No city in America reinvents itself more often than Las Vegas, and after a few quiet years on The Strip, the skyline is about to change again.

James Packer, an Australian billionaire and chairman of Crown Resorts, recently bought the land that once held the New Frontier casino, located north of the Fashion Show Mall. The 34.6-acre property will house the latest megaresort in Las Vegas and is located just south of an 87-acre property recently bought by Genting Group, which is building the $4 billion Resorts World Las Vegas.

The former New Frontier Hotel, which will be the site of The Strip's newest megaresort. Photo source: KyleLV via Wikimedia.

These two properties are being developed while resorts on the Las Vegas Strip continue to struggle financially, and when completed they will add capacity to an area that will arguably be oversupplied for the next decade. But reasons for these moves can be found if you dig deep enough behind the headlines.

The changing face of Las Vegas

First, let's cover exactly what we know about what Packer and Genting Group want to build.

Genting Group is building an Asian-themed resort on the site that once held the Stardust hotel and casino, a property Boyd Gaming tore down to build the $4 billion resort Echelon Place. Those plans were abandoned when the economy went into free fall in 2008, and the partially constructed resort was sold to Genting Group for $350 million. Genting intends to build on the existing foundation and construct a resort that some estimate could cost as much as $7 billion to complete.

The abandoned Echelon Palace site, which will soon become Resorts World Las Vegas. Photo source: Bobak Ha'Eri via Wikimedia.

Genting's plan is to construct the resort in three phases with Phase 1 including 3,000 hotel rooms, 3,500 slot machines and table games, and 30 food and beverage locations. Construction of the first phase is planned to be complete in 2017.

Packer's plans are in a much earlier phase: Construction is expected to begin next year, with completion targeted for 2018. While a smaller footprint for the site means a smaller scale than Resorts World Las Vegas should be expected, the budget will still be in the billions.

Why Las Vegas and why now?

The Las Vegas Strip isn't exactly a booming market right now. The region still hasn't reached gaming levels seen in 2007, and supply had already been added to the market in recent years by CityCenter and Cosmopolitan, among other smaller hotel resorts.

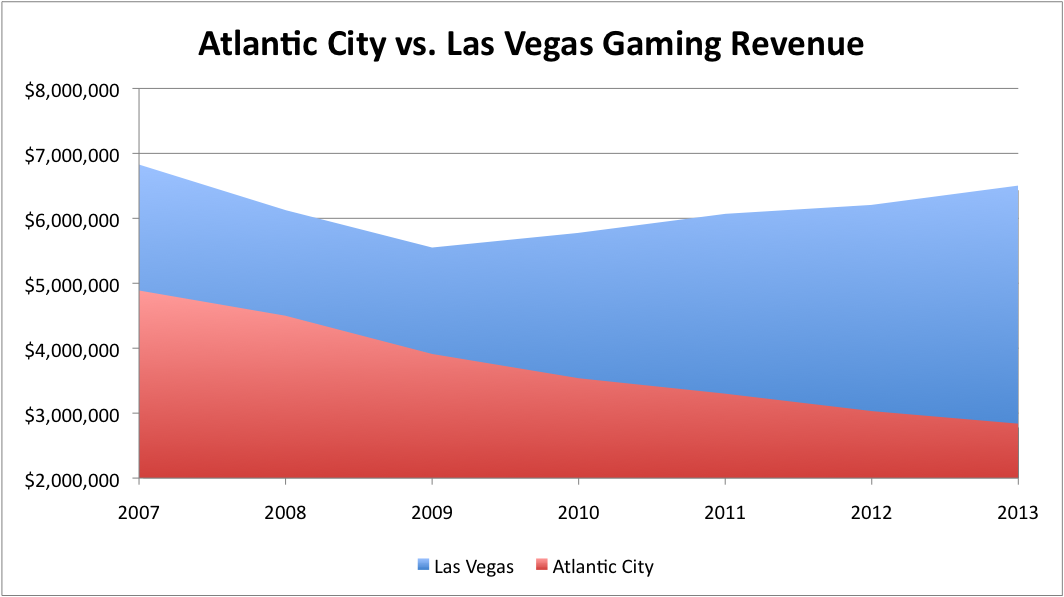

But Las Vegas' gaming revenue is recovering from recession lows more quickly than other regions in the U.S., particularly Atlantic City, New Jersey. The chart below shows that Atlantic City continues to see gaming revenue fall in the face of increased regional competition; meanwhile, Las Vegas is on the road to recovery.

Another attraction to Las Vegas is the fairly open market for gaming operators, unlike booming Asian gaming markets such as Macau, Singapore, and The Philippines. These Asian markets are restricted to a small number of players who had to win competitive bids to enter the market while the number of gaming companies in Las Vegas isn't as restricted. As long as Packer and Genting Group pass a stringent regulatory compliance check they can enter the market.

It isn't that they've ignored the Asian market. In fact, Genting has one of two licenses and casinos in Singapore and Packer's Crown Resorts is a partner in Melco Crown, which is one of six concessionaires in Macau. Singapore isn't expanding beyond two casinos any time soon while Macau's buildout of the Cotai region is under way, including a resort from Melco Crown. Beyond the resorts they already have operating or under construction in Asia, there just aren't many attractive opportunities to expand in Asia, so they looked to Las Vegas. It may be a risky move, but it's one they felt was needed to build a presence in one of the world's best-known gaming markets.

Can the new generation of Las Vegas megaresorts succeed?

The challenge now is building a resort that can be profitable, which is harder than it seems. The Cosmopolitan -- the newest megaresort on The Strip -- has reported annual losses of about $100 million per year since opening in 2010, and CityCenter just reported a $2.1 million operating loss for the second quarter.

What Packer and Genting have going for them in Las Vegas is location. I recently highlighted that north Strip residents Wynn and Encore Las Vegas make up the most profitable resort on The Strip, while neighbors The Venetian and Palazzo Las Vegas are also doing well targeting upscale customers.

You can see below that EBITDA -- a proxy for cash flow -- of $331 million from CityCenter over the past year doesn't exactly show a solid return on the $8.7 billion investment. But resorts on the north side of The Strip have fared better and show that decent returns are available.

| Property |

Construction Cost |

EBITDA (TTM) |

|---|---|---|

|

Wynn and Encore Las Vegas |

$5 billion |

$501.4 million |

|

Venetian and Palazzo Las Vegas |

$3.3 billion |

$321.1 million |

|

CityCenter |

$8.7 billion |

$331 million |

Source: Company earnings releases. TTM = trailing 12 months.

As Genting Group and James Packer build Las Vegas' newest megaresorts, they'll be betting that this city as a whole can continue to grow and that the north side of The Strip can attract more traffic. It's a risky move, but I wouldn't bet against these two as they are the latest to reshape the skyline of Las Vegas.