Sometimes, even the most promising tech stocks need a little nudge to remind the market of what it's missing. And in the case of Universal Display Corporation (OLED 1.87%), just such a nudge came from analysts at Goldman Sachs Friday.

To be sure, shares of Universal Display popped on Friday, after Goldman issued a new report both reiterating its buy rating on the stock and raising its 12-month per share price target by $2 to $44. For perspective, that represents a nearly 51% premium to Thursday's close.

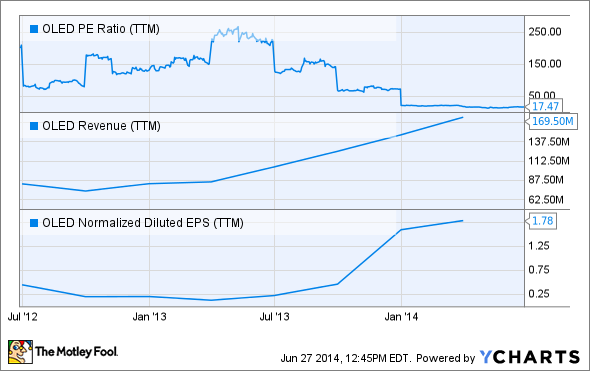

To explain its optimism, Goldman echoed its long-held sentiment that Universal Display is the "most underappreciated product cycle play under [its] coverage," this time thanks to "new product and customer-driven catalysts lining up to drive stock outperformance in 2H14." The report also notes shares currently trade below 18 times trailing 12-month earnings, which means Universal Display is sitting near mouthwatering multi-year lows -- and this despite an earnings compound annual growth rate of 89% since 2011, and a 30% increase in average earnings per share estimates since March.

This is also something, by the way, that fellow Fool Anders Bylund astutely pointed out early last month. For the sake of illustration, here's an updated version of a chart Anders used illustrating as such:

OLED P/E Ratio (TTM) data by YCharts

After shares pulled back two weeks later in spite of Universal Display's exceptional first-quarter results, I even went so far as to call its still-depressed share price "a gift for the patient." After all, for long-term investors, I'm still convinced now it's a perfect opportunity to open or add to a position.

So what's coming down the pipe to drive Universal Display's results over the next year?

First, we've seen continuously growing commitments to OLED technology from Universal Display's largest customers in both Samsung (NASDAQOTH: SSNLF) Display and LG Display (LPL 1.49%).

LG Display's 55-inch OLED panels offer umatched clarity and infinite contrast ratios, Credit: LG Display

On Thursday, for example, LG Display confirmed plans to invest nearly $790 million to ramp large-screen OLED production capacity at its OLED TV facility in Paju, South Korea, during the second half of this year. LG Display Chief Executive Officer Han Sang-beom elaborated the company is also working on deals to supply panels to Chinese tech manufacturers, whom he believes have emerged as "trend setters" in the global OLED industry. What's more, Han also insists "The OLED sector will become the mainstream of the global industry at a faster pace than cathode ray tube or liquid crystal display TVs."

Samsung's Galaxy phones & tablets use Universal Display's OLED technology, Credit: Samsung

In addition, multiple sources recently confirmed LG Display has struck a deal with none other than Apple to serve as the sole-supplier for flexible OLED displays for an upcoming iWatch device. Mass production for the iWatch is apparently slated to begin next month, and could serve as an important piece of validation for Universal Display's flagship technology.

Meanwhile, Samsung has had to put its OLED television ambitions on hold as it works out the kinks in its large-screen OLED manufacturing techniques. However, Samsung has since redirected funds initially pegged for that effort into a new facility to expand small- and mid-sized OLED production for Samsung Galaxy series devices.

As it stands, suffice to say there has arguably never been a more exciting time to be a Universal Display shareholder. Today's gains might seem noteworthy, but over the long-term I'm convinced the best is yet to come.