Macau's beautiful skyline gets better and better. By the end of 2015, it will be even more amazing than this. Photo: Four Seasons

Las Vegas Sands (LVS +2.12%), Melco Crown (MPEL +2.54%), and Wynn Resorts (WYNN +3.04%) are each preparing for their new resorts to open on Macau's Cotai Strip in the next 18 months. Macau has brought incredible profits over the last decade and a half since beginning its gaming growth story in 2002. Amazingly, the growth has continued with as much as 21% revenue growth for Las Vegas Sands in Q1 of this year over Q1 2013. However, with all of these new casinos coming, there is one important issue to continue watching while you are thinking of placing your bets.

Photos: ChinaTourAdvisors and Macau Government, Edited: Bradley Seth McNew

All of these casino resorts are under construction and preparing to be opened as early as summer of 2015 for Melco Crown's Studio City and Las Vegas Sands The Parisian, with Wynn Palace likely coming by the end of 2015. However, we have yet to get confirmation that the Macau government has granted gaming licenses for these new resorts, and the deciding officials have remained relatively tight-lipped on the subject. Without such casino approval, the resorts would essentially be luxury hotels.

What's at stake? Curbed growth

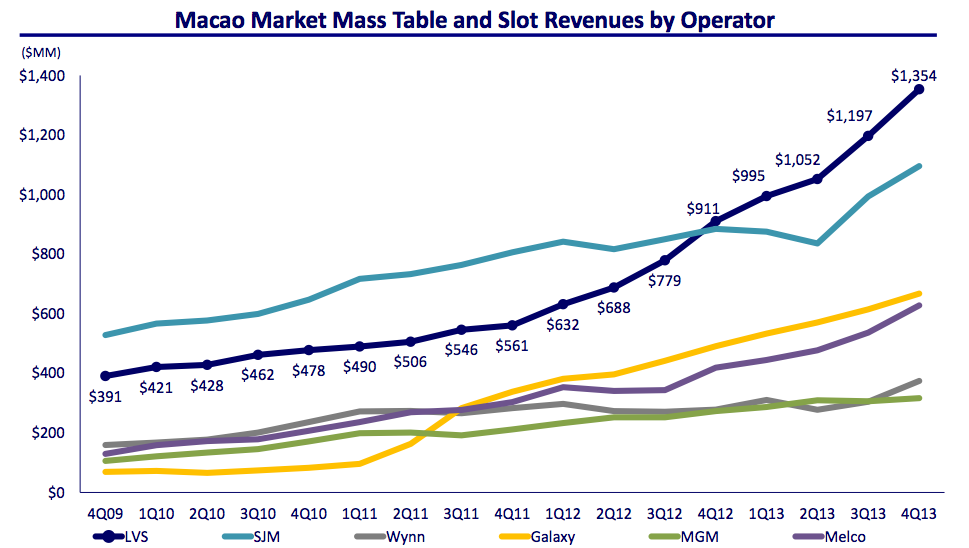

Casino companies in Macau have posted incredibly strong 2013 earnings, and that trend has stayed strong through the first quarter of 2014. Wynn Resorts and Melco Crown have been expanding rapidly in Macau over the last decade with revenues that grew in 2014 Q1 by 10% and 19% year over year, respectively. For Las Vegas Sands, growth this year has been even more impressive with revenue of a record $4.01 billion, up over 21% year over year, highest in the industry. While these growth rates are impressive, to sustain this growth the gaming companies will need to continue drawing in higher and higher visitation. Enter the mass market segment.

Operations in Macau over the last decade have been largely focused on VIPs -- the high rollers of the gaming industry. However, the mass-market segment of gamblers going forward is what will drive increased visitation and sustainable growth. Wynn and Melco Crown are both betting big on the mass market segment, but once again, it's Las Vegas Sands that is doing it the best. Melco Crown currently derives more than two-thirds of its EBITDA from this segment. Las Vegas Sands took a huge winning from mass table revenues in 2013 with a 58.3% jump in this revenue segment from Q4 2012 to the same quarter 2013.

