A brief look at revenue and EPS from Apple's (AAPL +0.65%) earnings report Tuesday afternoon suggests the company's results are what the Street would call "mixed." But a closer look at the overall picture shows a few items that should boost investor confidence in this market leader as a long-term holding.

Image source: Apple.

The results

Apple's $37.4 billion was slightly below the consensus estimate of $37.9 billion. Apple's EPS of $1.28 per share matched expectations. Revenue and EPS were up about 6% and 20%, respectively, from the year-ago quarter. While revenue growth was in line with rates in the last several quarters, Apple's EPS growth marked its highest EPS growth in seven consecutive quarters.

iPhone sales of 35.2 million units were in line with analyst estimates, up 13% from the year-ago quarter. iPad sales of 13.3 million units were 1.1 million below analyst estimates, down 9% year over year.

Where Apple crushed it

On the surface, it certainly appears Apple's results were solid. But three particular metrics beyond the typical revenue, EPS, and iPhone and iPad unit sales, provide me with greater confidence that Apple is still undervalued at levels near $100.

1. Apple's growing cash hoard

The company's massive pile of cash continued to grow during the quarter. Despite the world's largest capital return program, Apple's cash and marketable securities grew by $13.9 billion sequentially to $164.5 billion. While much of this has to do with a successful debt offering in April, Apple's $10.3 billion from cash flow from operations certainly helped, too.

Apple's monstrous level of cash continues to be a key reminder that its capital return program, which expires in late 2015, is not a temporary fix to boost shareholder value. This cash cow is poised to continue to be able to repurchase shares and pay out dividends in meaningful sums for the long haul.

2. Share repurchases and dividends

To reinforce the power of Apple's cash hoard and cash flow, consider how vigorous Apple was with its capital return program during the quarter. Apple spent $5 billion during the quarter to repurchase 59 million shares and paid $2.9 billion in dividends.

In total, Apple has now spent $74 billion of its authorized $130 billion capital return program -- $51 billion of which has gone to share repurchases.

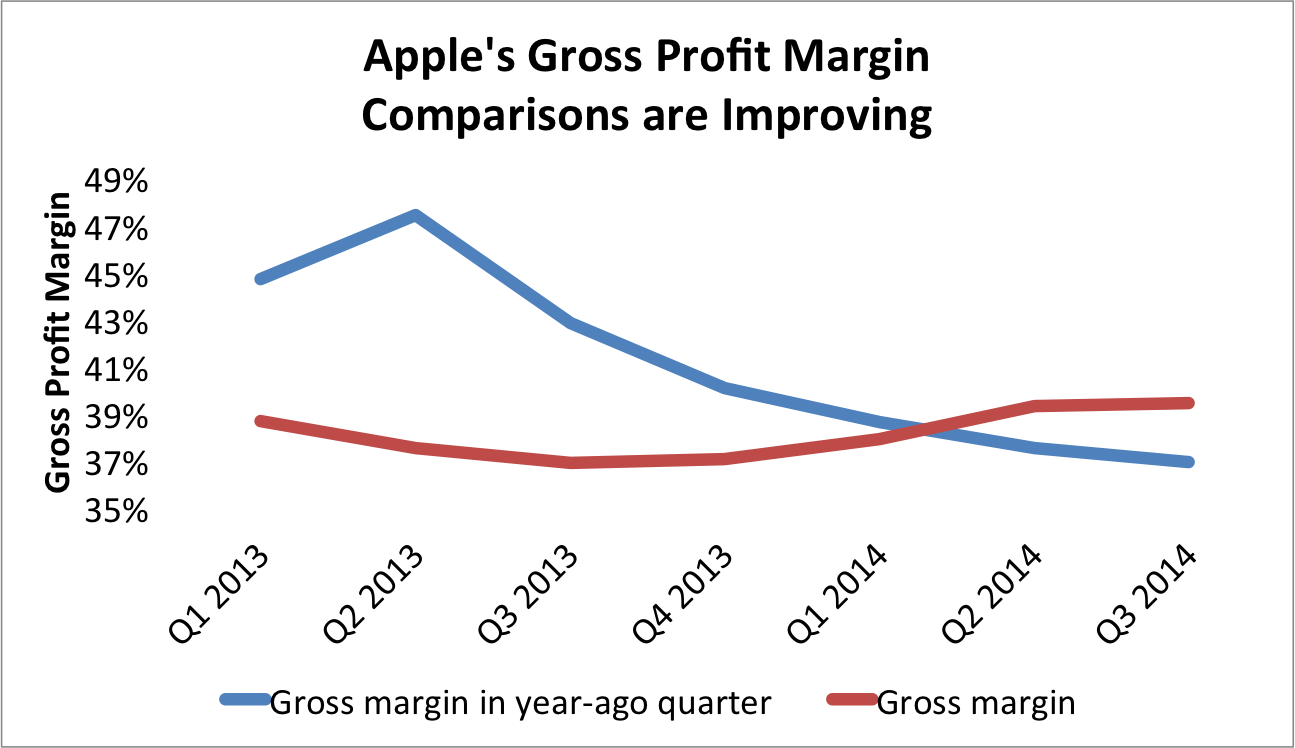

3. Gross profit margin

Contrary to the now-expired doom and gloom case for Apple stock in late 2012 and the first half of 2013, which suggested an increasingly competitive smartphone and tablet market would cause Apple's profitability to suffer, Apple continued to increase its gross profit margins in Q3.

Apple's gross profit margin of 39.4% was significantly higher than its guidance for 37%-38%. Further, Apple's gross profit margin was not only up year over year, but it was up sequentially as well. This is the fourth quarter in a row Apple's gross profit margin was up sequentially and the second quarter in a row gross profit margins were up year over year.

Perhaps these three points are key factors in what appears to be driving the stock about 3% higher Wednesday morning as the market digests Apple's latest figures.

With EPS up 20% from the year-ago quarter, profitability looking sweet, and Apple's capital return program firing on all cylinders and looking more sustainable than ever, Apple stock continues to appear undervalued at just 16 times earnings.