The year 2013 was a truly incredible one for American Express (AXP +0.37%) and its shareholders. The company delivered a total return -- including dividends -- of nearly 60%, almost doubling the 32% return of the S&P 500.

But things have come back down to earth in 2014, as the stock has dipped into the red through the first eight months, whereas the S&P 500 has continued its impressive run, gaining nearly 10%.

While American Express has still provided remarkable results, and is topping the return delivered by the S&P 500 since the beginning of 2013 -- roughly 60% versus 45% for the index -- the natural question becomes, will that gap continue to shrink? Or will American Express instead reverse the trend and continue its impressive historical run?

Although we don't know what the ultimate result will be -- no one can-- there are three distinct reasons to think the future of American Express could be bright, and its stock price will be on the rise.

1. Great broader industry trends

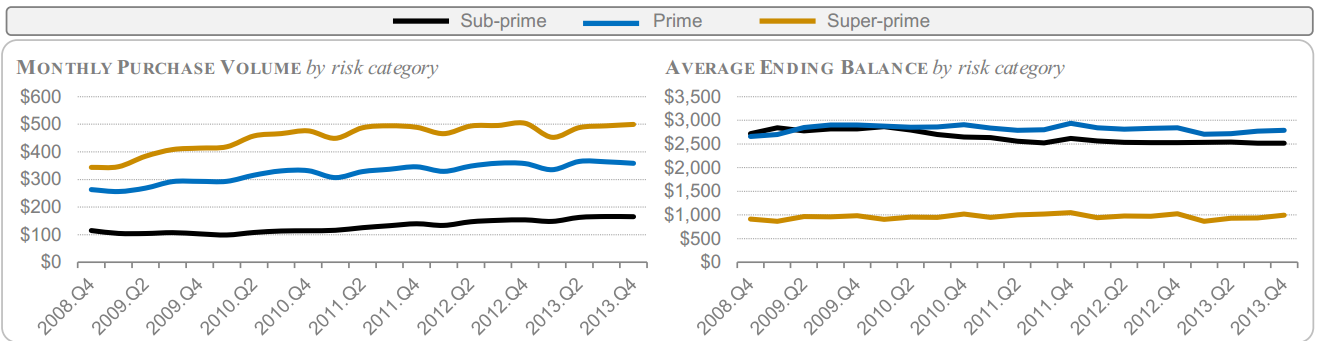

Since the depths of the financial crisis, one of the most fascinating things is the broader trends of the credit card industry. As the American Bankers Association has continued to show, while the average spending on credit cards has continued to rise during the last five years, the average balances have essentially remained flat:

Source: Q2 2014 American Bankers Association's Credit Card Market Monitor.

As you can see, this is most notable among those borrowers designated as "super-prime" -- the ones with the best credit scores. This is the exact target market of American Express.

But you may be asking yourself, because people are racking up an unchanged amount of debt on their credit cards, doesn't that bode poorly for American Express, because it won't be collecting additional interest income from the loans it issues? That's a great question; but, as it turns out, that actually isn't the case.

Source: Flickr / Images of Money.

In 2013, just 15% of the total revenue at American Express came from net interest income, which is the interest it collects on loans. By comparison, the credit card business at Capital One (COF +0.58%) saw 77% of its revenue come from interest income.

Because American Express offers a closed-loop network, it saw more than half -- $18.7 billion -- of the revenue it brought in last year come from discount revenue. As the company defines it, this is "fees generally charged to merchants when Card Members use their cards to purchase goods and services at merchants on our network."

In fact, American Express notes that its capability as a closed-loop network, where its success is principally driven by what its customers spend on their cards -- and which it calls a "spend-centric business model" -- is one of its most essential competitive advantages. The broader reality -- that the highest quality customers are spending more and more on their cards each month -- will only be a good thing for American Express.

2. Continued share buybacks

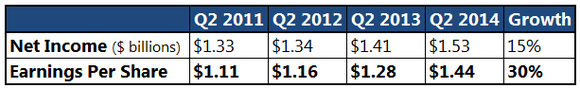

While this isn't exactly fresh news -- I highlighted it in the coverage of earnings -- American Express also could see its stock rise as a result of the continued dedication of management to buy back stock. During the last three years, it has watched its shares outstanding drop by 12% and, as a result, while its net income has risen 15%, its earnings per share -- that which is actually available to shareholders -- has grown by 30%:

Source: S&P Capital IQ,

But one of the most striking examples of share buybacks is the massive stake Warren Buffett has in American Express through Berkshire Hathaway (NYSE: BRK-A)(NYSE: BRK-B). He hasn't added to his position in the company since 1998, when his ownership stake stood at 11%. Yet, thanks to the continual buybacks the company has made during the last 15 years, the ownership stake of Berkshire stood at 14.2% at the end of 2013. As a result, that increased ownership of American Express meant an additional $172 million of the $5.4 billion in income American Express earned in 2013 is technically available to Berkshire.

Of course, for individuals, those numbers will be markedly smaller; but it goes to show how much value a dedication to share buybacks can provide to investors.

3. Capable evolution into the new payments landscape

Much has been made about the evolution in the payments landscape. From newcomers like Apple, Amazon, and Facebook to old timers like American Express, it seems like a day does not go by without some report of evolution in the industry.

But, as a recent Fortune Magazine interview noted, no matter what changes occur, "Ken Chenault [CEO of AmEx] plans to insure that American Express remains in the center of every transaction."

Chenault went on to say:

We have the largest integrated global payments platform. We bring together users, card members, and merchants, and the data is incredibly valuable. We know where they spend online and offline. We want to deliver benefits and services when our card members want it, where, and how they want it.

Chenault wants us to see that, no matter how an individual pays for something -- whether it be a card or a phone or something altogether different -- American Express will be the preferred means for millions when the transaction is done.

We must remember all of these entrants from the technology landscape aren't threatening the business of American Express; they're just evolving how payments are made, not who they are with. As a result, AmEx is poised to continue its dominant position no matter how the industry shifts.

The Foolish bottom line

More work needs to be done before a definitive investment decision can be made; but the reality is, there's a lot to like about American Express. These three reasons are just scratching the surface when you consider why its stock could rise.