As competition in the aircraft space intensifies, the prime point of concern for the European aerospace giant Airbus Group (EADSY +0.25%) is cash generation amid massive development costs. The aircraft manufacturer's negative cash conversion in the past several quarters has drawn a lot of attention and criticism. But the company has taken a target of generating breakeven "free cash flow before acquisitions" in the current financial year. How will Airbus manage this uphill task?

Source: Airbus.

Lessen cash drain

Primary factors that are contributing to the poor cash generation are development programs like A350, and A320NEO, a plunge in defense spending by the government, weak sales of jumbo jet A380, and large one-time charges. Free cash flow was -2.03 billion euros in the first quarter vis-a-vis -3.16 billion euros recorded a year ago.

But the good news is that, other than A350 and currency impact, the company does not anticipate any more significant one-time charges. It's also counting on its substantial backlogs, completion of the A350 development program, and its operating strategies, to attain its free cash flow target. Airbus Group expects EBIT before one-off to be modest this year, but is confident that it would be in the range of 7%-8% in 2015.

Substantial backlogs and higher delivery rates

Airbus is trying to improve its cash generation by working its way up the backlog list and delivering as many aircraft in the earliest possible time. The world economy is gradually recovering, and this has resulted in better air-traffic volumes. With more and more people opting to travel by air, the demand for aircraft is expected to increase in the future. And it's on the basis of this expectation that airlines are placing better orders, resulting in bigger backlogs.

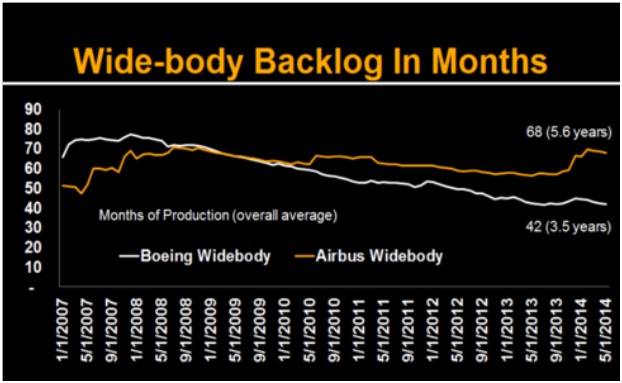

According to a Bloomberg report, Airbus' wide-body backlog is currently at 5.6 years of production, ahead of Boeing's (BA +1.83%) less than four years. The European plane maker recently signed a deal for 50 A350s, which pumped up its order book.

Source: Bloomberg.

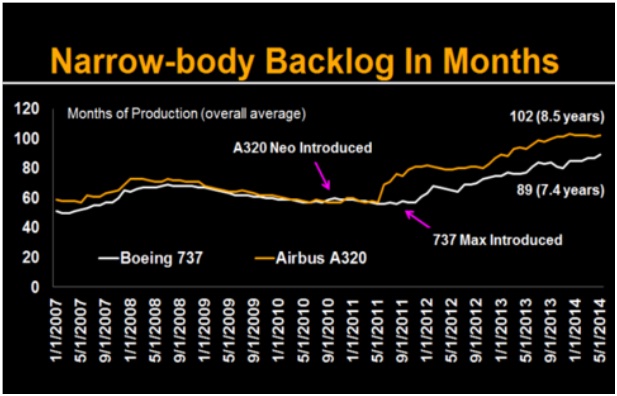

Narrow-body backlog is also at record levels, with more than eight years of production for the best-selling A320 series airplanes. Airbus has bagged a contract for 146 A320 airplanes from EasyJet. Boeing's 737 series currently has a backlog of more than seven years. Airbus has successfully increased its production to 46 planes a month, but the new order wins are still more than the monthly deliveries. The faster production rate should help cash flow generation.

Source: Bloomberg.

A350 is "progressing toward certification"

Airbus and Boeing have heavily spent on the A350 and 787, respectively, in an endeavor to create revolutionary carbon-fiber aircraft. Finally, the Flight Test program for A350 is nearing certification with more than 1,600 FT hours logged to date. The company is trying to keep a tight rein on costs, and remains on track for its first delivery in the third quarter. Although Airbus has given cautioned regarding the A350 XWB program, which could have an impact on schedule and cost, it expects lesser teething troubles than Boeing's 787.

A350 XWB. Hot weather test performed in May 2014 at McKinley Climatic Laboratory. Source: Airbus.

Working on existing platforms

After spending billions on the A350 program, Airbus has warmed up to the idea of remodeling on existing platforms to generate cash. Modernization of A320 and A330 are cases in point. The upgraded version of Airbus' top-selling A320, called the A320neo, is scheduled to enter service in 2015, two years ahead of the 737Max. The A320neo has received orders for nearly 2,650 units, while the 737Max has recorded orders for 2,000 units.

Airbus is considering planting new engines on the refreshed A330 to cut fuel costs and compete with the Dreamliner. According to Airbus COO John Leahy, the refreshed version, dubbed the A330neo, could log orders for more than 1,000 units. Both Boeing and Airbus are heavily relying on their cash-making models to make up for the money drained in developing the 787 and A350, respectively.

Targeting breakeven on A380

On its website, Airbus says that, "An A380 takes off or lands every five minutes in the world." Though more than 10 airlines operate 132 of these jumbo jets throughout the world, demand for this aircraft has been sluggish since 2007.

According to Bloomberg, the more efficient twin-engine aircraft and the global recession have eroded the jumbo jet market significantly. However, Airbus has been luckier than Boeing has been with its 747s. Airbus got an order for 47 A380s from Emirates in November, which increased its order book to eight years of production. Boeing's 747 backlogs currently stand at 2.8 years. Airbus wants to learn from its experience with the A380s so far, and is targeting to break even on this platform by 2015.

Foolish thoughts

Airbus' poor cash flow generation is a long-standing concern for investors. But, finally, things could be looking up with huge backlogs, nearing completion of the A350 development program, the company's strategy of overhauling existing aircraft, and a possible breakeven on the A380. Though the risk of complications in upcoming models leading to additional cost remains unavoidable, the overall strategy looks well placed, and augurs well for the plane maker.