Regional jet maker Embraer (ERJ 4.60%) recently released its second quarter numbers that swept past analysts' estimates. The company scored well on most of the key operating metrics like sales, deliveries, backlogs, operating margin, and net income, much to investors' delight. Negative free cash flow was the only spoilsport, and once again brought to the forefront Embraer's volatility in the area. By reporting good numbers in consecutive quarters, the company is telling the world that it's back in business, after the 2012 slump. Let's dig deeper.

Deliveries aided revenue growth

In the quarter, the company recorded revenue of $1.76 billion, that comfortably beat average analyst estimates of $1.67 billion, and was up 13.1% over the year-ago period's $1.56 billion. The growth came from strong commercial and executive jet deliveries coupled with a 15.5% revenue increase in the Defense and Security segment.

Data source: Embraer 2Q 2014 Earnings Release

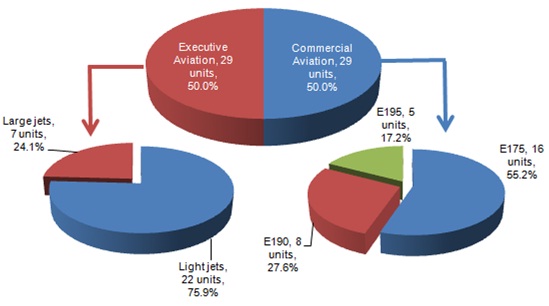

Embraer delivered a total of 58 aircraft, evenly split between commercial and business jets in the quarter. Last year, it had dispatched 22 commercial planes and 29 business jets in the same period. The market for smaller business jets is finally looking up after deliveries fell 62% between 2008 and 2013, according to Bloomberg Businessweek. The news agency reported that deliveries grew 20% in the first half of 2014 as estimated by New Jersey-based aviation consultant Brian Foley. This could mean higher deliveries for Embraer's Legacy 500 and 450 going forward.

Second quarter delivery break-up, chart by author, Data source: Embraer

With 92 dispatches year to date, Embraer's looking to deliver around 197-217 jets for the full year. It's aiming for revenue in the range of $6.0 billion-$6.5 billion. According to a Reuters report, Embraer shouldn't have any problems in meeting its full-year targets, and Joseph Nadal, an analyst with JPMorgan Securities, thinks that Embraer's guidance is "abundantly conservative." The plane maker is focused on maintaining its production rate to manage timely deliveries.

Earnings were encouraging

Embraer reversed its year-ago net loss of $5.3 million, or 0.03 per basic ADS, and reported net income of $143.4 million, or $0.78 per basic ADS (American Depository Share). Analysts were expecting earnings of $0.63 per basic ADS. An ADS is equal to 10 common shares, and earnings per basic ADS is derived by multiplying earnings per share by 10. Embraer benefited from greater operating leverage owing to higher revenue, which helped in leveling off the effect of the unfavorable product mix in the commercial segment and the 8% rise in wages compared to the year-ago period. Its operating profit, or EBIT, rose to $186.8 million from $135.3 million registered in the second quarter of last year, and operating margins widened to 10.6% from 8.7%.

The company's commitment toward lean management and cost efficiency is helping to keep overhead in check. And with the conclusion of the E-Jets E2 development program in June 2013, the quarter's research expenses saw a dramatic fall to $11.4 million from $30.2 million in the same period last year, helping operating profit to grow. Embraer also gained from a tax credit of $15 million on account of foreign currency movement vis-à-vis an expense of $97 million in the second quarter of 2013. For fiscal year 2014, analysts forecast the Brazilian jet maker to earn $2.52 per ADS -- a marked improvement over $1.88 per ADS recorded last year.

Backlog remains stable

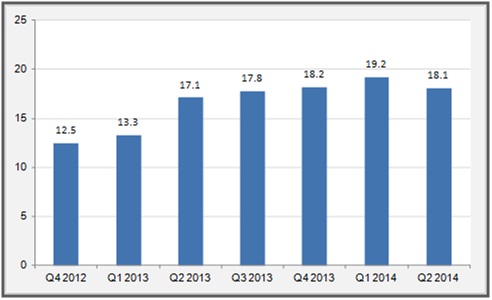

The company ended the quarter with a firm order backlog for 440 jets worth $18.1 billion. The E175 jet remains the jet maker's most popular model, and E2, the next generation E175, has taken second place.

Source: Embraer 2Q14 Deliveries Release

During the quarter, Embraer struck a deal for delivering 60 E175s to American Airlines. In another deal, the plane maker won orders for 100 E175-E2s from Utah-based Skywest. Additionally, Trans States Holdings placed orders for 50 E175-E2 jets worth about $2.4 billion at list price, with purchase options for another 50. Continuous order flow from U.S. based airlines is playing a key role in giving the backlog a much-required boost after the order famine of 2012.

Firm order backlog, in $billion, chart by author, Source: Embraer

Embraer's E2 jets were a big hit at the Farnborough air show held last month. The aircraft maker bagged total orders worth $6.7 billion, which will be reflected in the third quarter's financials. It is keen on getting good orders for its current generation E-Jet in order to facilitate smooth transition to the new model.

Cash generation

Embraer's net cash reduced to a negative $114.3 million from a positive $58 million in the year-ago quarter. Net cash from operating activities fell to $140.1 million over $412.6 million in last year's comparable period on account of a $109.1 million rise in trade accounts receivable, among other things. Embraer generated negative free cash flow of $149.5 million.

However, the company expects to see improvement in cash generation in the second half of the year, which is typical of its business as deliveries are stronger as the year wears on. Its irregular cash flow remains a point of pain, but could stabilize in the future once the jet maker starts dispatching the E2 jets.

Final word

With good traction in commercial orders and outlook for business jets improving, tough days are fading for the once struggling Embraer. The E2 jets have also received a warm reception from airlines, as evident from the order trend. With a decent backlog, better-than expected revenue and profit, the company looks ready to fly high.