Samsung (NASDAQOTH: SSNLF) recently released its second-quarter guidance, and things didn't look so good for the world's largest smartphone maker. The company expects profit to fall to about $7.1 billion for the quarter, representing a 24% drop year over year.

To help calm investor fears, Samsung released a "reference material" document explaining what's causing the company's profits to fall. But as we've seen in the recent past, these problems may be more than just a one-time issue.

China and Europe issues

Here's what Samsung had to say about sales in China and Europe:

The company "saw increased competition in the Chinese and some European markets." And that increase "led to higher inventories for the medium- and low-end smartphones." In sum: Cheaper rival devices, particularly in China, caused a large amount of Samsung devices to go unsold. In addition to this, Chinese consumers are snubbing Samsung's 3G devices as they wait for more 4G network rollouts in the country.

But we've heard this before. Back in January, Kantar Worldpanel data showed that Samsung sales dropped 2.2 percentage points, year over year, in Europe, and the ambitious smartphone maker Xiaomi unseated Samsung as the top smartphone maker in China during the same time.

In a Bloomberg article published two years ago, Asymco analyst Horace Dediu, said he was skeptical of Samsung's continued strength in its smartphone position because it doesn't control the software its phones run on -- making it hard to keep customers within its brand when cheaper alternatives come along. In China at least, this seems to be coming true for Samsung.

More problems on the way

At its I/O Conference last month Google (GOOG +0.72%) (GOOGL +0.66%) rolled out new smartphone standards, called Android One, aimed at developing markets. Android One is Google's way of getting inexpensive smartphone markers to create devices that meet strict hardware specification standards and ensure the Android software can be continually updated.

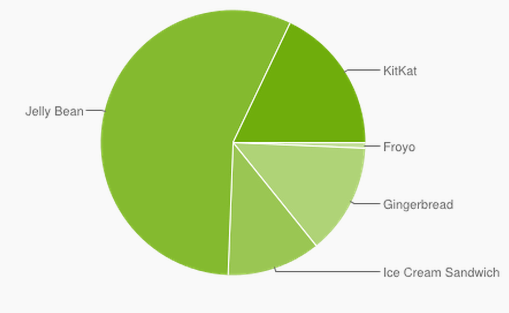

Google helped close the fragmentation gap a bit with KitKat, but there are still a lot of Android versions running out there. Source: Android.

With Android One, Google is trying to tackle its software fragmentation problems and in turn help smaller vendors make better devices. But this could eventually have a negative effect on Samsung, as it's already taking a hit from vendors making cheaper Android devices.

Chinese vendors typically use forked versions of Android, but with Android One we could start seeing a lot more smaller companies making official Android devices, pushing Samsung's lower-end devices down even further.

Foolish takeaway

Part of Samsung's problems are actually part of a larger picture for most smartphone manufacturers. Though the South Korean-based company may be taking the brunt of the issues in Europe and China right now, that doesn't mean Apple and LG won't feel some of the same effects. While the iMaker has made China one of its top priorities, the company has been pushed down by Chinese smartphone vendors just as Samsung has.

What's a bit troubling for Samsung is that unlike Apple -- which makes its own OS -- Samsung has to rely on canvasing the smartphone marketing with lots of products and then marketing the heck out of them to generate sales. While that's worked for a while, the latest guidance report suggests this may no longer be a viable strategy in China and Europe.