There's no corporate rivalry out there more fierce or storied than Coca-Cola (KO 0.55%) vs. Pepsi (PEP -0.76%). It all started more than a century ago, when John S. Pemberton developed the original recipe for Coke in 1886. Pharmacist Caleb Bradham developed the recipe for Pepsi-Cola 13 years later, and the rest, as they say, is history.

Today, the two companies are both globally recognized behemoths, and each currently sports a market cap north of $100 billion. Year to date, Pepsi has grossly outperformed Coca-Cola, but the real question is: which is the better investment in today's market?

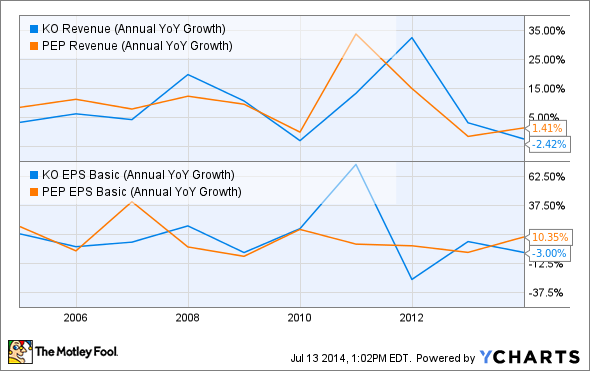

Round 1: Growth

KO Revenue (Annual YoY Growth) data by YCharts

When you evaluate growth you can either look at a company's top line (revenue) or bottom line (EPS). In their own respects, both have equal importance, but at the end of the day EPS growth is king. Growth on the top line, however, is crucial because without it a company has to rely on margin expansion, which will inevitably stop, to grow EPS.

Coca-Cola and Pepsi have pretty similar growth pictures over the past decade on both the top and bottom lines. A noticeable trend, however, is that Coca-Cola's growth is much choppier than that of Pepsi. While it may have been a rocky road, Coca-Cola has, in the end, gotten to the same point as Pepsi. Over the past decade Pepsi grew its revenue 127% and EPS 77%, while Coca-Cola grew its revenue 115% and EPS 94%.

Round 1 result: Draw.

Round 2: Valuation

KO P/E Ratio (TTM) data by YCharts

The price to earnings ratio is widely recognized as the most popular measure of a company's relative valuation. Simply put, it compares a company's current stock price with its EPS for the past year.

Coca-Cola and Pepsi today both carry P/E ratios of around 20. Ignoring a few year-to-year inconsistencies, both companies have basically traded at the same P/E ratio over the past decade. Even more interestingly, both companies' forward P/E ratios (using the consensus EPS estimate for the upcoming year instead of the past year's EPS) are nearly identical.

Round 2 result: Draw.

Round 3: Income

KO Dividend Yield (TTM) data by YCharts

Incredibly, these two companies stack up similarly on income metrics as well. Both currently offer dividend yields in the 2.7% region, and, over the past decade, their yields have risen and fallen in lockstep.

In terms of how well these two companies have grown their dividends, Pepsi began the decade with dividend growth superior to that of Coca-Cola, but since then its dividend growth rate has slowly but surely declined and dropped below Coca-Cola's pace, which has remained relatively steady throughout.

As for the payout ratio, a metric that measures what percentage of EPS a company is paying out in the form of a dividend (typically the higher this number the better for shareholders, as long as the number is sustainable), both companies currently sit near the 50% mark, but over the past decade Coca-Cola has consistently committed more EPS than Pepsi to rewarding shareholders.

Round 3 result: Slight advantage to Coca-Cola.

Round 4: Future prospects

While Coca-Cola is strictly a beverage company, Pepsi is both a food and beverage company, with 52% of Pepsi's overall 2013 revenue coming from food. This exposure to food is the primary reason why Pepsi's profit margin is nearly half that of Coca-Cola, but going forward this exposure outside of beverages will prove incredibly valuable to Pepsi.

Soda in the United States is a fading industry. US soda consumption fell in 2013 for the ninth consecutive year, and this descent is not forecast to stop anytime soon. These two companies stand to lose the most as the kings of soda. While both have extensive portfolios of alternative beverage brands which they continue to build up, soda is still the lifeblood of their beverage businesses. For Pepsi, however, this transition to new beverage types will be much easier on its overall business than it will be for Coca-Cola.

This is why some have called for Coca-Cola to acquire a food business of its own, with Mondelez being the name most commonly brought up. Until something like this happens, however, Coca-Cola will have to deal with a majority of its revenue stream falling on hard times.

For 2014, analysts expect flat revenue for Coca-Cola and 9% bottom-line growth, while Pepsi is looking at 1% top-line growth and 5% EPS growth.

Round 4 result: Advantage to Pepsi.

The Foolish takeaway

These companies are nearly identical fundamentally. Look forward, however, and Pepsi has a slight edge on Coca-Cola because it has diversified its business away from soda. For the long-haul, however, both are fundamentally sound businesses that would make tremendous long-term investments.