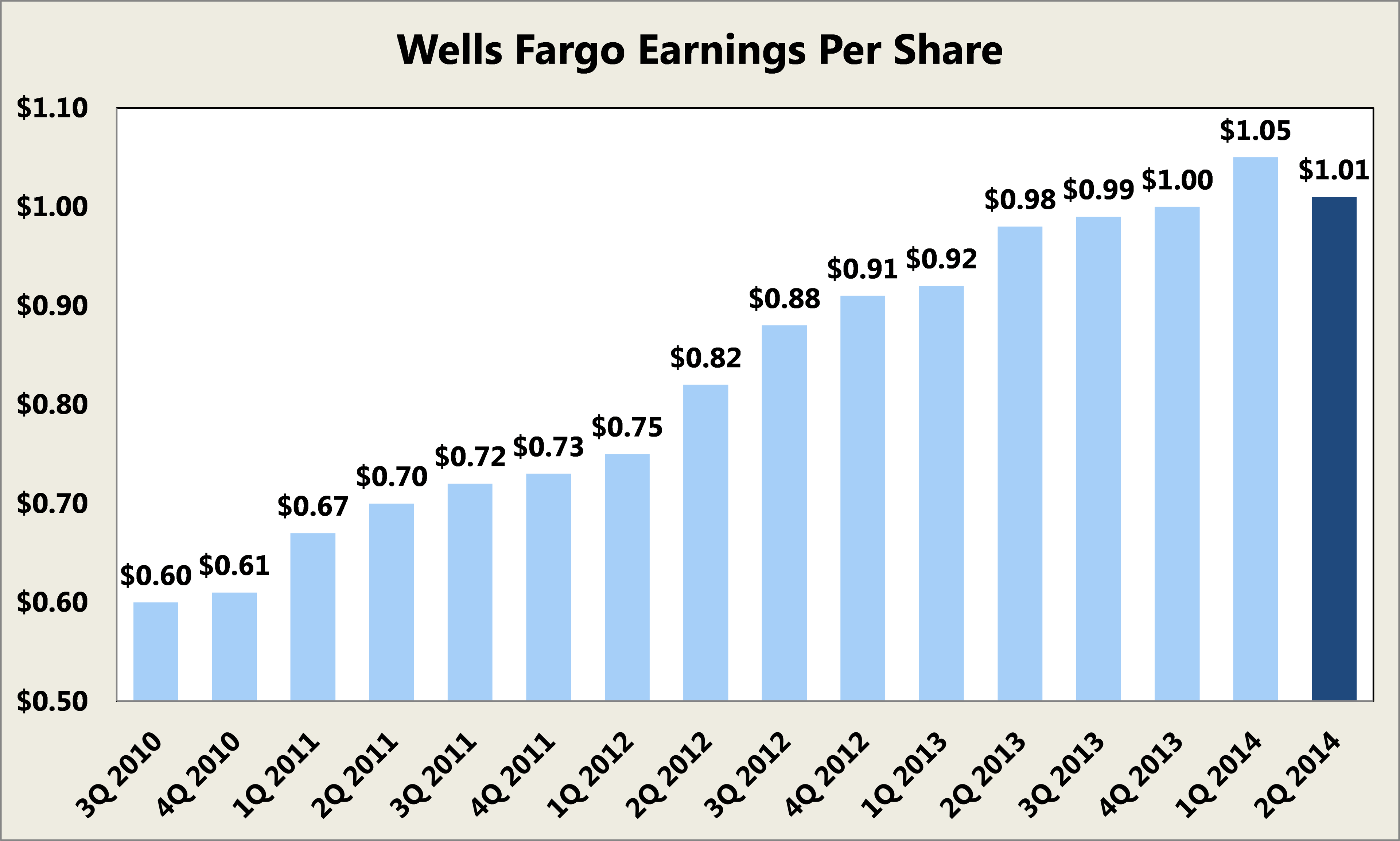

Today Wells Fargo (WFC 0.31%) announced its earnings for the second quarter of 2014, and while it reported strong growth, its streak of 15 consecutive quarterly earnings records came to an end as its earnings per share stood at $1.01, a gain of 3% over the second quarter of 2013, but down relative to the first quarter of this year.

Source: Company Investor Relations.

In total, net income at Wells Fargo stood at $5.7 billion, up 4% year over year, but down 3% versus the first quarter. However, part of the reason behind the strong gains seen in the first quarter was a tax benefit of $423 million, or $0.08 per share.

In total, through the first six months of the 2014, net income at Wells Fargo has risen by 9% to stand at $11.6 billion. A major reason for this gain is a continued reduction in its provision for credit losses -- what it expects to lose on the loans it has written -- which has fallen from $1.9 billion to $542 million, a 71% drop.

Somewhat offsetting this gain seen from the reduced provision was that Wells Fargo has witnessed a steep decline in its mortgage banking income, which fell from $2.8 billion in the second quarter of last year to $1.7 billion this year. However, the $1.7 billion was actually a slight improvement relative to the $1.5 billion recognized in the first quarter of 2014. In total, through the first six months of 2014 its mortgage banking income is down 42% versus 2013 levels.

On the bright side, Wells Fargo continued to see strong growth in both its loans and deposits, as its core loans increased by 7% year over year to stand at $764 billion. In addition its core deposits officially surpassed $1 trillion by the end of the second quarter, which also represented a gain of 7% relative to the second quarter of 2013.

"Our strong results in the second quarter reflected the benefit of our diversified business model and our long-term focus on meeting the financial needs of our customers," noted Wells Fargo Chairman and CEO John Stumpf in the earnings announcement. "By continuing to serve customers we grew loans, increased deposits and deepened our relationships. Our results also reflected strong credit quality driven by an improved economy, especially the housing market, and our continued risk discipline."

Stumpf concluded his remarks by saying, "We remain dedicated to building long-term shareholder value, and I am optimistic about the future as we continue to focus on meeting the needs of our consumer, small business and commercial customers."

Although its streak of record quarters officially ended as the earnings were down slightly quarter over quarter at Wells Fargo, all things considered, second-quarter results were solid, albeit an unspectacular, for Wells Fargo.