Shares of Stratasys (SSYS 1.32%) skyrocketed 20% in morning trading after the leading 3-D printing company crushed analysts' estimates when it announced its second-quarter 2014 results today before the market opened.

Here are the highlights:

- Revenue jumped 67%, to $178.5 million, handily beating analysts' expectations of $156.6 million.

- Organic revenue grew a strong 35%, significantly beating the company's 2014 organic growth target of "at least 25%." This excludes the $33.6 million in revenue generated from MakerBot.

- Non-GAAP earnings per share increased 22%, to $0.55, crushing the consensus of $0.45.

- GAAP EPS came in flat at $0.00, versus a loss of $0.07 in the year-ago period.

Moving beyond the headliner numbers and market reaction, here's what investors should know:

Revenue growth continues to power along

Stratasys sells 3-D printers, print materials (or "consumables"), and provides services, which include on-demand 3-D printing services, and maintenance contracts for its printers. Here are key revenue stats for the quarter:

- Product revenue increased 70.7%, to $154.1 million.

- Within products, system (printer) revenue jumped 108%, while consumables revenue increased 35%.

- Excluding MakerBot, system revenue rose 51%, while consumables revenue grew 24%.

- Service revenue increased nearly 50%, to $24.4 million.

- MakerBot generated revenue of $33.6 million, a 100% increase over the revenue it generated as an independent company in Q2 2013.

During the conference call, CEO David Reis noted these areas of strength:

- Sales of high-end Fortus systems, driven by increased demand for manufacturing applications.

- Sales of the Objet500 Connex3 Color Multi-material 3D Printer, the world's first 3-D printer that can print in multiple colors and materials.

- Sales of entry-level Mojo and uPrint systems.

Continued strong demand for the company's 3-D printers bodes well for future growth of print materials. Consumables are a key reason that both Stratasys and 3D Systems are powering up their efforts to capture as much market share as fast as possible. The more printers these companies install, the more reoccurring revenue from material sales they should receive, because most 3-D printers use proprietary materials. Consumables generate higher than company-average profit margins, so they boost earnings.

Here's the revenue trend picture since Q1 2013:

Source: Stratasys.

Gross margin up, profitability down, as Stratasys invests for future growth

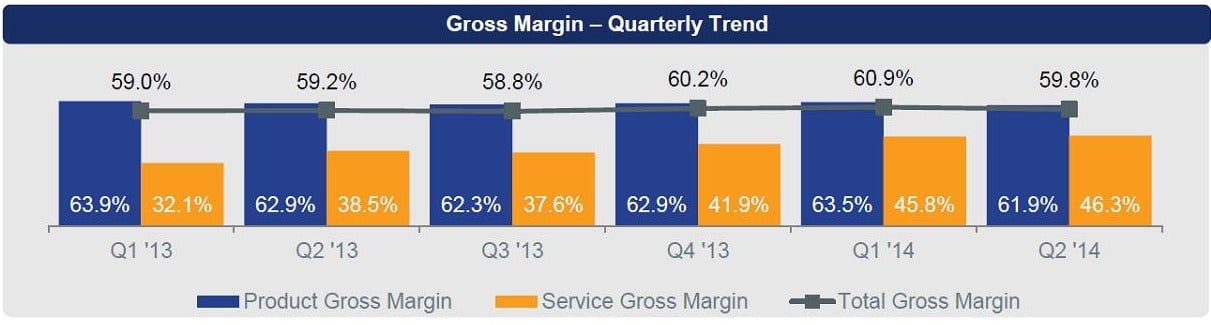

Adjusted gross margin increased to 59.8% from 59.2% in the year-ago period. This is especially notable because MakerBot continues to grow faster than Stratasys' overall business, and MakerBot's margins are lower than Stratasys' overall margins.

The following chart nicely shows what's happening. Stratasys adjusted gross margin in its product division decreased 1% from the year-ago period, to 61.9%. However, the adjusted gross margin increase in the service division more than made up for the product division's decrease, as it increased to 46.3% from 38.5%. It should be interesting to see how the service gross margin is affected by the two service bureau acqusitions. We might get some idea of that in Q3; however, because the acquisitions just closed in Q3, it won't be until Q4 that we'll get a clearer picture.

Source: Stratasys.

Like last quarter, Stratasys' increase in adjusted gross margin didn't make it down to the operating and profit margin levels. Operating margin decreased to 16.1% from the year-ago period's 20.3%, while profit margin (not shown here) decreased to 15.7% from 17.4%.

Decreased profitability, however, was expected due to the company's growth strategy of sacrificing short-term profits for spending on activities aimed at fueling long-term growth and capturing market share. Stratasys racheted up its sales and marketing spending in the quarter, which resulted in increased operating expenses, and a lower operating margin.

Source: Stratasys.

Key business highlights

The quarter's key business highlights included:

- Completed the acquisitions of Solid Concepts and Harvest Technologies, which both provide on-demand 3-D printing services.

- Began shipping the MakerBot Replicator Mini and MakerBot Replicator Z18 desktop printers.

- Expanded the MakerBot sales channel to include Home Depot and Tech Data, as well as Stratasys Japan in Asia, and the creation of MakerBot Europe.

Solid Concepts is the largest independent 3-D printing services operation in North America, while Harvest Technologies has expertise in advanced parts production and materials. Stratasys now expects these acquisitions to be "modestly accretive" to its non-GAAP earnings in 2014.

Guidance for 2014 raised

Stratasys raised its guidance, as I said that I thought it likely would in my earnings preview. It increased revenue guidance to $750 million-$770 million, up from its previous $660 million-$680 million. It increased non-GAAP EPS from $2.25-$2.35, up from $2.15-$2.25. Stratasys didn't update its GAAP EPS guidance, which remains in the range of $0.20-$0.38. This is because the final accounting of the company's two service bureau acquisitions is not yet completed, according to information shared on the call.

Additionally, Stratasys now expects organic sales, which exclude MakerBot sales, to grow at least 30%, versus previous guidance of at least 25%. MakerBot is expected to grow at a higher rate.

The 2014 guidance at the midpoint implies revenue growth of 56% and adjusted EPS growth of 25%.

Long-term operating model updated

Notably, Stratasys increased its organic growth projection by 5%. Here's the updated model:

- Annual organic revenue growth of at least 25%, versus the previous projection of at least 20%.

- Non-GAAP operating margin of 18% to 23%, versus the previous projection of 20% to 25%.

- Non-GAAP effective tax rate of 10% to 15%, versus the previous projection of 15% to 20%.

- Non-GAAP profit margin remains unchanged at 16% to 21%.

The decrease in non-GAAP operating margin indicates the company plans to play its elevated growth game a bit more than previously expected over the long term. This is a slight decrease, and nothing to be concerned about, in my opinion. The fact that the company now expects its effective tax rate to decrease will certainly help its bottom line. However, the tax rate has no effect on either revenue or operating income (or, thus, operating margin), so it's not the reason for these targets being updated.

Foolish final thoughts

Foolish investors who have stayed the course with Stratasys can rejoice as the company turned in impressive results -- and there doesn't appear to be any obvious yellow flags lurking beneath the strong headliner numbers. For instance, cash flow from operations was greater than adjusted operating income, which is a positive.

More importantly, since the market is a forward-looking game, Stratasys' 2014 and long-term guidance bump up across multiple fronts -- revenue, non-GAAP EPS, and organic growth -- underscores managements' confidence in the company's immediate and longer-term future performance.