Apple's MacBook Air laptops. Source: Apple.

Over the past few years, Apple (AAPL 0.47%) has managed to outpace PC growth and gain additional market share, but new data shows the company's most recent growth came from emerging markets -- a bit of a twist for some of the most expensive consumer computers in the world.

Where the growth is coming from

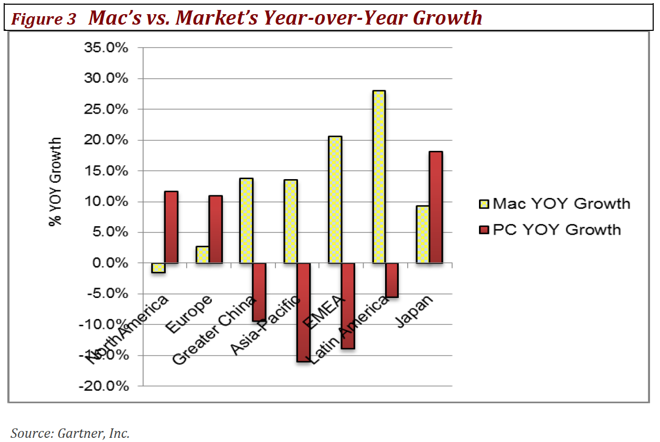

According to recent Gartner data, Apple's Macs are significantly outpacing PC growth in Greater China, the Asia-Pacific region, Latin America, and the EMEA region -- Europe, the Middle East, and Africa.

Take a look at Gartner's chart to see just how well Apple is doing in these emerging markets compared with the PC.

Mac sales data from Gartner. Image source: Needham & Co.

AppleInsider reported that Needham & Co. analyst Charlie Wolf isn't exactly sure why Apple's growth is outpacing PCs in theses markets. Wolf said he can't see any "obvious explanation for the disparity" and believes Apple's fiscal Q3 earnings release, which we'll see on July 22, will shed more light.

Long live the Mac

While Mac sales have become a smaller and smaller percentage of Apple's revenue -- they made up about 12% in fiscal Q2 2014 -- it's clear from the Gartner data that there's still room for growth.

This comes as Apple experienced a drop in yearly global Mac sales in 2013, the first since 2003.

Source: Statista.

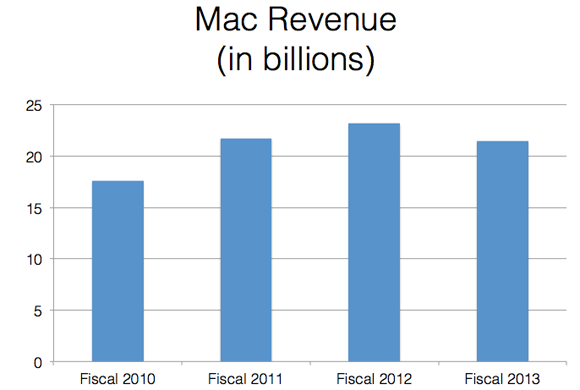

Here's how Apple's Mac revenue has played out over the past four fiscal years:

Data Source: Statista.

To help prop up Mac revenue, Apple could continue to grow Mac sales in emerging markets -- and its latest pricing strategies could be part of that.

Back in April, Apple introduced its most inexpensive laptop ever, in the form of the $899 11-inch MacBook Air. In addition, the company launched a $1,099 iMac last month -- a full $200 cheaper than any previous iMac. These new offerings aren't included in the latest Gartner numbers, which means they could help move even more Macs in the non-developed markets.

But as Wolf pointed out, the latest sales spike may just be a quarterly blip. We'll have to wait until Apple reports quarterly earnings next week to find out more concrete information. And even then it'd be wise to take into account all the Mac sales numbers for fiscal 2014 to understand whether Apple is truly pulling ahead in the emerging markets. For now, investors should be pleased with the Gartner numbers -- but I don't think it's going to change much for Apple's stock price going forward. The lion's share of Apple's revenue comes from iPhones and iPads, and those sales numbers are typically what investors are paying attention to.

In fiscal Q2, the iPad experienced a year-over-year sales decrease of 16%. That obviously wasn't good news for investors, especially considering the iPad makes up about 20% of Apple's total revenue. Next week, Apple releases its Q3 2014 earnings, and noted analyst Horace Dediu estimates that 16 million iPads were sold in the quarter. If true, that would be a year-over-year increase of about 10%.

On the flip side, the iPhone continues to march on seven years after its launch. In Q1 2009, almost two years after the iPhone made its debut, Apple earned just $2.94 billion from the device. In Q1 2014, that number ballooned to $26 billion, and iPhone sales set a sales record of 51 million units. And it's still growing. In Q2 2014 iPhone sales increased 16.8% year over over. With Apple expected to introduce at least one new form factor for its new iPhone this fall, investors should look for even more growth as pent-up demand for a larger iPhone is realized.