Shares of Argentinean integrated oil and gas company YPF (YPF +2.04%) have been particularly volatile over the past few years. The separation from Repsol in April 2012 and economic jitters in Argentina are big reasons for uncertainty regarding YPF. On the other hand, the stock has risen by an impressive 91% over the last 12 months as the company is generating solid financial performance on the back of increased production and strong profit margins.

Let's go over YPF's latest earnings conference call and highlight some important quotes from the company's management team and their implications for investors.

Strong performance in U.S. dollars in spite of currency devaluation

YPF reports official financial figures in Argentine pesos, which can be quite confusing, considering that the local currency has materially depreciated over the past year. But management decided to also show its main financial figures in U.S dollars during the second quarter, and the company is doing quite well in spite of macroeconomic volatility in Argentina:

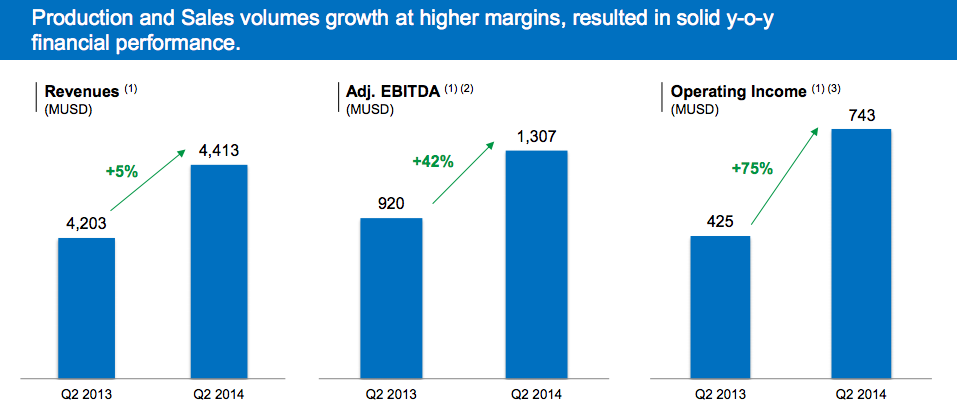

While the currency devalued, or depreciated, by 53% against the U.S dollar in the last year, revenue still grew 5% in dollar terms, EBITDA was up 42% in dollar terms, and operating income was up 75% in this quarter.

Source: YPF

Solid performance in both upstream and downstream

Both the upstream and downstream business are generating increased profitability because of growing volumes and increased prices.

The improved operating income was balanced in both businesses -- upstream and downstream -- as we showed increased production in the upstream and increased processing and increased sales in the downstream, and in both cases at higher prices in dollar terms. And, of course, significantly higher in pesos.

Production in Vaca Muerta is going as expected

Vaca Muerta is a world-class shale oil and gas reserve. A 2013 report from the U.S Energy Information Administration estimates that Vaca Muerta positions Argentina as having one of the biggest shale gas and oil reserves in the world, with 802 trillion cubic feet of technically recoverable gas and 27 billion barrels of technically recoverable oil barrels.

Source: EIA.

According to YPF´s management, the company is making sound progress when it comes to production in this remarkably valuable formation:

Moving more specifically to shale, operations are running as expected. We have 21 drilling rigs in Loma Campana, including the four rigs that came in in the last few months. Still waiting for another 15 rigs that have been secured and will arrive in the next months. This quarter we drilled around 50 wells, and plan to drill another 100 before the end of the year, targeting Vaca Muerta formation. Since the inception of the project we have already invested over $2 billion, including investments founded by Chevron, and have drilled over 200 wells.

Consistently rising profit margins in U.S. dollars

After the separation from Repsol, many analysts were wondering whether the Argentinian government would allow YPF to generate an adequate level of profitability, or whether the company would need to prioritize low fuel prices for internal consumption and other political and ideological considerations.

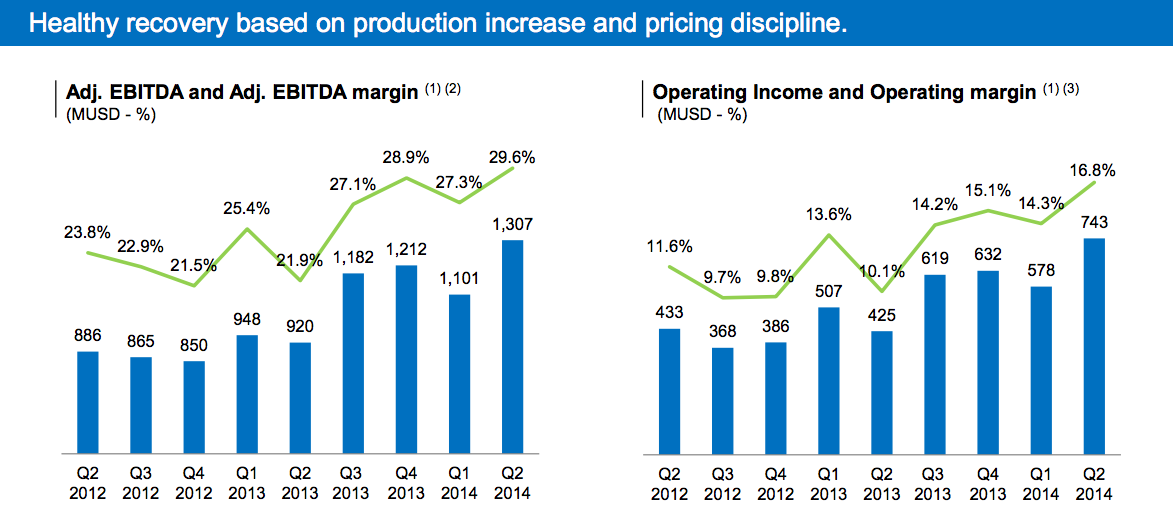

Profitability margins have consistently increased over the past several quarters, and this is good news for investors in YPF when it comes to evaluating the company and its capacity to operate profitably under government ownership.

Part of the strategy that we put out two years ago was based on increasing margins coming from both the upstream and as well as downstream. Coming from production increases and also from price discipline. I think results speak for themselves, you can see that both EBITDA margin and operating margin moved up for at least for quarters in a row.

Source: YPF.

Healthy financial position

The Argentinean default can be a considerable source of uncertainty for YPF and its capacity to access international funding, especially if the situation continues deteriorating and Argentina continues losing access to global financial markets.

Management believes the company has more than enough financial resources in the middle term. On the other hand, restricted access to global credit could be a major limitation for YPF and its ability to invest for growth if the Argentinean default crisis doesn't find a solution in the coming months:

As a result of strong cash flow generation and the $1 billion bond we issued at the beginning of April this year, we ended the quarter with a cash position that fully covers our debt maturities for the next 18 months. On top of that, I feel very confident in our ability to refinance debt maturities coming due in the next couple of quarters, as they are mostly bonds issued in the local market.

Source: YPF.