As earnings season kicks into gear, this time around it will be a much different story for many companies compared to the first quarter, which had a harsh winter adversely affecting results. In CSX Corp.'s (CSX +0.06%) case, the harsh winter weather sent overtime costs and labor expenses soaring. The question was whether or not CSX could make up lost volume and earnings throughout the year.

Looking at CSX's second-quarter results, we have part of our answer; but on the flip side from the first quarter, a surge in car loads brought a handful of different problems. Here are the details, and what investors should keep in mind going forward.

By the numbers

First, let's dig into the dreary numbers. CSX reported a mixed bag compared to estimates with a profit of $529 million, or $0.53 per share, on revenue of $3.24 billion, compared to analysts surveyed by Thomson Reuters who expected earnings of $0.52 per share on revenue of $3.25 billion. Revenue and operating income jumped 7% and 6%, respectively, while CSX's operating ratio remained stable at 69.3% in year-over-year comparisons.

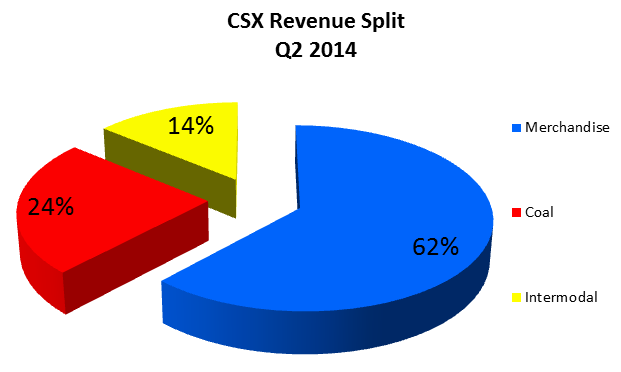

CSX's business is split into three segments -- merchandise, coal, and intermodal.

Chart by author. Information source: CSX Q2 presentation.

Merchandise continues to lead the segments in terms of revenue per unit, or RPU, at $2,593, with coal and intermodal checking in at $2,255 and $650, respectively. CSX's total RPU was down in the second quarter, from last year's $1,839 to $1,821. The decline was due to coal's 9% decline in RPU compared to last year's second quarter, as well as intermodal's 2% decline for the same time periods.

While RPU declined due to weaker pricing, total revenue drove higher because of increased volume. However, the latter factor also brought additional problems for CSX.

The downside

CSX network performance was severely hurt because of the higher than expected surge in car loads. Compared to the first quarter, second-quarter car-load volumes were up 14%. At the same time that car-load volume was surging, velocity, or mph, declined on average from the first quarter -- not a favorable change.

Because of the slower velocity and higher than expected surge in car loads, CSX's network performance was adversely affected. CSX's on-time arrivals dropped from 82% in last year's second quarter down to 42% last quarter. Its train velocity, or mph, dropped from 23 during last year's second quarter down to 19.3 last quarter. Meanwhile, the amount of hours that carloads dwelled in terminals rose from 21.9 during last year's second quarter to 25.9 during the last quarter.

Investors should expect CSX's network performance to stabilize and reverse during the next quarter as the company will be better prepared to deal with the surge in car loads. Overall, this was a strong quarter for CSX, and the surge in volume far outweighed the cost in its network performance.

Looking ahead

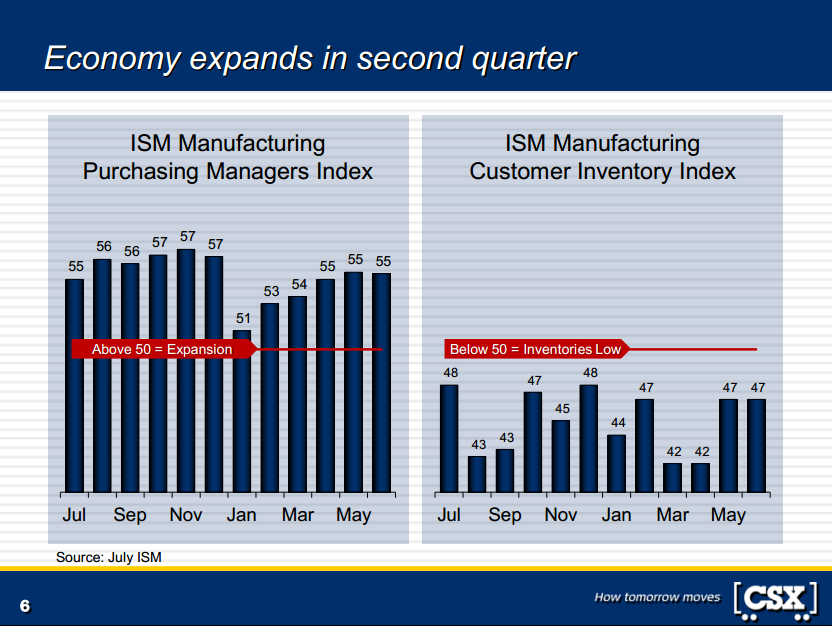

Going forward, as the U.S. economy gains more momentum, it will provide CSX with a surge in business. Consider that ISM Manufacturing's Purchasing Managers Index has continually indicated expansion in the U.S. manufacturing industry during the last year. Moreover, ISM Manufacturing's Customer Inventory Index has continued to indicate inventories remain low -- a potential boost in business for CSX when those inventory levels inevitably rise.

Slide from CSX Corporation's Q2 presentation.

CSX's management confirmed that the remainder of 2014 would bring modest earnings improvements, but investors can expect margin improvements and double-digit earnings growth to take place in 2015.

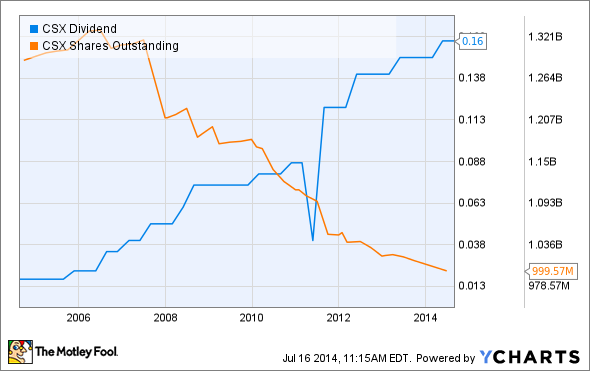

While investors may have to wait a couple of quarters to see those gains take place, the silver lining is that CSX has continuously returned value to shareholders through increased dividends and share repurchases.

Source: YCharts.