YouTube has exclusive content to differentiate its service. Source: Android PolicDespite several setbacks, Google (GOOG 2.48%) (GOOGL 2.42%) is moving forward with its YouTube subscription music service. This week, a series of leaked images from Android Police gave us quite a few details about what the service will be like.

Despite several setbacks, Google (GOOG 2.48%) (GOOGL 2.42%) is moving forward with its YouTube subscription music service. This week, a series of leaked images from Android Police gave us quite a few details about what the service will be like.

Most notable among the speculative features of the service is that Google will tap into YouTube's trove of live concert footage, remixes, and song covers -- music that's mostly exclusive to YouTube. Additionally, it will remove ads from YouTube music videos, allow for audio-only listening on mobile, and integrate with Google Play Music All Access, Google's current music subscription service.

Google is setting itself apart from the plethora of music subscription services, and is poised to dominate the growing market.

Everybody has 25 million songs

The rapid rise in music streaming has led to a plethora of choices when it comes to which platform to use. The problem is exacerbated because just about every one of them has the same catalog of music. Each mainstream music streaming service boasts over 20 million songs.

There are slight tweaks that might differentiate one from another. Pandora has its Music Genome Project and loads of data, which makes a great radio service, but it's not on-demand. Spotify capitalized on people's desire to share music with friends with its shareable playlists. Others are built on top of terrestrial radio (iHeartRadio, TuneIn Radio), and still others are about curated playlists or stations (Beats, Slacker, Songza).

But really, it's the same product with different packaging.

Right now, there's not much difference between Google Play Music All Access and Spotify. Source: Google and Spotify

Microsoft is surprisingly ahead of the pack. Its Xbox Music service includes over 92,000 music videos. YouTube houses even more, though, with its Vevo joint venture library topping 100,000 videos.

Google will separate itself even further if it integrates its exclusive live performances and other audio content with streaming albums from All Access. It's like Google is selling the deluxe edition of an album for the same price as its competitors are selling the standard edition.

Taking share of a growing market

With a superior product, Google should be able to take a large chunk of the market as it grows. In the first half of 2014, on-demand music streaming (different from Internet radio) grew 42%. That's even faster than the resurgent vinyl medium, and it's off a much larger base.

Even with a superior product, though, Google could miss out on a significant share of the market. It's already starting at a deficit to services like Spotify and Deezer, which both have strong momentum in the market. But YouTube is the perfect launching pad for Google. The ad-supported nature of the site will allow Google to put banner ads or pre-roll ads around music videos. These are qualified leads -- hundreds of millions of them.

Most music subscription services don't do much consumer-facing marketing. Those that have, like Beats Music, haven't had great success. Using YouTube's platform to advertise is low-cost and low-risk for Google.

A recent survey by MIDiA Research found that 7% of consumers would pay a monthly fee to watch YouTube music videos with extra content and no ads. That's potentially 70 million users, which is on par with Pandora's free radio service. Of course, $9.99 per month is probably much higher than most of those 7% had in mind. Still, converting even 1% of YouTube users, 10 million, would equal Spotify's subscriber count.

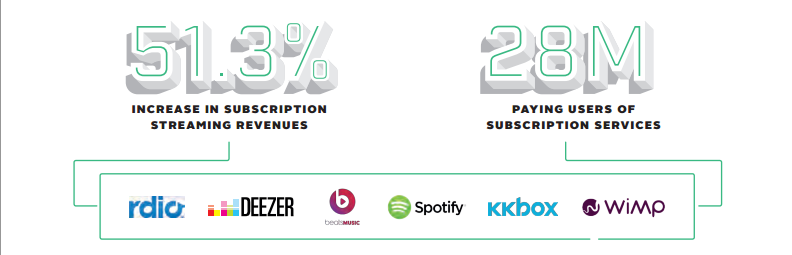

The subscription streaming music market is growing rapidly. Source: IFPI.org

A big opportunity

Paid music subscriptions are growing in-line with the rest of music streaming. Last year, the number of listeners that subscribed to a music service grew 40% to 28 million. It's easy to see that the number of subscribers could grow to 100 million within the next five years, creating a $10 billion industry. That's a big opportunity, even for Google.