European plane maker Airbus (NASDAQOTH: EADSY) recently received a rude shock. One of its key clients and the fastest growing Gulf operator, Emirates Airline, cancelled a multibillion-dollar deal the two had made back in 2007. What makes matters worse is that the cancellation is for the A350 aircraft on which Airbus' future hopes are tied, and it happened just months before the aircraft enters service. The A350 is Airbus' answer to Boeing's 787 Dreamliner and regarded as a modern marvel. How does this setback affect Airbus? Let's find out.

The multibillion-dollar setback

Emirates recently called off its 70 orders for Airbus A350 wide-body aircraft, which is the largest cancellation suffered by Airbus to date. The deal amount was around $16 billion in 2007, and the current list price is roughly $21 billion. Though Emirates management did not cite any specific reason for the decision, suggesting it had to do with "fleet management," it did sound an alarm bell for Airbus. The company is currently pressed for cash, having invested around $15 billion on development of the fuel-efficient A350XWB aircraft, which is expected to showcase similar technology as in Boeing's widebody Dreamliner 787 jets.

The A350-900, Source: Airbus.

With this cancellation, the order book for A350XWBs currently stands at 742 from 38 customers. Albeit this number shows that the backlog is strong and not dwindling, the cancelled Emirates order did represent around 8.5% of Airbus' backlog. This is also a big competitive setback as Emirates placed orders for 150 Boeing 777Xs with 50 more options at the Dubai Air Show in November. Bloomberg reports that Mark D. Martin, CEO of Dubai-based Martin Consulting, has said that "the 777 is now increasingly becoming the mainstay fleet of Emirates ... the 777 is flying to almost all their key destinations."

Airbus-Emirates relationship continue

The Emirates' cancellation made investors nervous, and the stock price dropped, but COO John Leahy has soothed concerns by saying other operators have shown interest in buying the planes, and the company hopes to sell the lot by 2020. The firm order of 50 A350 planes by Etihad Airways from the Dubai Airshow also serves to neutralize the negative impact of the Emirates cancellation. The plane maker has a huge wide-body aircraft backlog of 5.6 years of production, with a majority of A350 logged orders.

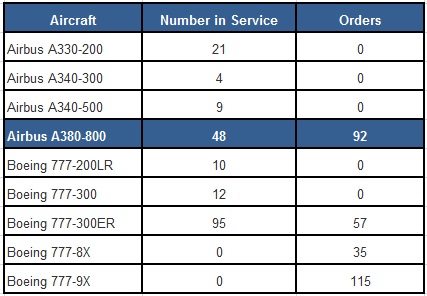

The deal cancellation does not signal a rift in the long-standing relationship of Airbus and Emirates. A few months back in November 2013, Emirates placed orders for 47 A380s. Given that the superjumbo jets are finding it difficult to find buyers with growing popularity of twin-engine aircraft, the deal was a nice surprise. Tim Clark, President of Emirates Airlines, said while appreciating this airplane, "The A380 is our flagship aircraft. It is popular with our customers and delivers results for us in terms of operational performance." Emirates already has a fleet of 48 A380s in operation and remains the top client for this aircraft.

The Emirates fleet dynamics. Source: airchive.com.

With this order Airbus' backlog for A380 superjumbo increased to eight years of production, far ahead of Boeing's backlog of 2.8 years of production for its own superjumbo 747.

Airbus is in a strong market position

Airbus won 15 new customers in 2013 and ended the year with close to 51% gross market share in the aircraft category over 100 seats. It successfully closed its order book 80% higher than that reported in 2012 for commercial aircraft. This was almost 11% greater than the net order count reported by Boeing. Airbus President and CEO, Fabrice Bregier, stated -- "In 2014, there will be further improvements in our global competitiveness, efficiency and effectiveness. The focus also will be on incremental innovation that is simpler, less risky, and less costly and comes faster to market."

True to his words, within the first five months of this year, Airbus racked up 203 net orders that is a comfortable count for the airplane manufacturer. The company is undertaking several measures to improve its profitability and free cash flow generation that has been a big concern for investors.

Foolish last word

The cancellation of the Emirates order is definitely bad news for Airbus, but it's good to know that the company is confident that this would not disrupt its delivery schedule. Emirates is a big account for the plane maker, and the A380 order marks the trust that the airline still has on Airbus manufactured airplanes. The strong backlog and the ongoing recovery in the commercial airplane segment provide Airbus with a cushion for what could have been a big blow to its future revenue prospects.