Imagine if you could own a part -- albeit a very small one -- of every piece of property you walked into. Whether it be a restaurant down the street, a friend's house in the neighborhood over, the building you worked in, or the office of your doctor.

And knowing all that, what if 90% of the rent money those properties paid was in turn sent right back out to the individuals who owned them?

Sound too good to be true? Well, while you may not own the properties outright, through Real Estate Investment Trusts (REITs) you can invest in the companies which own those properties, and so much more.

What are Real Estate Investment Trusts (REITs)?

In 1960, after the signature of President Eisenhower on the REIT Act, Congress established the ability for individuals to invest in the companies which can both own and operate real estate and property across the U.S.

That property -- and sometimes just the pieces of paper which own the property -- can span a variety of different types, including:

- Commercial property -- office buildings, shopping malls, warehouses, etc.

- Residential property -- apartments, single-family homes, self-storage facilities, etc.

- Property financing -- mortgages, loans, etc.

And that is just the tip of the iceberg. There is likely a REIT out there which owns just about anything you can think of, whether it be a cell-phone tower, a retirement home, your favorite restaurant chain, and so much more.

But it's important to note, generally speaking, REITs don't own the businesses themselves, just the locations in which they operate, and in some sense, are like a landlord.

How big is the REIT industry?

While many of the REITs may not be household names, some of the companies which lease property from them are. Whether it be a CVS, LA Fitness, or so much more, properties across the country are owned by REITs.

And at last count, the REITs in the United States had more than $1.2 trillion worth of real estate and there were 40,000 pieces of commercial property that were owned by REITs in the U.S.

178 of these REITs are listed on the New York Stock Exchange, and there are 20 REITs which are currently included in the S&P 500. Oh, and those 178 REITs on the NYSE have a market cap of nearly $700 billion.

All of this is to say, the REIT industry is a massive one.

How does the REIT industry work?

There are many variations of what exactly a REIT is, and there are three main types of REITs, Equity REITs, Mortgage REITs, and Hybrid REITs.

Equity REITs own physical property, and make up 90% of the total REIT industry. Nearly all of the income they receive comes from managing the properties and renting them out to various tenants as a part of its portfolio of investments.

Mortgage REITs usually don't own the properties themselves and rent them out; they instead own a collection of individual mortgages, or mortgage backed securities (MBS). From those bundled packages of residential or commercial loans, Mortgage REITs then collect interest on those securities they hold.

As you might have guessed, Hybrid REITs mix the strategies employed by both Equity and Mortgage REITs.

But regardless of what type of REIT it is, in order for a company to be designated as a REIT, every year, it must send 90% of its taxable income out to shareholders through dividends. As a result of it being designated as a REIT, those companies are allowed to deduct the dividends paid to shareholders from taxable income -- thanks to accounting quirks, often they will pay more than 100% of the taxable income to shareholders -- and in turn, don't owe corporate taxes.

In addition to having both its assets and income related to real estate and paying out more than 90% of its taxable income to shareholders through dividends, REITs are required to have more than 75% of both assets and income be from real estate sources.

What are the drivers of REITs?

For those REITs which own physical properties, one of the drivers of success is the current state of the American economy.

Although many leases lock tenants in for multiple years, REITs are of course dependent on those tenants actaully paying their rents. Many of the industries in which REITs operate have a variety of characteristics too, so a REIT focused on retail property will perform differently than one which owns health care buildings.

In addition, many REITs seek to expand by buying more property to in turn lease out. While this driver is up to each individual company and its management team, overpaying for properties and taking on too much debt could present problems.

Finally, interest rates affects REITs. Generally speaking, falling interest rates cause more investors to seek the dividends REITs are required to pay out, driving up their stock prices. Similarly, if rates are rising, REITs could be hurt because people looking for income will look to fixed income.

Mortgage REITs are most affected by rising rates, because when rates rise, the prices of the bonds held falls. And for equity REITs, rising rates typically mean better economic conditions, which should lead to greater demand for property. But that may not always be the case.

The bottom line on REITs

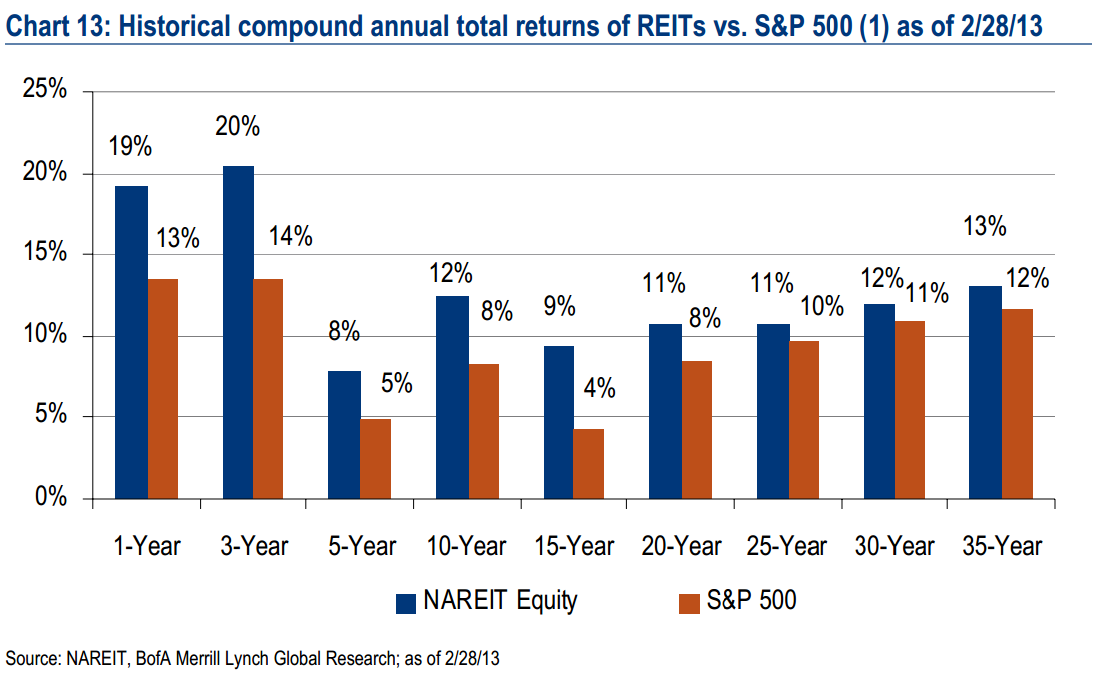

Thanks to the high dividends REITs offer, they often pique the interest of many investors. Throughout their history, REITs have time and time again outperformed the broader stock market:

Source: BofAML REIT Primer, A Peek Into the Industry.

That's not to say that will continue into the future, but all things considered, there's a lot for investors to like about REITs.