Leading drone maker AeroVironment (AVAV 1.50%) reported better than expected profit for the fiscal fourth quarter earlier this week, and fiscal 2015 looks like it will be another strong year.

This is the second quarter in a row that AeroVironment has toppled expectations, and it appears that bright days are ahead for the company. Here's an overview of what I learned from the report and why this is quickly becoming one of my favorite stocks.

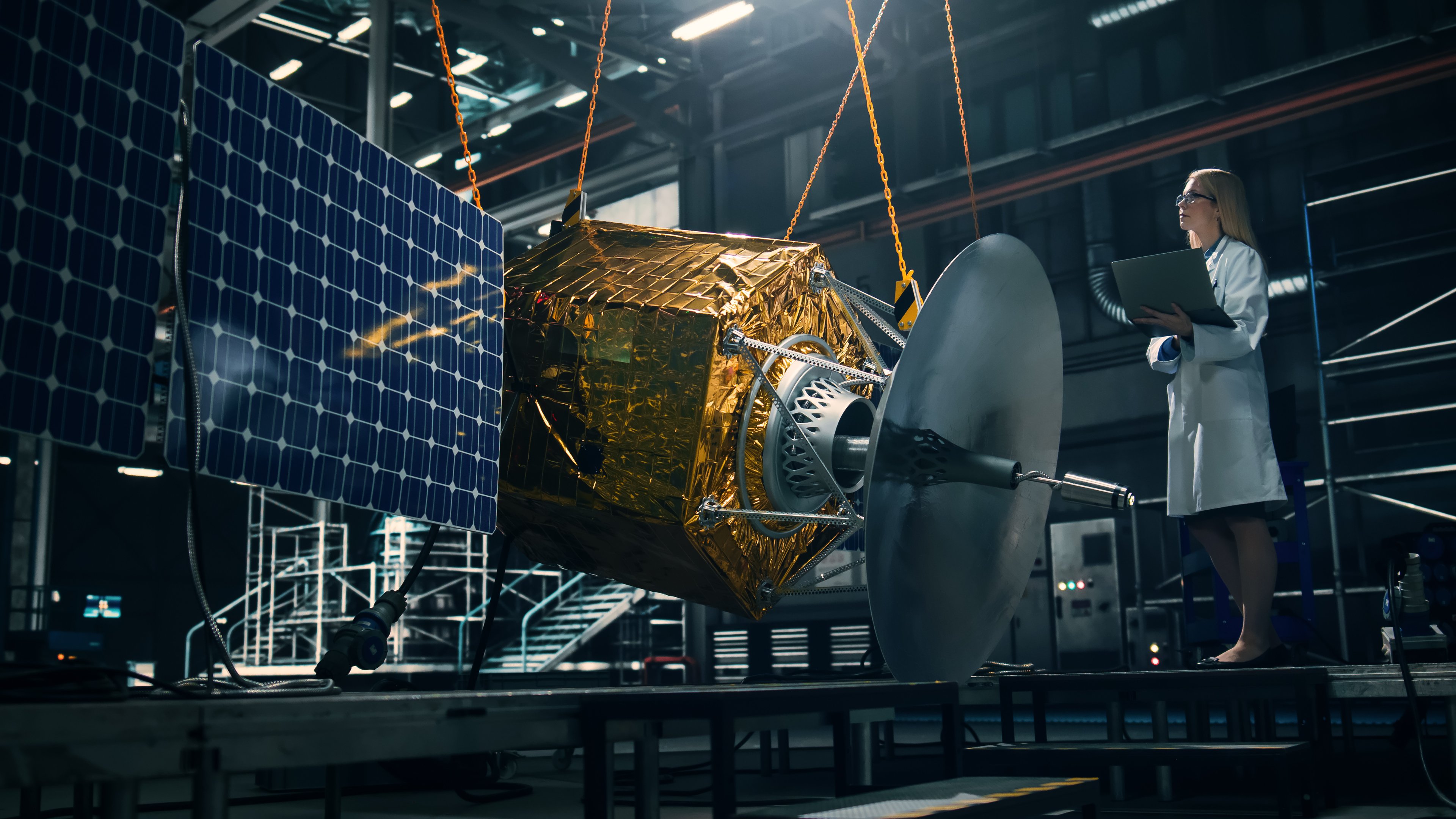

AeroVironment is flying commercial missions for BP in Alaska, the first commercial flights in the country. Source: AeroVironment.

Drones are making a comeback

For now, a majority of Aerovironment's revenue comes from making drones for the military. This may change someday as commercial drones are tested and approved, but in the short-term the military is where demand is.

Small commercial drones like this one are the future of AeroVironment. Source: AeroVironment.

In the fiscal fourth quarter, Unmanned Aircraft Systems (UAS) revenue was up 42% from a year ago to $60.0 million, driven by a $22.4 million increase in product revenue. After dealing with tight military budgets over the past few years it looks like spending is opening up slightly and small drones are becoming a priority for the military.

But when I look at AeroVironment's potential I see a number of new markets that will open up beyond just the military. The company is flying commercial missions for BP in Alaska, mapping and modeling the terrain as part of its contract. In that respect, AeroVironment is adding capabilities beyond just providing drones to customers.

Its Global Observer model is another high potential business for the company, although its timeline for significant financial impact is three to five years. The high-flying aircraft is targeted for surveillance in countries around the world and a recent partnership with Lockheed Martin (LMT 0.52%) to provide system support gives it even more appeal. The fact that Lockheed Martin would come into the fold when it has its own UAS under development is a good sign. The partnership will be able to leverage Lockheed's worldwide reach and system integration capabilities to offer an attractive surveillance offering to countries over the next decade, which should benefit both companies.

Long-term, the UAS business provides incredible opportunity for growth both as a leader in supplying small drones to the military and as the only approved drone maker to fly the first commercial missions over land, Aerovironment already has a lead in the market.

TurboCord is AeroVironment's effort to create a simple charging solution for consumers. Source: AeroVironment.

EVs contribute to growth

The other business for AeroVironment is investing in is Efficient Energy Systems (EES), or electric vehicle chargers. This business is much smaller but still grew 15% to $13.5 million last quarter.

AeroVironment has partnerships with most major automakers to provide charging products and is simplifying charging with TurboCord as well. The adoption of EVs hasn't been terribly fast so this business remains small, but it certainly has upside long-term.

If you're interested in AeroVironment's stock, don't consider buying it because of EVs alone. They're a sweetener if you like the drone business because EVs have high potential and AeroVironment is building a lot of very attractive partnerships concerning charging.

The future looks bright

Drones and electric vehicle charging can both be volatile businesses, even just based on the timing of orders. But over the long term, both businesses are seeing positive trends develop, as was evidenced last quarter. For investors who can buy and hold for years, AeroVironment provides great exposure and leading market share in both of its emerging businesses.