Over the past few years, Western equipment makers have shifted their focus to China. They have been lured by the country's urbanization trends and astronomical construction spending. Caterpillar's (CAT 0.78%) top brass refer to China as their trump card for the construction business. Where is this growth that everyone is talking about, though? While there's no doubt about the country's long-term prospects, things have become quieter in the construction market in the past few months. Where does this leave Cat, which has its hopes tied there?

Source: Caterpillar China

Is China becoming El Dorado?

China is the world's largest construction market, growing to nearly $1.8 trillion in size in 2013. Most research papers published between 2010 and 2013 talk of the country's phenomenal prospects over the coming decades. A 2011 report (link opens a PDF) by ICD Research says that China's construction sector would grow at a CAGR of 11.79% between 2010 and 2015, outpacing the overall earth-moving equipment market growth of 11.3% during the forecasted period.

A 2013 report by PwC on the global construction market reveals that China could play a major role in the world's construction output, which is expected to see a 70% rise to $15 trillion by 2025. China's global market share could increase from 18% in 2013 to 26% in 2025.

Most of these forecasts stem from the rapid wave of urbanization in the country. The government started an extensive urbanization plan this year that will try to bring 100 million more people to the cities by 2020. The present concern, however, is that growth has slowed in China's construction market in the past few months.

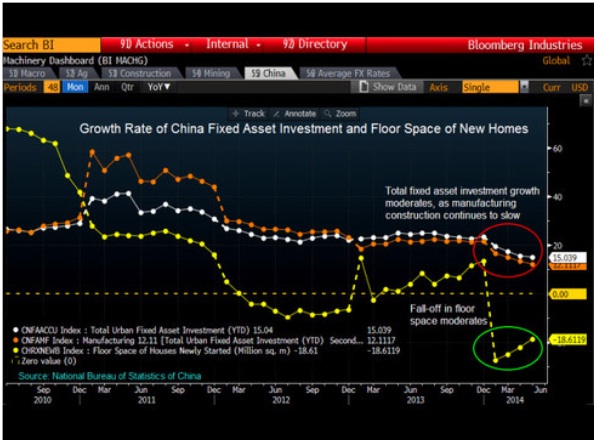

According to a recent Bloomberg report, China's fixed asset investment year to date gains fell to 15% in May from 22% in April, marking the fourth consecutive month of slowed growth. Most of the weakness has been felt in manufacturing construction. The report also shows that the floor space of newly started homes fell by 18.6% in May compared to a 1% increase last year. This is taking a toll on the demand for construction equipment. Difficulty in obtaining financing and inventories of new and used equipment are making the situation even more difficult.

Source: Bloomberg

Cat is feeling the heat

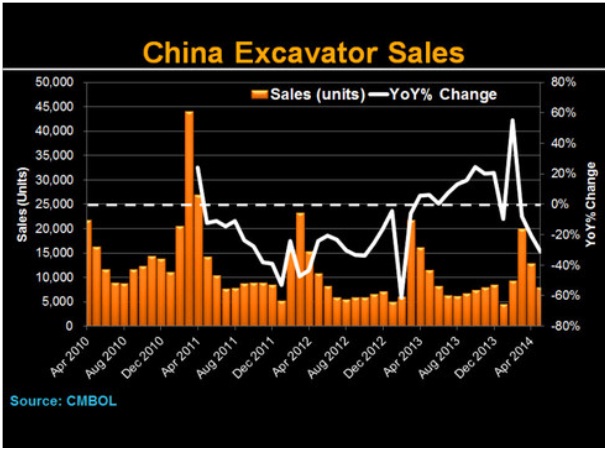

In the first quarter, Cat did well in China with revenue growing 30% across all lines of its business. There was an uptick in the construction business as dealers replenished their stock for the year. According to Bloomberg however, the company's excavator sales declined 5.7% in May from the previous year's levels as the market contracted by 31% -- the worst decline since February 2013. The only good news for Cat's investors is that its decline was far less than its peers. Chinese equipment maker Sany Heavy Industry posted a fall of 26.3%, while Japan-based Hitachi saw a 24.5% drop. Together, the three hold one-third of China's excavator market.

Cat has a stronger hold in excavators in the mainland's construction equipment market compared to the loader market, which is dominated by local players. Bloomberg data shows that excavator sales were down 9.5% through May, and demand could be further affected over the coming months as local governments lower their spending. That's definitely not pleasant news for the equipment maker.

In its first quarter conference call, Cat said that it's expecting 7.5% GDP growth in China in 2014. If the economic growth slows significantly, however, it can have an impact on the company's overall sales. The uncertainty in China is a key reason why management is maintaining a "5% plus/minus range" around its $56 billion sales outlook.

Source: Bloomberg

Facing the challenge

Despite the recent headwinds, China's potential is too huge to ignore. Cat's strategy has always been that of aggressive expansion, as well. The equipment maker recently celebrated the 20th anniversary of its first hydraulic excavator manufacturing facility in China which now churns out close to 20%-30% of the company's total excavator production.

With several manufacturing facilities across the country and a strong network of dealers, Cat is optimistic about its long-term future prospects in this emerging economy. Its business model is based on providing its customers with the highest value when it comes to purchasing and maintaining a machine. It's independent dealer structure is an added advantage for providing superior after-sale support.

2013 was a good year for Cat as it grew its market share in excavators and reduced the gap between it and Sany. Sany had widened the lead over Caterpillar in the past few years by offering aggressive customer financing schemes. It held around 13.6% of the market in 2012, while Caterpillar had just a 6.9% share. Cat increased its market share to 9% in 2013, though, while Sany's fell to 12%. Sany's excavators are priced around 15% lower, but their quality is in no way comparable with Cat's equipment.

Ending note

CEO Doug Oberhelman aptly summed up the China situation, saying "China is one example of both the potential and uncertainty we face." Generating sustainable growth in China is not going to be easy, and competitive pressures will keep mounting on the company in times to come. Cat has a good business model, however, and it is outperforming both its peers and the overall industry in the excavator market. Management remains bullish on the country's long-term prospects and is focused on increasing its market share in the world's largest economy.