Source: Sands 2013 earnings presentation

With increased wealth and leisure travel spending by mainland Chinese, Macau's largest audience already, there is still plenty of room for this segment to grow. With advancements like a new bridge from Hong Kong to Macau, a better rail system linking separate parts of the island for faster transportation to and around the island, and digital passport entry and exit into and out of Hong Kong and Macau, there are plenty of reasons to be bullish that this increase in visitation will come. Therefore, the casino companies are confident that if they build it, they will come. However, to get the kinds of revenues investors have come to expect, those visitors will also need to be able to gamble at these new resorts.

Even without official gaming approval, casino companies are still building and remain optimistic

These casino operators are unfazed by the risk of the Macau government's not handing over gaming licenses right away. Instead, they are continuing to focus on Macau's massive potential for even more growth than we've already seen. To gain on this growth, especially in terms of driving in new mass market gamers, Las Vegas Sands, Melco Crown, and Wynn Resorts are each ramping up production on their upcoming casinos.

Steven Wynn shows off his new Wynn resort. Photo: Reuters

Wynn Resorts is hoping for a surge in revenues from the addition of its $4 billion Wynn Palace Cotai, which could open as early as the end of 2015. This amazing new resort will help to increase the number of guests that Wynn can host in Macau. One highlight for the company's most recent quarter is that mass market operations led to an increased room occupancy rate from 93% in Q1 2013 to 98% during the same period this year. This new casino is a bet on driving even more guests to Wynn properties in Macau.

But before Wynn can open the doors to the Wynn Palace, Melco Crown's Studio City resort will already be open. This cinematically-themed integrated resort on the Cotai strip is set to be better than anything Melco Crown has produced yet, with 500 gaming tables, more than 1,500 slot machines, a five-star hotel, shopping mall, and more.

Melco Crown's CEO Lawrence Ho has continued to drive growth in this quickly expanding company. Photo: Bloomberg

According to the Crown resorts website, Studio City will be a mass-market focused, large-scale integrated resort that incorporates gaming and non-gaming amenities. But even here they throw in "Subject to receiving the necessary approvals from the Macau Government..."

Analysts have said that Studio City will be the "best situated" resort on the Cotai strip, as it will be directly adjacent to the Lotus Bridge that connects the strip to mainland China via Hengqin Island, and is on a proposed stop for the new intercity light rail coming next year.

Close sources, including the Macau Business Daily, have reported that very positive government commentary has been made by government officials that Melco Crown will be able to offer casino gaming at Studio City.

Yet once again, Las Vegas Sands is still the one winning on this one as well. The two casinos on the strip owned by Sands, The Venetian Macao and the Sands Cotai Central, have already posted solid growth and revenue.

The coming Parisian resort on Cotai, the biggest of the coming casinos. Photo: Las Vegas Sands

Las Vegas Sands is preparing its own newest integrated casino resort, its fourth resort and fifth casino on the Cotai Strip. The Parisian, which will open in mid-2015 in a race with Melco Crown, is set to be a major advance for gaming in Macau. This resort will be the biggest of the new resorts put up by Wynn or Melco Crown with over 3,000 hotel rooms and suites, roughly 450 table games, 2,500 slots, a retail mall, and an impressive replica of the Eiffel Tower at 50% scale.

Foolish move for investors: Stick with it

One thing we do know is that the Macau government, per leadership guidance from Beijing, is seeking to diversify Macau with more than just gaming revenue. However, there is very little reason to believe that these casinos are not going to get their gaming licenses. With billions in tax revenue on the line, it's a good bet that the Macau government wants to grant gaming licenses for these coming casinos. Furthermore, if Las Vegas Sands, Melco Crown, and Wynn Resorts, who are much closer with the Macau government than we are, are each confident enough to continue building these resort casinos, then we should be confident as well. Of course, for the safest bet, continue watching for official announcements that gaming licenses have been granted. Otherwise, these coming casinos will likely be huge profit drivers, especially for Las Vegas Sands, and Foolish investors might want to bet early.