The Dow Jones Industrial Average (^DJI 0.62%) was trading 144 points higher, or 0.86%, by midafternoon after positive economic data on China and U.S. manufacturing hit news feeds. China's factory sector expanded in June for the first time in six months; and while growth in the U.S. manufacturing sector slowed a bit, new orders reached a six-month high. Investors have been patient after disappointing economic data from the first quarter, and have found few reasons to sell as economic data improved over the last three months.

Meanwhile, the automotive industry this morning released sales data for June.

Sales day

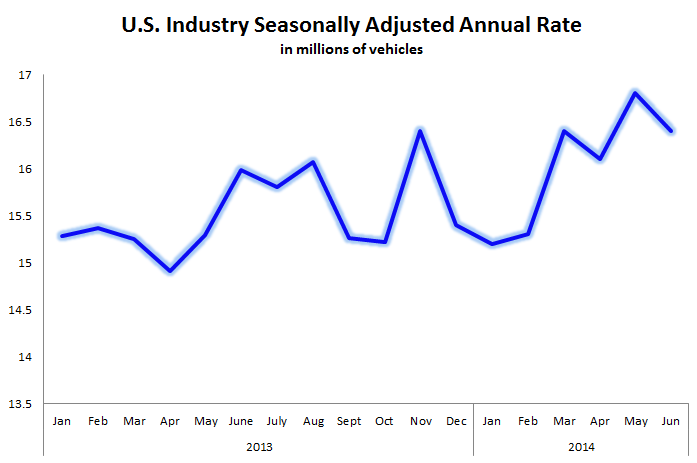

While all the data from major automakers in the U.S. hasn't been compiled yet, the numbers look positive at first glance. There had been concerns that a very strong May, which had a fifth selling weekend, pulled sales from June. While that may indeed be the case, sales results from last month still appear to be very strong. If the projected seasonally adjusted annual rate, or SAAR, of vehicle sales holds up, it will be the fourth-consecutive month that SAAR will top 16 million vehicles.

Auto industry SAAR of vehicle sales. June 2014 estimate from Edmunds.com.

Fiat Chrysler Automobiles (NASDAQOTH: FIATY) and Nissan appear to have led all major automakers with respective 9% and 5% sales increase in June, compared to last year's results. Despite General Motors' (GM 0.27%) massive 2014 recall total of more than 25.6 million vehicles in the U.S. alone, it eked out a 1% year-over-year sales gain last month. Ford (F +0.15%) posted a 5.8% decline in June sales, which was slightly better than the 6.5% drop forecast by Edmunds.com.

While these gains may not seem impressive, there's more to the story. Many automakers don't adjust for differences in selling days between the comparable months from year to year. For example, June 2013 had 26 selling days, while last month had only 24.

When Fiat Chrysler Automobiles' 9% year-over-year sales gain in June is adjusted for selling days, the spike to 18%. Likewise, General Motors' meager 1% gain in June, compared to last year, improves to a 9% increase through that adjustment. And adjusting Ford's 5.8% sales decline in June converts it to a 2.1% increase from the year-ago period.

Industry executives remain upbeat about automotive demand in the back half of 2014, and beyond.

"Sales in the first half of 2014 indicate a steadily recovering industry, and we expect this pace to increase as we move into the second part of the year," Bill Fay, Toyota division group vice president and general manager, said in prepared comments, according to Automotive News.

Ultimately, the automotive market and new-vehicle demand in the U.S. remain very healthy and in arguably the best shape since before the recession. Interest rates and credit availability, mixed with improving economic conditions, should provide room for sales to drive higher in the years ahead.