Warren Buffett's Berkshire Hathaway (NYSE: BRK-B) is sitting on a record amount of cash, causing Wall Street to speculate as to what the Oracle of Omaha plans to do with it all.

BRK.B Cash and Equivalents (Quarterly) data by YCharts.

With $55 billion in cash and Buffett having stated in the past that "we will always maintain supreme financial strength, operating with at least $20 billion of cash equivalents," that leaves $35 billion for potential acquisitions. As my Foolish colleague Patrick Morris recently highlighted, Berkshire is betting big on energy. Having bought MidAmerican Energy Holdings in 1999 in a $9 billion deal, Berkshire followed up with several other major energy purchases. These include the $9.4 billion acquisition (cash plus debt) of utility PacifiCorp in 2006 and the $10.1 billion purchase of NV Energy in 2013.

In his 2013 shareholder letter, Buffett stated, "NV Energy will not be MidAmerican's last major acquisition," and the Oracle proved true to his word with Berkshire acquiring AltaLink, a Canadian power transmission company that serves 3 million customers.

Berkshire Hathaway Energy

On April 30, MidAmerican Energy was rechristened Berkshire Hathaway Energy.

The subsidiary has over $70 billion in assets, serves 8.4 million total international customers, and in 2014 is expected to generate 10% of Berkshire's pre-tax profits from $12.6 billion in revenues.

On May 3, Buffett announced his intentions to continue adding to Berkshire Hathaway Energy with an acquisition up to $50 billion. An acquisition of that size would require both cash and taking on debt, but at today's low interest rates, Buffett indicated he'd be comfortable doing so.

According to noted Buffett scholar Robert Miles, Berkshire is interested in capital-intensive companies with consistent cash flows, strong moats, and returns on equity above 10%. This is because Berkshire Hathaway generates $2 billion per month in cash flows and has a lower cost of capital to invest in projects that other companies might not want to take a risk on.

Buffett's next big purchase -- pipelines?

Berkshire Hathaway Energy already operates 16,400 miles of natural gas pipelines through its subsidiary Northern Natural Gas. Pipelines would be a perfect fit for Berkshire for three main reasons.

First, they generate gobs of cash through long-term contracts that are typically inflation-hedged. Second, they are expensive to build and require lots of capital, which Berkshire has in spades thanks to its insurance companies. In fact, Berkshire Energy can borrow money from Berkshire's insurance subsidiaries at rates lower than U.S. treasuries. This creates a durable competitive advantage that is the hallmark of Buffett investments.

Finally, Buffett likes investing along mega-trends, as seen by his $15 billion investment into renewable energy and, as he claims, "another $15 billion ready to go, as far as I'm concerned."

According to analyst firm ICF International, $641 billion in energy infrastructure investments will be needed by 2035 to support America's shale oil and gas boom.

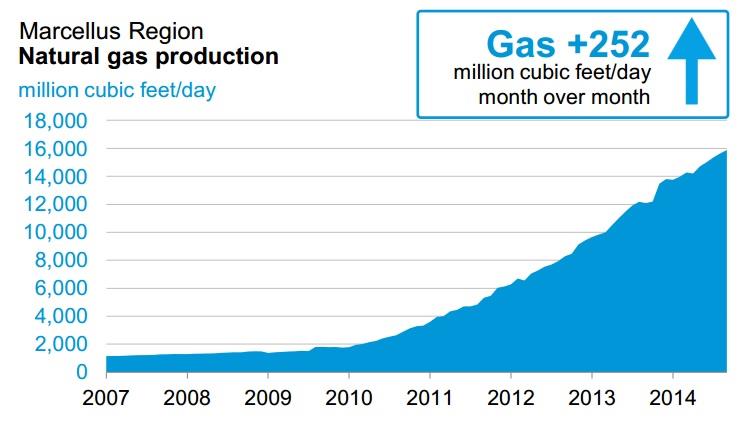

Source: EIA

And according to Scott Sheffield, CEO of Pioneer Natural Resources, U.S. oil production could nearly double to 14 million barrels per day within a few years.

Source: EIA July Drilling Productivity Report.

Similarly, U.S. gas production is soaring, with the Marcellus shale increasing production by 15-fold in just seven years, and ICF International estimating that this production will soar an additional 127% by 2035.

