Allstate (ALL +0.51%) and Progressive (PGR +0.70%) have commanding positions in the insurance industry in America. But it turns out Berkshire Hathaway's (NYSE: BRK-A)(NYSE: BRK-B) GEICO is absolutely crushing them.

The big leap

For the full year in 2013, we learned that GEICO supplanted Allstate to claim the title of being the second-largest auto insurer in the United States. The business at Berkshire Hathaway saw its auto insurance premiums rise by 11.3%, to $18.6 billion, while Allstate only saw its rise by 3.4%, to $18.1 billion.

The growth of Progressive and market leader State Farm was better than Allstate, but none of the big four in insurance saw the gains posted by GEICO:

Source: SNL Financial

In fact, it wasn't just the three major insurers of State Farm, Allstate, and Progressive that GEICO topped, but, in fact, all of the top-20 insurers when it came to adding to its customer base. SNL Financial notes the next closest insurer that saw growth close to what GEICO witnessed was Liberty Mutual -- its policies rose by almost $775 million, or 9.4%, to stand at $9 billion.

And GEICO is running its insurance business more efficiently and effectively, as well.

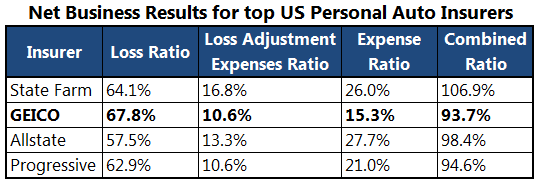

One of the key metrics to watch at insurers is the combined ratio. It's used to calculate if the insurer is actually making money from the policies it writes, after factoring out the losses and expenses. As my colleague Brendan Mathews explains, "A ratio below 100 is good -- that means profits on underwriting; a ratio above 100 is bad -- that indicates losses on underwriting."

Here, again, we see Allstate, Progressive, and State Farm were once again topped by GEICO.

Source: SNL Financial

GEICO had the highest loss ratio -- which measures the actual claims it had to pay out relative to the premiums it brought in -- but you can see it offsets this by doing a remarkable job at managing its expenses. This effective management of the costs explain why it was able to post an underwriting gain of $1.1 billion last year.

On the other hand, despite the fact that Allstate wrote just 3% fewer policies than GEICO, its income was 40% lower, standing at $668 million in 2013, thanks to its incredibly high expense ratio.

Looking ahead

Warren Buffett has long lauded GEICO for its ability to manage its expenses. When it was fully purchased nearly 20 years ago, he said, "The ultimate key to its success is its rock-bottom operating costs, which virtually no competitor can match."

This was true 20 years ago, and it clearly is still true today. It's one more reason for shareholders to be optimistic about the future of Berkshire Hathaway.