Fact No. 1: In the second quarter, Ford (F 0.36%) generated $2.4 billion in pre-tax profit in North America.

Fact No. 2: Nobody cares. Investors are more excited about Ford's $14 million in pre-tax profit in Europe, even though it's 174 times less than the amount collected here at home.

You can't blame investors for being excited, of course, seeing as how Europe has wiped out roughly $3.5 billion from Ford's bottom line since the beginning 2012. It was an unexpected gift for investors during Ford's second-quarter presentation, and one that almost didn't happen. Let's take a quick look at what has been Ford's most troublesome region in recent years, and get an idea of what we can expect in the back half of 2014.

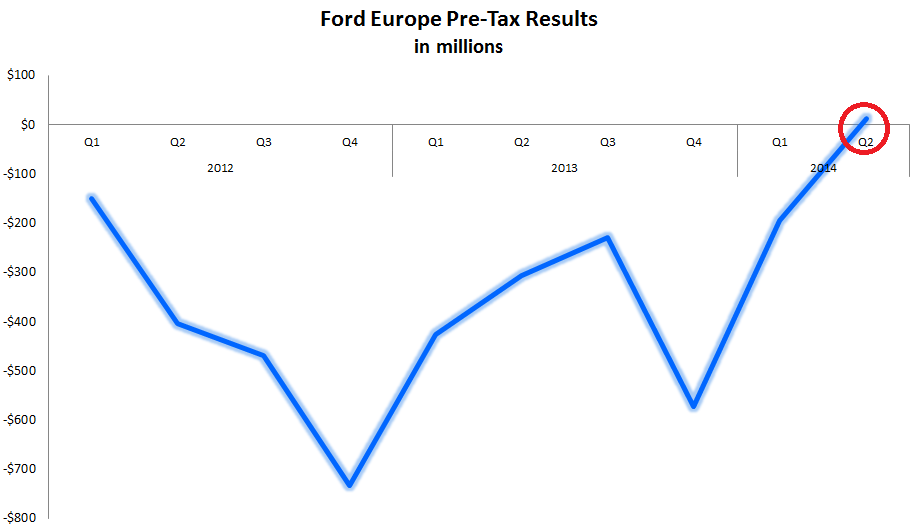

Europe, the profit black hole

As you can see below, Ford just eked out a profit in the second quarter in Europe; however, in a world in which close doesn't cut it, just barely will do the trick.

Chart by author. Source: Ford SEC filings.

The tiny sliver of profit, circled since it is easily missed, may not seem like a victory, but this certainly is a huge development. This was Ford's first quarterly profit in Europe in three year, and you can thank German workers for it. In order to keep production of Ford's Fiesta at a factory in Cologne, workers employees agreed to waive $63 million in bonus checks for their 25-year anniversary.

Part of me feels a twinge of guilt for the workers missing out on their bonus, and unfortunately, for the rest of you focused on profitability, there won't be any more waived bonuses to keep Ford in the black during the second half of the year. Fear not, though, this is merely the light at the end of the tunnel as an unprofitable journey nears its end.

Aside from trashing bonus checks, how did Ford get to the point of profitability in Europe? Are the trends likely to stay favorable for further profitability? What does this all mean for the bottom line? Good questions, to be sure; let's dig in.

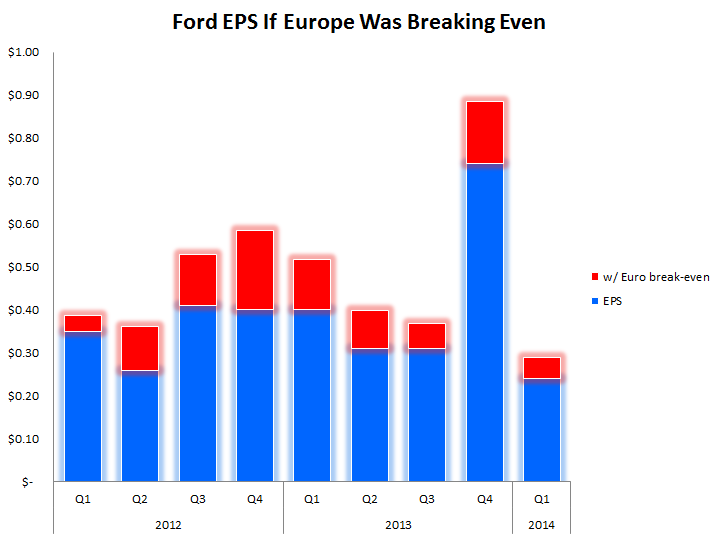

First, let's look at what this means for the bottom line, and thus, investor profits.

