Foursquare Labs, the mobile app company that named me "mayor" of my local coffee shop, launched a shot at Yelp (YELP +0.00%) and Google (GOOG +0.75%) (GOOGL +0.67%) earlier this year. On the company's official blog, Foursquare declared, "Local search is fundamentally broken." The new Foursquare app attempts to fix what's broken with local search, and puts pressure on Google and Yelp to improve their products.

No matter how this plays out, the way you find new restaurants is about to change.

The new app asks users what their tastes are when it's first launched. Source: Foursquare.

A personalized, mobile-first solution

One of the biggest complaints Foursquare has about Yelp and Google is that they provide "one-size-fits-all results." Foursquare asks users to tell it their tastes, and it uses people's previously visited businesses to recommend new ones. The result is a more personalized experience.

Foursquare also has a mobile first approach. Unlike Yelp or Google, which have had to adapt their products for mobile, Foursquare started on smartphones when it launched in 2009. This made features like "tips," where users provide short (character-limited) reviews for potential patrons, much more easily digestible on mobile.

Why Yelp should be concerned

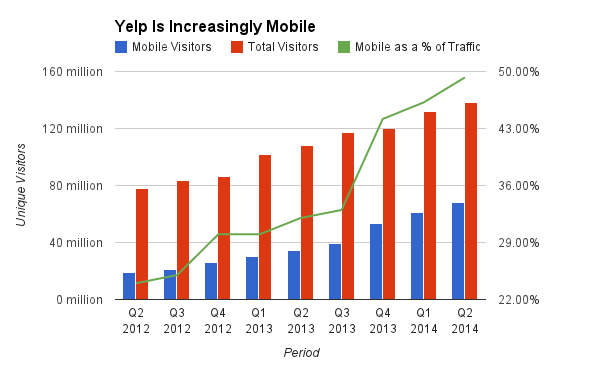

Although Yelp's product wasn't originally made for mobile, the company has adapted well. Last quarter, about 50% of Yelp's traffic came from mobile -- 68 million visitors. The number of mobile visitors grew nearly twice as quickly as overall visitor growth last quarter. Over the last two years, the percentage of Yelp traffic on mobile devices has more than doubled.

Source: Yelp earnings calls.

Yelp's presence on mobile is fantastic, but there's one caveat. The vast majority of Yelp's mobile traffic comes from the mobile web. Yelp stopped reporting its app usage last quarter, but in the first quarter, that number was just 10.9 million users.

Comparatively, Foursquare has 45 million registered users, but only a fraction of them are active. As of the end of 2012, Foursquare reported it had 8 million active users and 25 million registered users. It's quite probable that the number of people using the Foursquare app is similar to the number using the Yelp app.

60 million-plus local searchers up for grabs

Mobile web users are easily influenced by Google's search results. The default search engine on both Android and iOS is Google, and the company's share of mobile search is even higher than its overall web search share. Last year, Google accounted for 68.5% of all mobile searches.

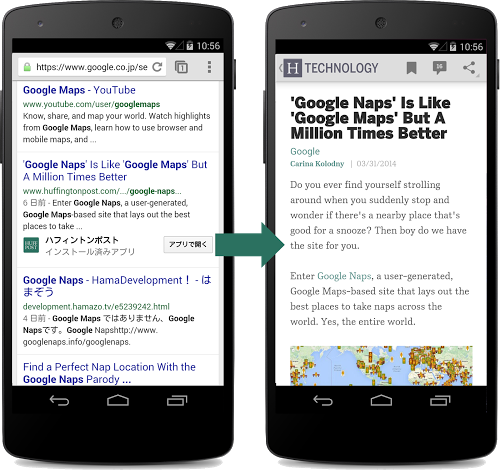

Yelp, by its own admission, is extremely reliant on its Google search rank, particularly on mobile. Google is already working on integrating its mobile web search with native apps. That ought to give Foursquare a boost in its mobile search results once mobile apps are fully integrated. The next logical step for Google is to offer app-install ads, which could have Yelp and Foursquare competing for consumer-facing ad space.

Google added app indexing to its mobile search engine in April. Source: Google "Inside Search" blog.

Meanwhile, Google is promoting its own products. Searches for "coffee shop" or "Mexican restaurant" on mobile bring up results on Google Maps, which is integrated with reviews from Google Plus and menus from Urban Spoon, another competitor of Yelp and Foursquare.

Google is increasingly interested in local search. Most notably, the company bought Zagat a couple years ago, and included its ratings in Google Now. With Google's position as the gatekeeper of the mobile web, it has an immense amount of influence over where those 57 million non-app Yelp users find local businesses.

The pressure is on

The new Foursquare app has received very positive reviews since its release at the beginning of August. Yelp ought to respond with some improvements to its mobile interface, or it risks losing share to the more personalized approach of its competitor. Yelp certainly has the data, having added the check-in feature soon after Foursquare came onto the scene. Google, too, suffers from an impersonal approach despite the gobs of data it has on its users, but improving search results ought to allow both Yelp and Google to increase ad prices for local businesses as they develop better individual profiles for their users.