Kinder Morgan Inc (KMI 0.93%) is expanding in two areas that could help it take advantage of growing global demand for liquefied natural gas, or LNG. A recent announcement by one of its master limited partnerships, or MLPs, hints at this, but its Elba liquefaction project shouts it out loud.

An expanding tanker fleet

First, let's be clear that the announcement was about an oil and petroleum products tanker, not an LNG carrier. On June 16, Kinder Morgan Energy Partners (NYSE: KMP) announced the expansion of its contract with General Dynamics NASSCO for an additional product tanker with a 330,000-barrel cargo capacity, which could specifically be converted to carry liquefied natural gas. The company expects to take delivery in the second quarter of 2017.

Golden State, courtesy Kinder Morgan.

Kinder Morgan already has five such tankers in operation, and four others are under construction at the NASSCO shipyard in San Diego. According to the announcement, these vessels are Jones Act-qualified, meaning they are allowed to engage in coastwise trade within the United States, a practice prohibited to foreign shippers under the law. Rob Kurz, vice president of Kinder Morgan Terminals and president of KMP subsidiary American Petroleum Tankers, said in prepared comments, "There continues to be increasing demand for waterborne transportation to move petroleum products, and these tankers will provide stable, fee-based cash flow to KMP unitholders for many years to come through multi-year contracts with major oil producers."

Kurz also mentioned the Jones Act in his statement, and this tanker fleet is clearly slated for the task of moving oil and petroleum products around the U.S. But it's interesting that the announcement noted the LNG-conversion-ready feature of these vessels.

The Elba liquefaction project

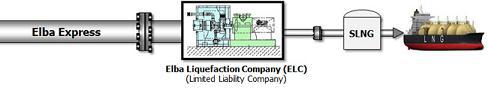

Kinder Morgan is certainly thinking about LNG. Another of its MLPs, El Paso Pipeline Partners (NYSE: EPB), counts among its assets a natural gas pipeline network and an LNG storage and regasification terminal near Savannah, Ga. Several El Paso subsidiaries are involved in a project to add liquefaction and export capability to an existing LNG terminal at Elba Island in Chatham County, Ga.

The two-phase Elba project includes the construction of 10 liquefaction units with an output capacity of 350 million cubic feet per day. El Paso expects to complete the approval process and begin construction by the second quarter of 2015. The Elba project is one of several LNG liquefaction projects undertaken by midstream energy companies in the U.S.

That's because global demand for LNG is being fueled by the lack of pipeline infrastructure in energy-hungry Asia and the desire for more flexible gas supplies in regions beset by geopolitical uncertainty. The shale gas boom in the U.S.is poised to meet that demand, but this requires the ability to liquefy the gas and ship it out on LNG carriers.

Should Fools rush in?

So is Kinder Morgan's LNG-conversion-ready fleet a sign that the company is thinking more about LNG shipping? Even if not, the company still expects its expanding oil tanker fleet to boost distributions from Kinder Morgan Energy Partners.

Both Kinder Morgan and Kinder Morgan Energy Partners have seen solid revenue growth. However, net margins and net income have come down since the quarter ended March 31, 2013. El Paso revenue and net earnings have dropped only slightly, but the margins are steady. Keep an eye on El Paso's distributable cash flow, or DCF, coverage, though. The partnership distributed $0.62 per unit for the quarter ended March 31, 2013, on a DCF of $0.78 per unit. This works out to a coverage ratio of 1.26. In the same quarter of 2014 it distributed $0.65 on a DCF of $0.75 per unit, for a coverage ratio of 1.15. This is still in line with Kinder Morgan Energy Partners, so it's not a concern unless the decline continues.

If revenue, margins, and net income can get in step, all three Kinder Morgan companies bear watching. Keep in mind that the two MLPs are more suited for investors seeking high current yield and tax-advantaged income. Investors could do well over the long term, especially if the company takes full advantage of the emerging LNG boom.