Another day, another business Amazon (AMZN +1.41%) sneaks into. The company, already providing back-end services to data-hungry clients like Netflix, realized that it could create its own collaborative cloud storage service. Now, along with Dropbox, Box, Google Drive, and Microsoft OneDrive, customers can store and share files with Amazon Zocalo.

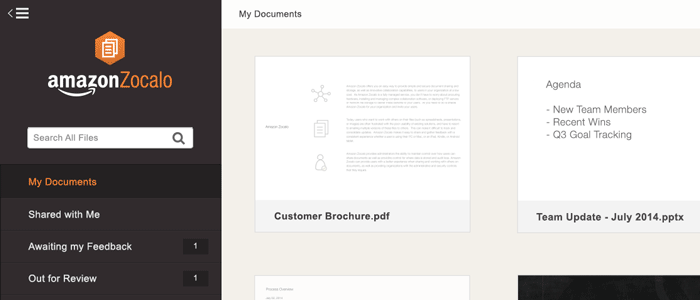

Source: Amazon.com

Zocalo's service and pricing reflect all of Amazon's values, which should make its competitors fear for their survival.

Customizable customer-centric product

Premium features of cloud storage, like editing documents and easier collaboration between users, were once the domain of the first movers. Differentiating themselves on these features along with ease of use, they were able to charge premium prices. But other cloud storage services are catching up, like Apple's (AAPL +1.25%) iCloud. Currently offering a simple and more personal solution that mainly backs up photos and iTunes purchases, a new iCloud will arrive this fall with cheaper pricing and easier to use storage and editing for files in the cloud.

Amazon Zocalo, geared more toward enterprise users, touts features like simple document feedback, access from any device, security, user control, and integrated corporate directories. A lot of these features won't be for the majority or simple, personal users, but they match top competitors in both customization and leading prices. This continues Amazon's practice of customer-centric service.

Cutthroat pricing

Like Amazon's traditional business, which is run on razor-thin margins or even no margin at all, Zocalo offers an incredible value in order to steal market share and build up its customer base. Comparison of cloud storage is inherently difficult, with no standard offering, but Amazon's is definitely near the cheapest available.

| Service | Storage | Price |

| Amazon Zocalo | 200GB | $5/month |

| Google Drive | 100GB | $2/month |

| Microsoft OneDrive | 200GB | $8.30/month* |

| Apple iCloud | 200GB | $4/month |

| Dropbox | 100GB | $10/month |

| Box | 100GB | $5/mo |

*Microsoft OneDrive charges $100 on an annual basis for the 200GB plan.

Box, which has yet to publicly list shares despite being eligible since April, might be the most comparable for focusing on enterprise customers, but offers half as much storage for the same price. At the low end, even though Apple's iCloud will be charging a dollar less, the service is less adaptable than Amazon's, as well as focused on the personal segment over enterprise.

Integrated ecosystem

The final feature that puts Zocalo over competitors is the integration with Amazon WorkSpaces, its cloud-based virtual desktop service. WorkSpace users receive 50GB of storage for free with Zocalo, and can upgrade to 200GB for just $2 per user per month. Box has no such virtual desktop service.

Amazon is known for small upgrades to existing services that may not seem like much at first, but can grow to become a highly valued conglomeration that customers won't want to leave. For example, Amazon Prime has consistently added services to the original free two-day shipping program. Now it includes streaming of a collection of free TV, movies, and music that help keep customers satisfied and loyal.

Already a classic Amazon service

Zocalo fits right into Amazon's strategy. Because Amazon Zocalo is targeted toward enterprise clients, the services targeted at personal users may not feel any threat. But Box and other business-focused cloud storage companies might want to look for ways to differentiate themselves even further in order to survive.