Ford headquarters in Dearborn. Source: Ford Motor Company

When all was said and done, Ford Motor Company (F 2.35%) put the finishing touches on an outstanding 2013. Ford capped off the year with its 18th consecutive quarter of pre-tax profit and posted a record automotive operating-related cash flow of $6.1 billion for the full year.

How did investors reward the folks at the Blue Oval? With a quick sell-off, of course, because management warned 2014 would be less profitable due to the company building for its future through its most aggressive product launch in history.

Thus far, Ford's guidance has been correct, but some investors have jumped back on board, driving the stock price near $18. With that in mind, here are three things to look for when America's second-largest automaker releases its second-quarter information next Thursday.

Operating margin

It's no secret that North America generates the vast majority of profits for Ford. North America becomes even more important to quarterly and annual success when sales volumes are stagnant. Ford's North American vehicle sales declined roughly 1% during the second quarter, compared to last year, and that's going to limit the company's revenue growth.

Ford's 2015 F-150. Source: Ford Motor Company

But if Ford bounces back from its lower operating margin from the first quarter, it would still be a strong second-quarter performance. Here's how it could play out.

Ford's most profitable product is the F-Series full-size pickup truck, hands down. While Ford's total sales were slightly down in the second quarter, its F-Series accounted for nearly 30% of those sales. Fortunately, for Ford and its investors, for much of the second quarter the F-Series enjoyed the lowest level of cash incentives and deals while posting the highest average transaction prices among competing trucks.

Put another way, Ford sold an F-Series truck every 41 seconds during the second quarter at a much more profitable rate. Look for Ford's North American operating margin to move higher than last quarter's 7.3%, hopefully between 8-9%.

Another very important takeaway from Ford's second quarter will, of course, be from its operations in Europe.

Burning billions

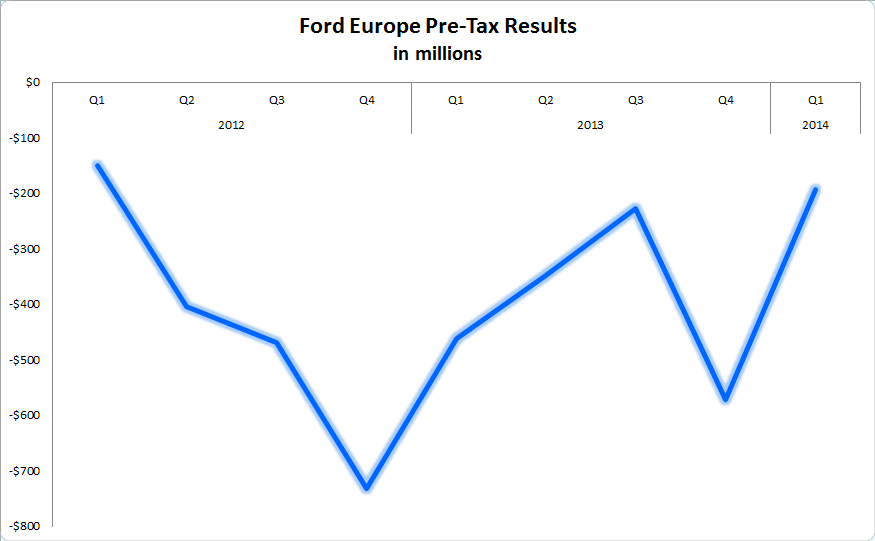

Ford investors know the story too well -- the automaker has burned roughly $3.5 billion in Europe since the beginning of 2012. In fact, if Ford had just broken even last year it would have added $1.6 billion directly to the bottom line, or about $0.40 per share. That's essentially an entire quarter's worth of earnings for the automaker!

Management remains on its plan to break even in Europe sometime next year, and in every single quarter until that point investors will have a magnifying glass out, zooming in to see if operations in Europe slip.

Chart by author. Information source: Ford's SEC filings

Ford's first-quarter losses in Europe checked in at $194 million, which was a $231 million improvement from last year's first quarter, and was $335 million better than the fourth quarter. If Ford's second-quarter losses in Europe check in under $200 million it will be another good sign for its turnaround in the region.

There's reason to be optimistic regarding Ford's second quarter in Europe. Ford's sales have driven 6.6% higher in Europe, during the first half of 2014, and its sales mix continues to improve with more focus on more profitable retail and healthier fleet sales, rather than daily rental sales.

Also, 52% of Ford's sales in Europe through June were all-new designs or significantly refreshed vehicles which should drive top and bottom line improvements. If you need a crash course on how to sift through Ford's European data, look here.

The last thing to listen for, during the conference call, might not be found in the presentation; rather it will likely come up during the Q&A session.

Downtime and launch schedule

Ford's aggressive vehicle launch schedule this year will bring a second skill set into play, juggling. Management will have to build inventory of specific vehicles ahead of time to avoid speed bumps when production is halted for assembly line changes that will enable 2015 models to be manufactured. In addition to that, Ford will also shut down all of its assembly plants for its annual summer break. Ford has already said it would close two of its plants for only one week to keep up with demand for specific vehicles. If management announces additional factories with a shortened downtime, it could be a sign of higher demand coming in the third quarter.

Furthermore, if management offers any details during the Q&A session regarding the progress of its F-150 or Mustang launch, investors should listen intently. New vehicle launches are difficult, risky, and expensive. Though, it's unlikely management would mention any potential problems, some details regarding the launches of two of Ford's most important vehicles should start flowing shortly.