Computerworld sleuths have revealed how Google's (GOOG 0.23%) (GOOGL 0.20%) select carrier, Verizon (VZ +0.40%), has been failing to follow through on an online offer for 100MB of free data per month for two years to customers who purchased the 4G LTE edition of Google's premium Chromebook, Pixel. The online offer promised buyers 100MB of free data each month, but Verizon stopped honoring the free data pledge halfway through the promised two-year term. Verizon remains adamant that it was not aware of any two-year commitment, and insists its free data offer was only valid for one year.

Google is now to trying to do some damage control by providing $150 Visa gift cards to affected Pixel owners.

The Chromebook marketing debacle couldn't have come at a worse time -- Chromebooks have been quickly gaining traction after remaining in the shadows since their launch four years ago. About 25% of all low-cost laptops sold in the U.S. today are Chromebooks. It's quite likely that a sizable number of people were affected by the Verizon marketing mix-up, and the ordeal left a bad taste in their mouths.

Can this unfortunate development potentially reverse Chromebook's market share gain?

Details of the Verizon deal

Chromebook Pixel is a high-end 12.85-inch Chromebook model that Google launched about 14 months ago. The Pixel is a laptop designed to compete with Apple's 13-inch MacBook Air. The Pixel's screen sports 4.3 million pixels, giving it the highest pixel density of any laptop.

It appears as if Google introduced the Pixel to counter widely held perceptions that the Chromebook was a poor man's laptop. The base Wi-Fi model costs $1,299 compared to $199 to $299 for lower-end Chromebooks. The second Pixel model, which is the subject of the concern, comes integrated with Verizon LTE and costs $150 more than the Wi-Fi model.

Judging by the way the two Pixel deals have been packaged, it's fair to assume that buyers of the LTE model might have been partially influenced by the free data offer, although 100MB per month does not go very far. However, for many consumers, whether retail or tech, the quality of products and the ease of their availability tends to be more valuable than any freebies.

Google is trying to make amends for Verizon's goof by offering free Visa gift cards to aggrieved Pixel customers and, hopefully, the company's goodwill gesture will be well received.

That Chromebooks are selling like hot cakes is undeniable. But, just how many Chromebooks, or Pixels, are sold every quarter, on average? It's rather hard to get Chromebook sales figures because Google does not sell Chromebooks directly. Chromebooks are typically sold by third parties, not through the Google Play Store. It would be easy to argue that the Pixel marketing debacle happened because Google's marketing arm is not directly involved in the sale of these devices.

Google also does not license its Chromebook OS to manufacturers, unlike Microsoft, which licenses Windows OS to OEMs. Google simply dictates the specs and price points of Chromebooks, which is why they are considerably cheaper than other laptops.

Despite the success of the Chromebook, Google revealed in its fourth-quarter fiscal 2013 results that it does not book any revenue on Chromebook sales -- at least not directly.

However, Google maintains frequent updates for all 19 of its Chromebook models, including the earliest version, Chromebook CR-48. Considering that Google does not make a profit from Chromebooks, why does the company go to such great lengths with the devices?

Monetizing Google's free web-centric model

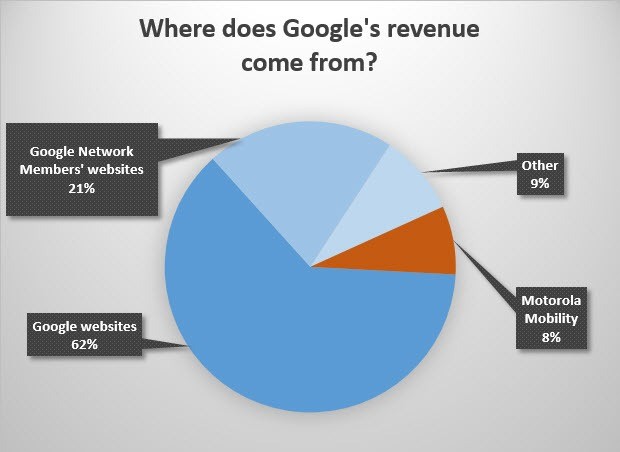

Google is, essentially, an advertising company, as 83% of its 2013 revenue came from advertising.

Source: ZDnet

Chromebooks have developed a reputation for providing great web surfing experiences. Google has developed a rich ecosystem of Web apps that makes for a better experience, encouraging people to surf more and view more ads, which in turn swells Google's coffers.

Chromebooks operate on Chrome OS, which is designed to work with Google services. A majority of Google Web apps such as Gmail, Docs, and Calendar have offline modes that operate much like programs on traditional computers. However, to access other apps and extensions, you must use Google's Chrome Web Store, which is carefully curated by Google to make sure items meet the company's stringent requirements. Google, therefore, makes money indirectly from Chromebooks when users connect to its cloud and download apps from the Web Store.

Microsoft uses a similar strategy to entice users to connect to its cloud. The company recently announced plans to lower the prices of Surface tablets (which it sells at a loss) and also decreased OneDrive prices for the lower price tiers to match those of Google Drive.

Conclusion

Whether or not the Verizon-Chromebook Pixel marketing debacle will materially affect Chromebook sales remains to be seen. However, for many customers, quality and supply chain glitches are typically considered more serious. Google remains fully committed to supporting Chromebooks by providing frequent product updates, which has played a big part in popularizing the laptops.