Digital Realty Trust (DLR +0.85%) delivered solid, albeit unspectacular results in the second quarter of this year, as its adjusted funds from operations rose by slightly less than 2% to stand at $1.21 per share.

This topped the expectations of Wall Street -- which stood at $1.20 per share -- and encouragingly it also raised its full year guidance, from $4.80-$4.90 per share to $4.85-$4.95. And after a review of the management's discussion of the earnings in its conference call, there are five key takeaways for investors to remember.

1. Slow times aren't exactly new

Matt Miszewski, the SVP of Sales & Marketing began his remarks by noting:

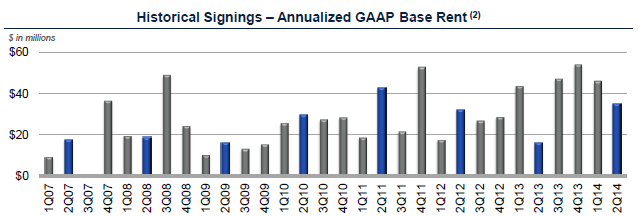

The first half of the year tends to be seasonally slow. The consistency of our recent leasing momentum is readily apparent from a comparison of our year-to-date leasing activity relative to the first half of any previous year.

A simple glance at lease signings it has made it the first half of 2014 relative to the last seven years reveals just how well the company performed through the first half of this year versus the traditionally slower season:

Source: Company Investor Relations

Meanwhile, the new leases signed so far this year are down relative to the last half of 2013, compared to all the first half's over the previous seven years, it is performing at an impressive pace.

And hearing Miszewski conclude his remarks on the subject by saying, "[T]his positive momentum has carried through to the month of July and the third quarter is off to a strong start as well," investors can be encouraged knowing the increased activity showed no signs of slowing down.

2. Open spaces are decreasing

As a result of the increased number of signings at Digital Realty Trust, Miszewski went on to add:

[W]e have reduced our finished inventory balance by over 25% since the Investor Day last November.

Source: Company Investor Relations

All REITs monitor their occupancy rates, because if they are unable to rent the property, which they own, the business results will suffer. So knowing in a little more than six months' time the available inventory of properties has fallen by 25% is encouraging.

It must be noted that the same-store occupancy rate has fallen from 92.5% at the end of June last year to 92% in the most recent quarter, but it encouragingly did improve from the 91.3% seen at the end of the first quarter.

3. Pruning isn't just for plants

In his brief prepared contribution to the call, chief investment officer Scott Peterson noted:

[T]he investment team is undertaking a wholesale analysis of every single property in our portfolio. This analysis is well under way and should be complete later this year. The first phase of the project targeted a group of high priority properties consisting primarily of non-core assets, data center properties in non-core markets, underperformers, and at-risk properties. As a result of this analysis, we expect to prune the bottom 5% to 10% of our portfolio in order to refine our strategic focus on future capital requirements and improve return on invested capital.

As noted earlier, fundamentally, REITs are collections of property that are in turn leased out to tenants. As a result, careful analysis of properties that are "underperformers," is critical, because if it is not done, having properties simply sit unoccupied is by and large and waste.

It's great to know that the investment team isn't working toward only finding new areas to invest in, but also ensuring its current set of properties is worthwhile. Peterson provides an encouraging bit of news that poor performers will be sold so the resources can be better aligned to more profitable initiatives.

4. There's one thing we don't know, but should

When discussing the second quarter in a broader sense, interim CEO Bill Stein said:

1.5 years ago at the Citi conference in Florida, Michael Bilerman stepped out of character for a moment and served me up a softball. He asked what aspect of our story was most under appreciated by investors. I responded that it was our global footprint and our enterprise customer base. That was true then, but it's even more applicable today.

At times we can get lost in the shuffle of companies and become enamored with the latest numbers and the financial position of the company as a whole. Yet hearing the Digital Realty Trust acting CEO suggest investors need to better understand the global footprint it operates and its enterprise customers (those big businesses) is something we must all keep in mind.

It's important to remember many of the major tenants at the company are names we hear on a daily basis:

|

Tenant |

Annualized Rent ($in millions) |

% of Annualized Rent |

|---|---|---|

|

CenturyLink |

$87.8 |

7.4% |

|

IBM |

$68.0 |

5.7% |

|

TelX Group |

$48.3 |

4.1% |

|

Equinix Operating Company |

$36.1 |

3.1% |

|

Morgan Stanley |

$31.0 |

2.6% |

|

|

$28.1 |

2.4% |

|

AT&T |

$26.4 |

2.2% |

|

Deutsche Bank AG |

$24.2 |

2% |

|

NTT Communications Company |

$22.8 |

1.9% |

|

JPMorgan Chase |

$22.1 |

1.9% |

Source: Company Investor Relations

And while it isn't as sizable, it's also important to see roughly 12.5% of the property it owns is located internationally.

All of this is to say, the "global footprint" and "enterprise customer base" of Digital Realty Trust are things we must keep in mind.

5. The new leadership is coming soon

In March investors learned Michael Foust, who had been the only CEO of Digital Realty Trust, was stepping down, and Bill Stein would move from being CFO to interim CEO, a position where he still stands. And when asked about who the new CEO would be, Stein said:

[T]he Board continues to be focused on sourcing the right candidate for the job, but no less the timing is still expected to be this year. And meanwhile, this team is focused on executing the strategic vision which we played out to be optimized and return on portfolio, recycling capital, and unleashing the intellectual capital to firm.

While Stein has performed well -- he noted the "Board is comfortable with the leadership that's in place" -- it is encouraging to know progress is being made toward the selection of a new CEO. An understanding of those who are leading the company is critical to an investment decision, so any title of "interim," always leaves uncertainty.

While we may still be months away, it is nice to know we will at least have a definitive answer by the end of the year.

Ultimately, there's a lot to dive into to better understand Digital Realty Trust, and these five bits of insight certainly help paint a clearer picture.