China is desperate for energy to fuel its continued economic growth. Unfortunately, at the moment it's also addicted to the dirtiest and least safe source of energy: coal. China now consumes over half of all of the coal in the world, and its consumption has tripled since 2000. In 2009, China derived 70% of its energy from coal, and the government plans to construct another 363 coal-fired power plants.

The country is paying for this intense focus on coal with some of the worst air quality in the world. For example, in February air pollution in Beijing reached eight times the maximum safe levels recommended by the World Health Organization.

However, China's government is making valiant efforts to move away from coal and has even said it will ban coal power plants in Beijing by 2020. To replace coal, the government is making a big push into solar and natural gas. Beijing is working to boost its natural gas power capacity from 26 gigawatts in 2010 to 56 gigawatts in 2015.

To help fuel all these new power plants, China will need a massive amount of natural gas. In May, the government signed a 30-year, $400 billion deal to buy natural gas from Russian giant Gazprom. However, China also has big plans to exploit its own natural gas resources, which are the biggest in the world.

China: king of shale gas

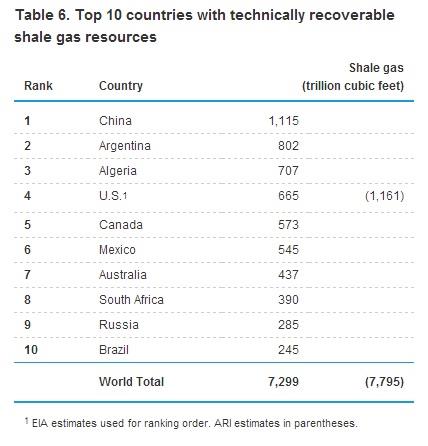

According to the U.S. Energy Information Administration, China has 68% more technically recoverable gas than the United States. China's government had previously announced an ambitious plan to produce 6.5 billion cubic meters of gas in 2015 and increase that by 56%-73% annually through 2020 to 60 billion-100 billion cubic meters. For perspective, that would be 22%-37% of U.S. gas production in 2013.

Now government sources are telling industry insiders that those goals are being pulled back by 50%-66% to just 30 billion cubic meters by 2020.

Three risks threatening China's potential energy miracle

There are three primary reasons China is having a difficult time recreating America's shale gas success: economics, infrastructure, and water.

More complex geology and smaller shale formations mean total production costs can be much higher in other nations compared to the U.S. For example, energy consultant firm Wood Mackenzie estimates that it costs nearly $4.9 million per well to drill in China's Sichuan shale, versus just $1.7 million to drill in the Huron shale of West Virginia.

Adding to the challenges of shale gas production is China's infrastructure problem, mainly that it's woefully behind the U.S. when it comes to pipelines.

According to the CIA World Factbook, in 2008 China had 28,132 kilometers of gas pipelines. In 2014 that number is 48,502 kilometers. China is in the middle of a massive pipeline construction project to double its pipelines between 2011 and 2016; however, with 4.1 times the population density of the U.S., China is simply too crowded to build out the necessary infrastructure to create an American-style gas boom.

Consider this: The U.S. is 16% smaller than China in area yet has 1.984 million kilometers of natural gas pipelines ( a number that has nearly quadrupled in the last six years).

The U.S. also has 41 times the natural gas pipeline infrastructure and is expected to invest $641 billion into additional infrastructure by 2035.

But perhaps the largest problem for China when it comes to the recreating America's shale gas miracle is the lack of water.

Water, water everywhere but not a drop to frack

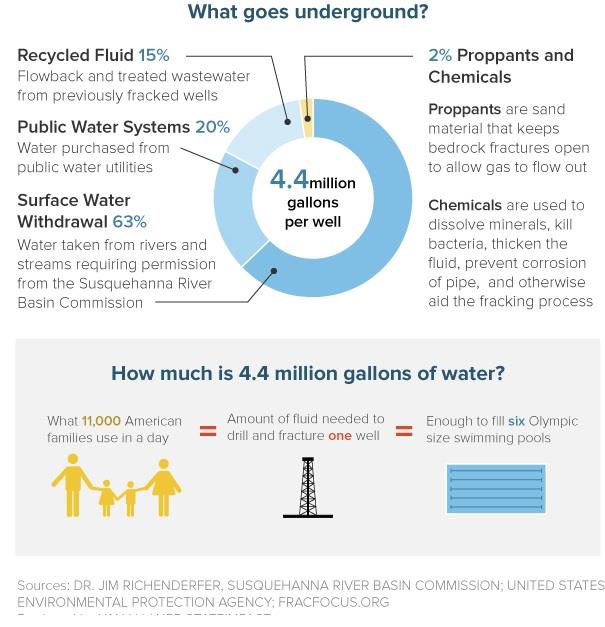

Fracking is very thirsty work, with the average gas well requiring 4.4 million gallons -- enough water to supply 11,000 U.S. households for a day.

According to the CIA World Factbook, the U.S. has 3,069 cubic kilometers of renewable freshwater resources, 1,583 cubic meters per person per year. On the other hand, China has 2,840 cubic kilometers of water and just 410 cubic meters per person per year.

China faces a significant water shortage, with per capita water resources declining by 20% since 2000 while per capita use has increased 10%. Given that almost all of China's power generation comes from water-intensive coal, nuclear, and hydro, government officials are concerned that not only might the nation run out of drinking water, but it soon could face a power shortage as well.

The situation is so dire that China is working on the largest water transfer project in history: the south-north water diversion project, which has been in planning since 1952 and won't be completed until 2050. The $62 billion project will divert 44.8 billion cubic meters of water annually 2,700 miles north. That is the equivalent of diverting the river Thames in London across the width of the United States.

A nation that must undertake such herculean efforts to supply its people with water and keep the lights on is unlikely to recreate the kind of shale gas miracle the U.S. is enjoying -- no matter how large its gas reserves might be.