The latest results from American Express (AXP +0.24%) are in, and while the results were impressive, they also reveal a clear picture of one thing investors love to see.

The strong second quarter

As a result of increased spending from its customers, which brought in more fees and higher interest income, American Express saw its net income rise 9% in the second quarter to stand at $1.5 billion. It also saw its revenue grow to $8.7 billion, a gain of 5% over the second quarter of last year.

Its earnings per share stood at $1.43, a solid surpassing of the $1.38 expected by analysts. But it must be noted it did recognize a $0.05 gain from it spinning off half of its Global Business Travel unit in a joint venture at the end of June.

Source: Flickr / Images_of_Money

In total the purchases made by customers on their American Express cards rose by 9% to stand at $258 billion. This resulted from both an increase in its cards in force, which increased by a little more than 5.5 million to 110 million, and it's the average spending of its basic card holders grew 5% to $4,288.

Encouragingly, American Express also continued to see improvements in the credit quality of its customers -- CEO Kenneth Chenault noted in his prepared remarks "the strong underlying performance this quarter reflected a continuation of some familiar themes," including "credit metrics at or near their historic lows" -- as its net write-off rate fell from 2% in the second quarter of 2013 to 1.6% in the most recent quarter.

And while all those results were undoubtedly good, it turns out one number is critical for investors to see.

The true beauty of share buybacks

One of the most fascinating things about American Express, which I didn't mention explicitly, was that while its income was up 9%, its earnings per share rose 13%.

Of course, part of the reason behind the strength of those gains is attributable to the sale of its global business division, but if even if that didn't occur there would still be a disparity between the growth in its bottom line net income and that of its earnings per share.

This is because in the last year alone, American Express has reduced its shares by more than 4%. Because of this, the strong gains in the results from core operates was compounded even further, and the money available to shareholders was even higher.

But it turns out this was nothing new, and over the last three years, its shares outstanding are down more than 12%:

While MasterCard (MA +0.72%) and Visa (V +0.50%) have also been slowly but surely reducing their shares -- and thus boosting the possible returns to owners -- banks like Bank of America (BAC +0.50%) and Wells Fargo (WFC +1.00%) actually have more today than they did previously.

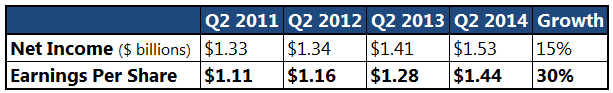

And shown a little differently, you can see since 2011, the net income American Express has steadily grown by 15%, but thanks to its aggressive share repurchases, the earnings available to its shareholders has grown at a rate twice as fast:

Source: S&P Capital IQ

All of this is to say, American Express isn't just seeing strong improvements in core results, but it is also clearly doing even more to ensure it is delivering the money it earns back to its shareholders.

In fact, in the second quarter, 87% of the capital generated by American Express ended up back in the hands of shareholders through either share repurchases or dividends paid out.

The Foolish bottom line

In earnings season we can so easily get caught up in the top or bottom line numbers, or how well a company fared relative to the expectation of analysts. But examples like this reveal the critical importance of gauging the long-term performance.

And it turns out American Express has continued to deliver impressive results both in the last three months and the last three years.