Allergan's (NYSE: AGN) attempt to thwart Bill Ackman and Valeant Pharmaceuticals' (VRX 1.59%) $53 billion takeover offer was dealt a blow by California courts this past week.

Allergan had hoped its insider trading lawsuit against Valeant and Ackman's Pershing Square hedge fund would halt their plans to call for a special meeting that would allow shareholders to vote for new board members likely to favor the deal.

However, in a ruling this week, California judge David Carter opted against moving up Allergan's lawsuit on the court's calendar, effectively clearing the way for Ackman and Valeant to call for the special meeting.

First, a bit of history

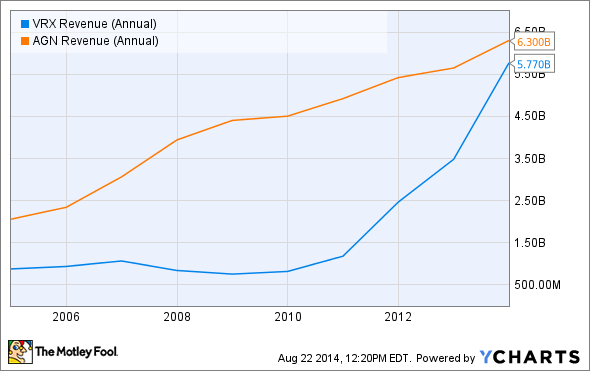

Valeant is one of healthcare's most acquisitive companies. Over the past decade, Valeant has cobbled together a host of companies that has allowed it to grow from a small player with $1.5 billion in annual sales five years ago to a major player with sales of $5.8 billion last year.

VRX Revenue (Annual) data by YCharts.

Source: Allergan.

Valeant's latest acquisition target is Allergan, the well-known maker of the cosmetic drug Botox. In April, Valeant offered Allergan shareholders $48.30 per share in cash and 0.83 shares of Valeant stock to acquire the company, and Valeant boosted its offer to $52.7 billion in May.

If approved, Allergan would be Valeant's biggest deal, roughly doubling Valeant's sales thanks to Botox and a slate of eye care products that would dovetail nicely with Valeant's Bausch and Lomb business.

Unconventional, to say the least

Valeant's CEO spent a year attempting to orchestrate a friendly deal to acquire Allergan, but it wasn't until Valeant approached Pershing Square with the idea of making a hostile bid that the idea to combine the two companies gained momentum.

That agreement between Valeant and Pershing Square leads to the crux of Allergan's lawsuit: Did Pershing Square inappropriately accumulate shares in Allergan ahead of Valeant's bid?

Pershing Square only began buying shares in Allergan in February, yet by the time Valeant made its offer to acquire Allergan on April 22nd, Pershing Square's position in Allergan had swelled to nearly 10%.

Failure to launch

Despite Pershing Square supporting Valeant's offer, Allergan's board resoundingly rejected Valeant's overture, leading to Valeant's higher $52.7 billion bid in May.

However, Allergan's board also rejected that increased offer as "grossly inadequate" and urged its shareholders not to tender their shares to Valeant.

Given the board's rebuff, Valeant and Pershing Square hope to hold a special meeting before the end of this year that could reshape Allergan's board; however, Pershing Square needs to line up support from at least 25% of shareholders before the meeting can be scheduled.

Fool-worthy final thoughts

Judge Carter's decision favors Valeant and Pershing Square because it doesn't block the chance to hold a special meeting before Allergan's lawsuit is heard. In his ruling, Carter determined that Allergan's bylaws don't prevent such a meeting from taking place prior to the case's resolution. Carter said in his ruling:

Even if the bylaws did have such a requirement, however, the court would be reluctant to create a precedent that allows corporations to demand at will the immediate attention and input of the federal courts in order to resolve intra-corporate disputes that might be better left to the dynamic free market or to the state court.

Allergan and Valeant investors should watch closely to see if Pershing Square can muster the votes necessary to hold the meeting, because if they can, it could put Valeant in a much better position to get the deal done. Regardless, we appear far from hearing the last on this issue.