Source: Apple.

Apple (AAPL 0.93%) may be best known for its strong consumer brand, with loyal fans flocking to its new devices, but the company is also one of the strongest contenders in the mobile enterprise sector as well. According to a new report by Good Technology, Apple's iOS outpaces Google's (GOOGL 0.83%) (GOOGL 0.83%) Android or Microsoft's (MSFT +0.70%) Windows Phones in the enterprise sector by a long shot.

A true business leader

Let's take a quick look at the two main categories of Good's report--smartphones and tablets. The graph below shows how Apple stacks up to Android and Windows Phone in net enterprise activations in the second quarter of this year:

Source: Good Technology.

Let's focus on the smartphone activations for a moment. Apple, by far, outpaces the competition with 51% of activations, while Android took 30%, and Windows Phone had just 1%. Good pointed out that Microsoft's operating system has maintained the same paltry percentage for the previous five quarters. Meanwhile, Android gained four percentage points in Q2, sequentially, and the iPhone maintained the same percentage.

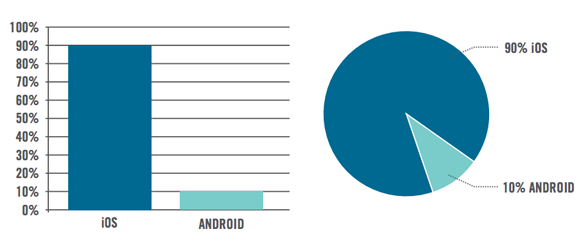

When it comes to enterprise tablet activations, Apple has the market by a stranglehold. In the second quarter, Apple was actually down two percentage points from Q1, but still accounted for 90% of enterprise tablet activations.

Source: Good Technology.

In addition to Apple's enterprise smartphone and tablet dominance, the company also took 88% of all enterprise app activations in Q2--a four percentage drop from Q1, but still far ahead of Android, which holds just 12%.

After analyzing all the stats, Good says Apple held a total of 67% of mobile device activations in the enterprise sector in Q2. That's down from 72% in the first quarter, which means Apple has a little work to do to gain back some ground.

So where does the company go from here?

Source: Apple.

Apple's brilliant plan to go even further

While Android made some slight gains in the second quarter, it would be premature to assume Google's OS can pull off an enterprise coup. Apple helped solidify its role in the business world when it joined forces with IBM (IBM +2.63%) just a couple of months ago. The two companies will create about 100 new enterprise apps, and IBM will officially cover 24/7 technical support for Apple enterprise devices under a new AppleCare for Enterprise service.

Source: Apple.

IBM and Apple said they'll initially focus on retail, health care, banking, travel, transportation, telecommunications, and insurance industries. According to data from Good, those sectors make up at least 55% of Apple's enterprise iPad activations in Q2.

That's good news for Apple, considering that last year businesses spent $11 billion on iPads, and Forrester Research expects that number to hit $13 billion by 2015.

Good's report quotes additional research from Forrester that says: "We see more spending shift to software for mobile applications and middleware as well as the necessary management solutions to provision and manage mobile applications. At the end of the day, we may talk about mobile devices, but in reality it's all about the apps."

And this is where Apple's partnership with IBM becomes so important. With the two companies creating at least 100 new enterprise apps from the ground up, and then having IBM manage the device security, cloud storage, and device management, it's going to be very hard for Android and Windows Phone to match that level of support and tailor-made applications.

As long as Apple and IBM execute their partnership well, there's no reason why Apple can't continue to grow its mobile enterprise lead.