Arguably the biggest obstacle in FedEx's (FDX +0.14%) growth path is the economic uncertainty and sluggish growth in the world economy. Speaking at the recent fourth-quarter earnings release, CFO Alan B. Graf Jr said, "It used to be that international trade was a multiple of GDP, and those days have passed, we do expect global trade will pick up, but I don't think it'll be a multiple of GDP."

While this is a harsh reality, FedEx has to expand its international footprint, as that's where the growth lies. According to the U.S. Commercial Service, 95% consumers live outside the U.S. Here's the latest update on FedEx's international gameplan.

Source: Wikimedia Commons.

Buying spree

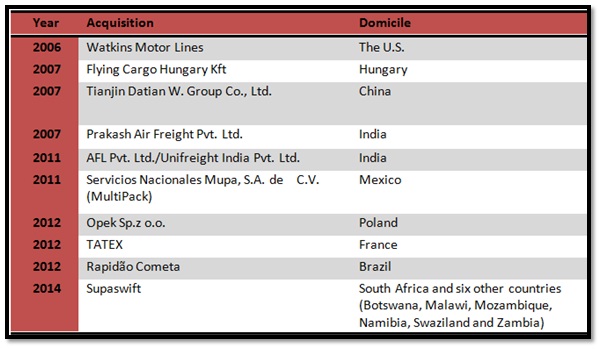

In its 2013 10-K, FedEx says that "as the world's economy has become more fully integrated, companies are sourcing and selling globally." Delivery companies are a direct beneficiary of the global buying and selling since they facilitate this trade. FedEx is present in more than 220 countries and handles 90% of the global GDP. It has significantly increased the pace of its international acquisitions in the last three to four years, with nine out of the last 10 acquisitions outside the U.S.

Source: FedEx.

Emerging nations in Europe, the Middle East and Africa (EMEA), and Asia are FedEx's biggest focus areas and could be its future growth engine. At the company's recent round table in Memphis, Raj Subramaniam, executive vice-president of global strategy, said, "Rich with possibilities, these young, vibrant new economies are just starting to flex their muscles, but by 2050, they are projected to make up many of the top 20 contributors to global GDP."

EMEA game plan

Things are improving in Europe. A recent Ernst & Young study says that in 2013, foreign direct investment (FDI) in Europe was 223 billion euros, 25% higher than 2012. There's also the big e-commerce explosion -- according to researcher e-marketer, by 2017, B2C sales in the EMEA region could grow to a whopping $569.5 billion.

EMEA president of FedEx Express, David Binks, is upbeat about the recovery in Spain, Portugal, France, and the U.K. He told CNBC that FedEx is trying to provide subject matter expertise to regional companies together with online tools in local languages, to help improve their global connectivity. Greater international trade in turn would accelerate FedEx's package volumes.

To tap the new opportunities, FedEx has opened 100 new depots in Europe in less than two year's time and added 3,600 more employees. It's offering cross-continent deliveries from 13 European countries. FedEx has an approximately 10% market share in the continent.

In February 2014, the company also introduced its award-winning SenseAware service in 14 European countries. SenseAware uses multi-sensor gadget to gather and send out data from packages, helping customers to better track their parcels during shipment. The service has been popular in the U.S. since launch in 2009. It's important that FedEx carves a niche as most of its rivals are also betting on Europe's prospects.

German delivery giant Deutsche Post DHL commands a 41% market share in the express segment in Europe, and late last year, it announced the expansion of its hub at Germany's Leipzig/Halle Airport. FedEx's domestic rival United Parcel Service (UPS 0.12%) has a 23% market share and recently expanded its European air hub facilities at Cologne/Bonn Airport in Germany.

Asia game plan

With growth slowing in the developed countries, emerging economies have become the hunting ground for Western companies, even if they come with their share of socio-economic and geopolitical risks. China and India are at the forefront of this group.

China is a huge courier market with more than 20 million packages delivered everyday . The market is fragmented and highly competitive with more than 7,500 companies scrambling for market share. Big local players include SF Express and ZTO Express. There's a huge opportunity emerging in China's contract logistics market, and many courier companies are eyeing the health care segment.

China's ageing population has pushed up demand for pharmaceutical and medical products. According to National Bureau of Statistics of China, at the end of 2013, more than 202 million people or nearly 15% of the country's total population were above the age of 60 years.

To seize the opportunity, FedEx is expanding health care logistics capabilities at its Shanghai international hub. Since health care customers often demand speedy services and late pickups, the company has reserved its new Boeing 777F aircraft for commuting between the U.S. and China. However, United Parcel is already ahead of FedEx in this space, and recently opened its second dedicated pharma logistics facility in Zhejiang Province.

Most global players, including DHL, TNT, United Parcel, and FedEx, are also expanding in India, thanks to the growing popularity of online retailing. Leading Indian finance daily Economic Times ran an article in February, which said that the Indian e-commerce market could grow to $56 billion by 2023. In this context, Ashish Jhalani, head of advisory firm eTailing India, said "Every single online retail transaction needs to be delivered. The opportunity for logistics is as big as online retail." Researcher Technopak predicts that e-commerce can add $5 billion annually to the bottom line of logistics companies.

DHL is the biggest player after the Indian Postal Service and holds more than 50% market share in the express segment. FedEx ranks among the top 10 players, and has established high-end facilities in New Delhi, Mumbai and Bangalore. To expand its reach, FedEx recently launched its Ship Site program in India that forges alliances with customers for easier shipping solutions.

Though North America remains central to FedEx's operations, it's venturing into different parts of the world in pursuit of growth. The company has executed well-planned acquisitions and expansion strategies in Europe, Africa, and Asia and is likely to continue the momentum. The timing and extent of global recovery remains a topic of debate, but without a doubt, FedEx stands to capitalize on any improvements we may see.