companies' financial backing, the cash strapped Boardwalk will be unlikely to complete the project. The fact that none of Boardwalk's pipelines actually reaches the Marcellus shale means that the partnership would need to build several hundred miles of additional pipelines to make the project a reality. The extra cost would make the venture uneconomical, especially given management's new emphasis on low EBITDA multiple (how long a projects takes to pay for itself) projects.

For example, Boardwalk's Ohio to Louisiana access project, which will cost $115 million and transport 625 million cubic feet/day of gas, will pay for itself in just 3.8 years. Unfortunately for Boardwalk, it has only four major projects currently under way and only one coming online by the end of 2015.

This means the current distribution is unlikely to grow for several years. Analysts are expecting no distribution increase until 2017 -- at which point they expect the distribution to be raised to $1.1/year (a 6.4% yield at today's price) and remain unchanged until at least 2023.

The rule of thumb for estimating long-term total returns is yield+distribution/dividend growth. When we compare Boardwalk Pipeline Partners to its midstream peers, we see it falls short.

| MLP | Yield | 10 year Projected Distribution Growth rate | 10 year Projected Annual Total Returns |

| Boardwalk Pipeline Partners | 2.30% | *10.65% | 4.40% |

| Martin Midstream Partners | 7.65% | 3.62% | 10.67% |

| Extran Partners | 7.48% | 3.24% | 10.74% |

| Crestwood Midstream Partners | 7.46% | 2.97% | 11.02% |

| El Paso Pipeline Partners | 7.40% | 0.31% | 7.71% |

| Kinder Morgan Energy Partners | 6.90% | 5.65% | 12.55% |

Source: mlpdata.com, S&P Capital IQ

This table compares Boardwalk to the highest yielding midstream MLPs. You can see that neither Boardwalk's current yield nor distribution growth rate (when adjusted for a single projected increase in 2017) is likely to serve investors well over the next decade.

| MLP | Yield | 10 year Projected Distribution Growth rate | 10 year Projected Annual Total Return |

| Boardwalk Pipeline Partners | 2.30% | *10.65% | 4.40% |

| EQM Midstream | 1.99% | 19.55% | 21.54% |

| Targa Resources | 1.86% | 21.11% | 22.97% |

| Oiltanking Partners | 2.10% | 18.46% | 20.56% |

| Sunoco Logistics Partners | 3.02% | 11.26% | 14.28% |

| Tesoro Logistics | 3.35% | 19.78% | 23.13% |

Source: mlpdata.com, S&P Capital IQ

In this table I compare Boardwalk to the fastest-growing midstream MLPs and we see that several have not just higher yields, but are likely to exceed both Boardwalk and the broader market in terms of total returns.

Better alternatives leading to superior returns

Kinder Morgan Energy Partners (NYSE: KMP) and Tesoro Logistics (TLLP +0.00%) are superior to Boardwalk Pipeline Partners for two key reasons:

First, Boardwalk's pipelines are lacking access to key shale areas; most notably the Bakken, Woodford, Barnett, Marcellus, and Utica shales.

Kinder Morgan services every major shale oil and gas region. Meanwhile Tesoro Logistics, though smaller, has a key presence in North Dakota's prolific Bakken formation. Tesoro is building out its High Plains gathering, storage, and transportation infrastructure in the Bakken -- an area in short supply of such infrastructure. By the end of 2015, Tesoro will increase its oil capacity to 100,000 bpd with 65,000 bpd already under long-term fee based contract.

Tesoro Logistics is at an advantage in that it owns two refineries in California (four total on the West Coast, as well as oil import terminals). Due to environmental regulations, no new refineries have been built in California since 1979, creating a substantial operational moat for Tesoro.

The second fundamental reason for owning Kinder Morgan and Tesoro Logistics over Boardwalk Pipeline Partners is potential for future growth.

Tesoro Logistics is working on expanding its West Coast oil import capacity by 350,000 bpd by 2015. With the right of first refusal on drop downs from its general partner Tesoro Corporation and management only pursing projects with internal rates of return of 15%-25%, Tesoro Logisitcs has managed to grow its adjusted EBITDA by 56% annually over the last three years and is expected to grow earnings by 23% annually over the next decade.

Kinder Morgan, meanwhile, has $16.4 billion in projects it's working on, including its $5.5 billion Transmountain pipeline to carry Canadian oil sands to export facilities on Canada's West Coast.

Kinder Morgan represents one of the most diversified MLPs in America, with heavy investments into enhanced oil recovery, CO2 transportation infrastructure, and even oil tankers. In fact, Kinder Morgan recently purchased five oil tankers (with four more being built) and just ordered its tenth capable of hauling 330,000 barrels of oil.

Foolish takeaway

I believe an investment in Boardwalk Pipeline Partners to be an unnecessary risk considering its poor current yield, worse distribution growth prospects, and limited project pipeline. This is especially true given that MLP investors have such excellent alternatives as Kinder Morgan Energy Partners and Tesoro Logistics. With higher yields, stronger distribution growth, and large project backlogs (backed by superior management and stronger balance sheets) income investors in these MLPs are likely to experience long-term market beating total returns while Boardwalk's returns languish.