Calculated as quarterly fully diluted EPS, divided by basic shares outstanding for the most recent quarter.

The chart shows what Ford's earnings per share would have been had it previously been breaking even in Europe, or not operated in the region at all. That would have added roughly $0.40 in net income per share to Ford's full-year $1.76 result in 2013 -- a roughly 23% boost. Furthermore, it seems only to be a matter of time before Ford is consistently breaking even in Europe, or dare I say earning a profit, and the cash flow Ford is positioned to save in the years ahead would be enough to double the dividend without skipping a beat, should the automaker choose to do so.

Breaking even in a very price-competitive region that offers gloomy growth isn't easy; how did Ford get to this point before 2015, when management expected to break even for the full year?

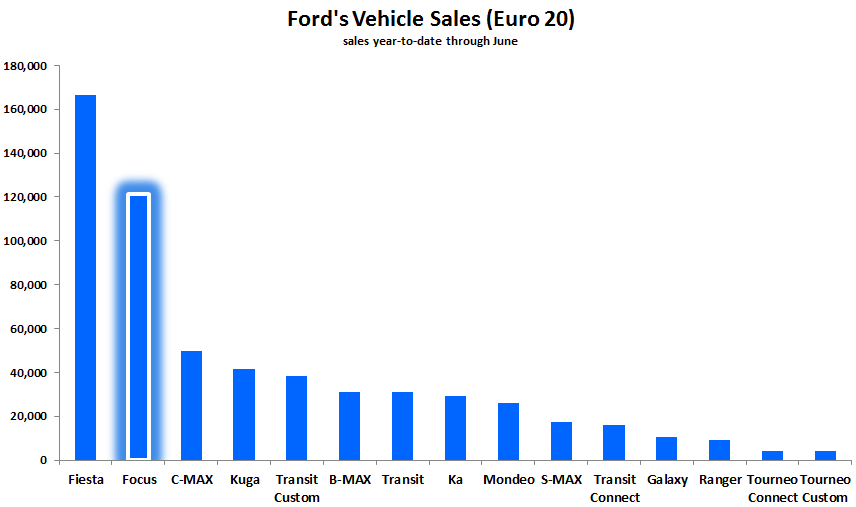

There are a lot of moving parts to attempt an answer for that question. Part of the answer is that Ford's smaller cars are more competitive than in the past, when nobody wanted to purchase a Ford vehicle unless it was a truck or SUV. That's changed; look at Ford's best-sellers in Europe:

The Focus "foreshadowing" is for a reason, wait for it. Chart by author. Information source: Ford.

In addition to Ford's smaller vehicles actually selling, the automaker made difficult decisions much quicker than competitors. Right when Ford's profits disappeared in Europe the automaker, under former CEO Alan Mulally, quickly decided in 2012 it would shut down three factories over the following years. That decision cut about 350,000 units of production capacity, lowering Ford's overhead costs. It followed that decision with another strategy: to keep up its fast pace of redesigns, rather than slowing down to cut costs.

It sounds simple now, because new vehicles with updated designs sell faster and for higher transaction prices. Back then, when cutting costs was imperative, maintaining a fast pace of redesigns was a difficult decision. But now Ford is beginning to reap the rewards.

Through the first half of 2014 Ford's sales in Europe increased 6.6%, and over half of those new vehicle sales were of all-new or significantly refreshed vehicles -- a more profitable situation. Ford has also focused on generating a more profitable vehicle sales mix; only 27% of the company's sales in Europe last month were to less profitable daily rental and dealer registrations. That's 500 basis points better than the rest of the industry, again making each Ford's sale more profitable.

Down the road

Can Ford keep this profitability going? In the short term, no, it can't. Expect full-year 2014 losses in Europe to still test the $1 billion mark. Working against the automaker, it has no plans to introduce its struggling Lincoln brand into Europe, which means Ford won't have a luxury lineup to juice its transaction prices or profits.

On the bright side, the automaker intends to bring a new premium trim to the Ford brand: Vignale. It will be priced about 10% higher than Ford's Titanium trim, and will have certain features only previously available on luxury models.

Also, included in the 25 new models Ford intends to launch in Europe over the next five years, a new Mondeo (Fusion) and Focus will hit the streets soon. The Focus is already a top seller, and the Fusion could be the next big hit. Both bode well for Ford in Europe.

The takeaway

While Ford's second quarter in Europe was certainly great news, we can't get too far ahead of ourselves. This is just the latest and brightest sign yet that Ford will indeed break even, or even become profitable, in 2015. However, there will still be more speed bumps along the way.