Who Buffett may buy next

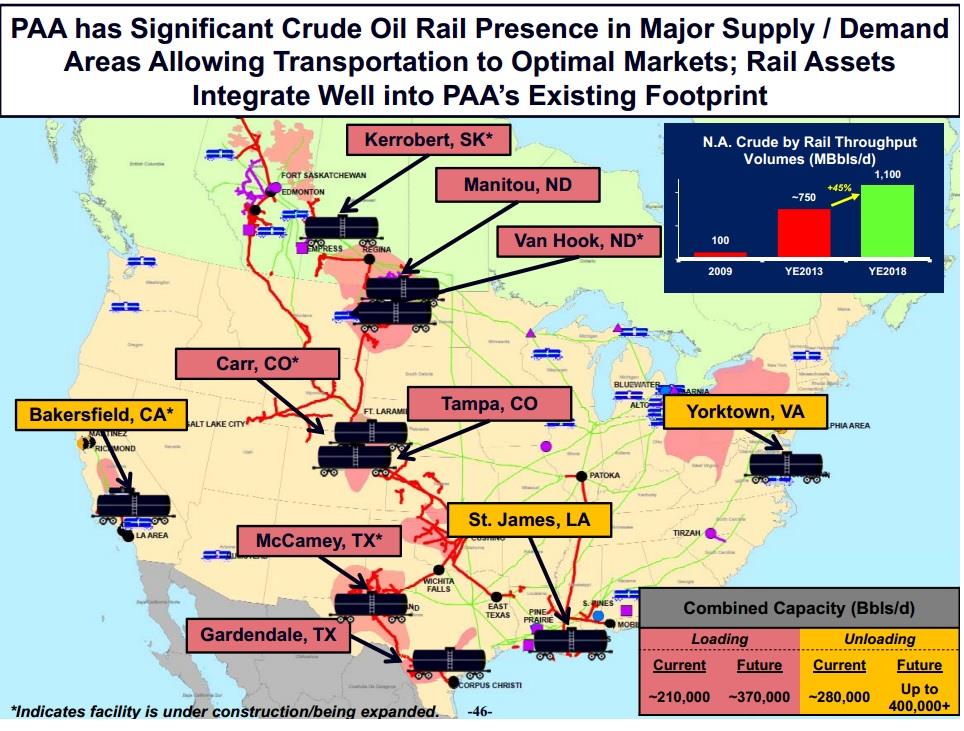

Analyst firm Robert W. Baird & Co believe Berkshire may be eyeing pipeline giant Plains All American Pipeline (PAA 1.75%) and its general partner Plains GP Holdings (PAGP 1.31%).

Why would Buffett find Plains All American appealing? Well, for one thing, Plains All American owns a fleet of 7,400 oil and natural gas liquids (NGLs) rail cars. This provides potential synergy opportunities with other Berkshire companies such as Union Tank Car and Burlington Northern Santa Fe railway. This is especially true given that oil tanker car volumes are expected to increase 20-fold from 2010 to 2015 or 2016, according to Toby Kolstad, president of the consulting firm Rail Theory.

Source: Plains All American Pipelines 2014 Analyst Meeting Presentation

Another thing Buffett looks for is solid management that can stay on after an acquisition and continue growing the company. Plains All American has one of the best management teams in the industry, with a successful history of over 70 acquisitions since 2001 and a good track record of organic investment, which has grown to over $1.5 billion annually.

Why Buffett should buy Plains All American

There are two main reasons Berkshire would do well buying Plains All American Pipelines and its general partner. First, the size of the deal is large, and it would move the needle for Berkshire Hathaway, whose $205 billion in projected 2015 revenue is getting harder to grow. Analysts expect Plains All American to deliver $48.5 billion in 2015 revenues, which would represent 23.7% sales growth for Berkshire.

The second reason is valuation. The enterprise value, which represents the cost to acquire a company by accounting for cash and debt, for Plains All American and its general partner is just $42.75 billion. Thus the price tag fits within Buffett's $50 billion maximum mentioned on May 3 and would represent a price-to-sales ratio of close to one. This is in line with ExxonMobil (P/S of 1.06), which Berkshire Hathaway owns 0.92% of in its stock portfolio.