Despite reporting an 11% year over year increase in revenues and a 10% increase in net income for the second quarter, shares of SanDisk Corporation (NASDAQ: SNDK) fell 17% July 17. This was the worst one-day decline since Feb. 2009 for the flash memory manufacturer.

SanDisk beat analyst expectations the last eight quarters, which means that it is increasingly difficult for the company to please analysts and investors. On this occasion, SanDisk managed to deliver margin expansion, but that wasn't good enough to surprise investors. To make matters worse, the company gave a current-quarter revenue forecast that was far below the Street estimate, warning that it may be unable to meet the booming demand for solid-state drives (SSDs) despite the recent acquisition of Fusion-io (FIO +0.00%). Is SanDisk's inability to meet SSD demand just a short-term issue? Will SSDs help SanDisk with top-line growth in the long run?

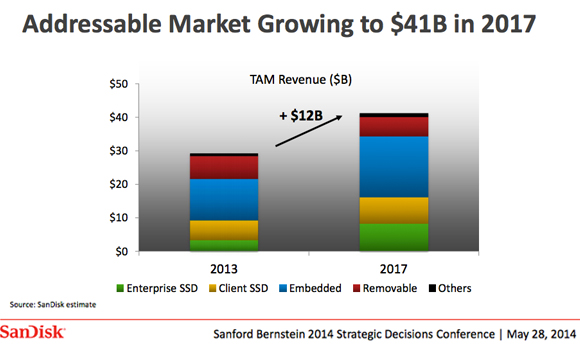

Source: SanDisk

The booming SSD market

SanDisk is directly exposed to the booming SSD market, which helped the company generate $1.63 billion in revenue in the most recent quarter, representing an 11% year over year growth rate. Note that the company's SSD revenues almost quadrupled in 2013, compared to 2012, reaching $1.17 billion or 19% of 2013 revenues.

In particular, the enterprise SSD segment -- which barely existed as a technology in 2008 -- is expected to grow rapidly in the next five years. This is because SSD technology allows enterprise data centers to avoid performance bottlenecks, which happen frequently when using hard disk drives (HDDs).

To benefit from this trend, SanDisk plans to introduce various enterprise SSD products in the second quarter, including the Optimus MAX SAS SSD, a powerful device able to deliver high-density data storage for enterprise, cloud, and virtualized data centers. The device, which has been designed for read-intensive applications such as data warehousing, provides plenty of disk space, which is unusual for SSD devices. This feature will most likely attract users who are still juggling between high speed storage (SSDs) and disk space (HDDs), and bring in new business to SanDisk.

Meeting demand

From a demand point of view, SanDisk has plenty of growth potential due to its direct exposure to the SSD market. However, it should be noted that SanDisk is supply constrained. It seems that the company is not able to deliver all of the orders that it gets. This is most likely because SanDisk has tried to reduce its cost base by limiting its wafer capacity expansion to only 5% this year.

However, this situation may be temporary, because SanDisk might have underestimated the SSD demand size for this year. To solve this, SanDisk could add wafer capacity as early as the fourth quarter of this fiscal year, according to Rajvindra Gill, an analyst at Needham & Co.

In addition, market pricing for SSD devices may be on an upward swing, according to analyst Richard Whittington from Drexel Hamilton. If this is correct, then SanDisk will no longer have to rely on limiting its wafer capacity expansion to keep costs under control, because better pricing for its SSD products will contribute to improved earnings.

Fusion-io

Finally, the acquisition of Fusion-io is likely going to be a long-term positive for SanDisk, as it will increase the company's exposure to the SSD market by bringing in 7,000 worldwide customers. SanDisk will also get access to Fusion-io's SSD production capabilities. Fusion-io shipped 531,000 SSD peripheral devices last year.

Needless to say, it may take several quarters before SanDisk can successfully integrate Fusion-io products into its portfolio, but both companies should eventually benefit from vertical integration, cost reductions, and software optimization.

Final Foolish takeaway

SanDisk shares were sold off heavily after the latest earnings call when the company warned that it would be unable to the meet the booming demand for SSDs by issuing weak guidance. However, the supply issues of SanDisk may just be temporary. In the long run, the company should be able to meet demand by increasing its wafer capacity. Other positives include benefits from vertical integration and software optimization related to the acquisition of Fusion-io, and better market pricing for SSD devices.