Source: Southern Company

Southern Company (SO 0.34%) stock has nudged up a miserly 2.4% in the past year, embarrassingly below the S&P 500's (^GSPC 1.07%) 18% gain. But the worst may not be over for this beleaguered utility. Here are three reasons why Southern Company's stock could be in for more trouble ahead.

1. American economy takes a dive

More so than almost any other sector, utilities are at the whim of the American economy. With Uncle Sam's heavy-handed earnings and price regulation, the only road to growth is through increased electricity use.

Utilities were hit hard during the Great Recession, forced to shutter unused power plants as supply outweighed demand. More recently, utilities have undergone another spending spree, spurred on by both lucrative natural gas opportunities and bucket loads of cash from reinvigorated investors.

If the American economy were to take another dip, the results would be even more disastrous. Whereas power plants pushed through with tried-and-true base load fuels like coal and nuclear for most of the recession, their new reliance of natural gas is based on a shakier foundation. Natural gas supply and technology is booming in the United States, and much of today's investments are based on tomorrow's price expectations.

At 45,500 MW, Southern Company has one of the largest generating capacities of any American utility. But it has made the switch, too, and now relies on natural gas for 42% of its capacity, more than coal (38%) and well beyond nuclear (16%).

2. Clean power plan is passed

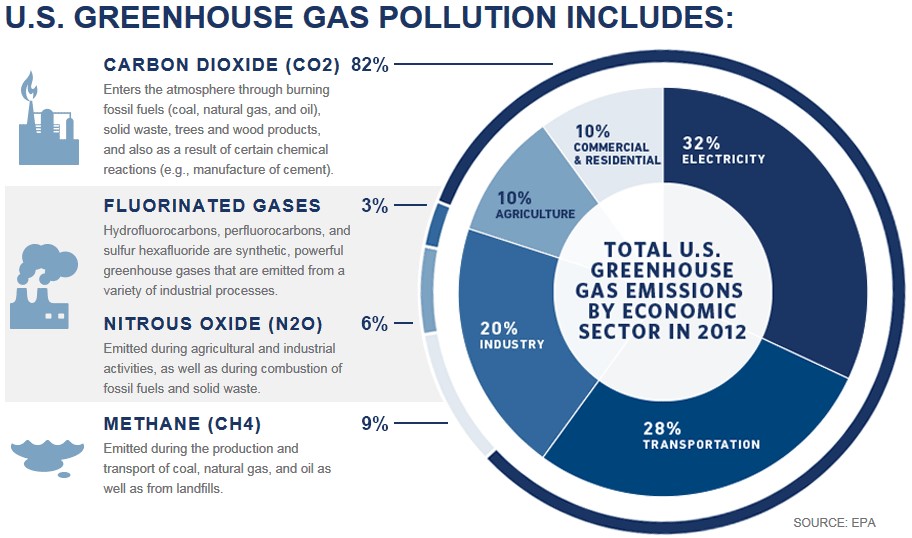

Source: EPA.gov

The Obama Administration has it out for coal. While coal has often found itself in the crosshairs of environmental policy, a new Clean Power Plan proposal could put an end to coal-fired power plants once and for all. As the Brookings Institute, an independent research organization, explains, the Clean Power Plan presents each state with four different choices for cleaning up their electricity act:

- Increased coal efficiency

- Shifting generation to natural gas

- Increasing nuclear and renewables capacity

- Improving energy efficiency

While point No. 1 may seem to be Southern's ticket out, the plan allows for just a 6% savings in coal emissions. Considering coal currently comprises a whopping 38% of Southern Company's total generation capacity, a 6% emissions rate reduction won't mean much for its overall carbon intensity.

Southern Company's dreams of cleaner coal may also be dashed. Since 2010, Southern has been hard at work on a Mississippi-based clean coal power plant. The project has hit multiple hurdles, and its initial price tag has ballooned from $2.4 billion to $5.5 billion, but its goal remains the same.

If Southern's carbon capture technology works, it'll result in a massive 65% drop in total emissions. Unfortunately, that 65% drop may not be scalable if the Environmental Protection Agency (EPA) refuses to acknowledge the unprecedented cleanliness of low-quality coal.

3. Energy efficiency technology picks up

Utilities are increasingly facing another electricity use enemy. Technological advancements are allowing end-users to moderate their power consumption more easily than ever before. Interestingly enough, utilities' biggest competitors may not be other utilities, but technology heavyweights like Google.

In January, Google coughed up $3.2 billion for Nest, an Internet-based home energy management system. While Nest might mean more comfortable homes for you and me, it also means lower overall energy use. Southern Company's 157 billion kWh of retail electricity sales are split nearly evenly between 3.9 million residential, 583,000 commercial, and 15,000 industrial customers.

Source: Nest.com

In Southern territory, Jackson, Mississippi, Nest estimates annual savings between $109 and $492. Taking the average across all Southern residential customers, that results in a $1.2 billion annual sales loss – 7% of Southern Company's overall 2013 sales.

The long view

The American economy won't tank tomorrow, the Clean Power Plan still has a long legislative way to go before being passed, and not every Southerner's going to let Google into their home overnight. But the threats to Southern Company's success are real, and they shouldn't be ignored. The world of utilities is increasingly erratic, and Southern Company would do well to prepare for the worst.