A 3M welding respirator. Source: 3M.

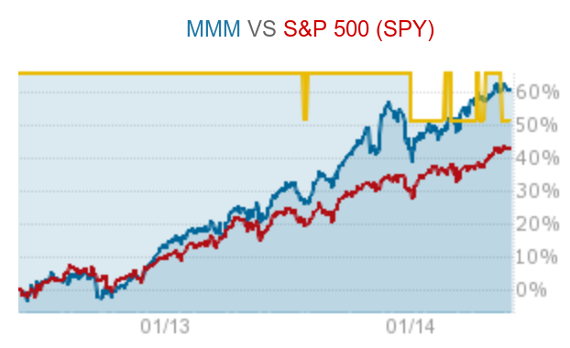

Five of the 30 Dow Jones Industrial Average (^DJI 0.47%) members are setting 52-week highs right now. Some of these annual records are also all-time highs for some of the market's largest and most celebrated companies. None are in any real danger of exploring fresh 52-week lows. Only one Dow member has actually lost investors money over the last year; four different Dow tickers have returned more than 30% in 52 weeks, even without accounting for dividend effects.

With a track record like that, it should come as no surprise at all that the blue-chip index itself is hovering just below its own all-time record level.

No stock in the last year has pulled more Dow points to the stack than 3M (MMM 0.63%). Shares of the multinational conglomerate have risen by 31% or $34.08 per share, which works out to 219 Dow points created. That's an impressive 11.3% of the Dow's entire 52-week gain, especially considering that 3M controls just 5.4% of the index's price-weighted value.

How did 3M pull off this market-defining performance? More important, can the company keep the party going?

Looking at 3M's financial trends, there's plenty to celebrate:

MMM Revenue (TTM) data by YCharts.

Sales are back to sustainable growth again after a few years of recession-powered insanity. Likewise, net margins have found a stable plateau at levels that put pre-recession margins to shame. Put these healthy trends together and you get skyrocketing bottom-line earnings.

Mind you, 3M investors have already swallowed these encouraging figures hook, line, and sinker. The stock's price-to-earnings ratio sits at 20.8 times trailing earnings, which is another multiyear high. The PEG ratio, which adds growth expectations to the basic P/E calculation, is 2.4. A value of 1 implies that valuation is in perfect balance with growth prospects; Values above 2 often point to overvalued stocks.

Our CAPS system also weighs investor sentiment and fundamentals against valuation. There, 3M used to hold a steady 5-star rating out of 5, but a rising share price has removed that coveted fifth star.

Source: Motley Fool CAPS. Yellow line denotes 3M's CAPS rating.

So let's get back to the million-dollar question. What will 3M do for investors next?

In one sense, it's impossible to say exactly what tricks 3M might have up its sleeve. It's in the very nature of this serial innovator to keep surprising everyone -- customers, rivals, investors -- with brand new ideas.

That's how 3M became the sprawling, global giant it is today, collecting 70% of its $31 billion in annual revenue from foreign markets. The company has five reportable divisions, more than two dozen more specialized business units, and household-name brands too numerous to count.

3M is the very picture of diversification, touching everything from consumer electronics and health-care products to heavy construction and industrial adhesives. This ultra-diverse business model makes 3M largely immune to changes or even outright revolutions in any single target market.

All of this diversity and prosperity flows out of 3M's fantastic research facilities. Very few companies put their back into research and development the way 3M does. The company's unwavering commitment to keeping its R&D-driven soul alive shows up in this chart:

MMM Revenue (TTM) data by YCharts.

More revenue? Great -- that means we get to do even more research!

That's the perfect attitude for any company that bases its entire business on continuous innovation, as 3M does.

All things considered, 3M shares are certainly running a bit hot these days. There's nothing wrong with the business model, especially if 3M can keep its margins high and stable without sacrificing revenue growth. But the company must still earn its lofty valuation ratios.

Nomura analyst Shannon O'Callaghan recently reiterated his buy rating on 3M, citing management's aggressive use of capital. According to O'Callaghan, a debt-powered flood of share buybacks will lower 3M's cost of capital while boosting earnings per share. The company also looks hungry for larger acquisitions these days, which could accelerate sales growth even further.

Weigh your own view of 3M's prospects against the sky-high valuation. 3M investors might want to wait for a price correction, buying on the dips -- but market timing is not an easy game to play and 3M's long-term value is fantastic either way.

I'm starting a bullish CAPScall on 3M based on this analysis. That way, I keep some virtual skin in the game while keeping an eye out for price swings or game-changing news on the company. Feel free to follow my example with a CAPScall of your own.