In its attempt to become a large social commercial site, Twitter (TWTR +0.00%) has recently bought an e-commerce platform called CardSpring. This newly acquired start-up provides a payment infrastructure that connects applications with payment cards. Through its API's, merchants can link with publishers to offer online-to-offline promotions, getting access to analytic data and assessing the success of their campaigns in a simple way.

The new advances in commerce could propel Twitter to increase its monetization, and attract or engage users looking to benefit from promotions as they connect with friends. However, social network giant, Facebook (FB +0.18%), is also looking for e-commerce as a potential revenue stream, and might present a threat to Twitter's moves in this field.

Becoming a social commercial site

In August 2013, Twitter hired ex-TicketMaster CEO, Nathan Hubbard, as Head of Commerce. Since then, the social network is undergoing changes in order to efficiently sell products and services to customers online. Moreover, Hubbard has a successful track record in TicketMaster, as he managed to drastically improve the business and increase sales, teaming with Facebook to enable users to see which seats their friends take at concerts or events.

As a part of Twitter, it seems like Hubbard has implemented new ideas. In May, the company teamed with Amazon.com. Users who have connected their Amazon and Twitter accounts can now add products to their shopping carts. All they have to do is reply with the hashtag, #AmazonCart, to tweets containing links of products for sale by Amazon.com.

By integrating CardSpring into its social networking and microblogging service, Twitter can enable its clients to advertise with promotion campaigns through tweets that have coupons and discounts. At the same time, it will let them know the analytics and offline performance of their campaigns. As a result, Twitter could better show how its site leverages its clients' brands, and how it affects consumer behavior.

New revenue stream

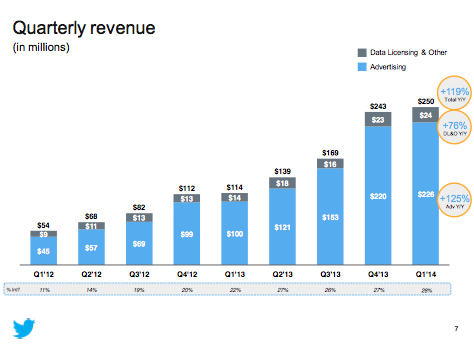

As Twitter becomes a service that provides useful coupons and discounts, it increases its site differentiation, adding a new buying experience to it. The success of it depends on how Twitter manages the promotions and ads. Despite a stagnating growth in user base, the company still manages to increase its revenue -- derived mostly from ads -- consistently quarter after quarter. In its Q1 2014 results, the company reported revenue of $250 million, up 119% year-over-year, plus 255 million monthly active users. For that matter, Twitter shows its aptitude in monetization strategies, a strength that could be useful in the integration of commerce in the social network.

Source: Twitter's 1Q 2014 Earnings Report

Competing with Facebook

Facebook is currently testing a new "buy" button on its site, promoting products and allowing users to purchase in the moment. In its last quarter, the social network giant reported 1.28 billion users, and revenue of $2.5 billion. Plus, the company looks to expand its service in the future by providing Internet access in emerging markets through solar-powered drones. For that matter, as Facebook builds its commerce features, its vast user reach and strong engagement could place the site as a better option for certain agencies and publishers, which threats Twitter's entrance into the market. Yet, Twitter can still benefit from adding value to its niche through e-commerce, as it improves its means of monetization.

Final foolish takeaway

The integration of CardSpring's technology into Twitter is a step forward for the social network in the land of e-commerce. Through it, the company could better allow its clients to offer promotions and analyze the performance of their campaigns. As Twitter shows consistent increase in revenue and efficient monetization, this new initiative could propel its business forward if it manages to appeal users. Yet, Facebook presents a potential danger, as it is testing its own approach to commerce, and has a large user base that attracts agencies and publishers.