Target's (TGT +1.45%) latest quarterly earnings results didn't do much to change the story of a retailer in distress. It's struggling to find growth in the U.S. while at the same time getting pinched by major losses from its expansion into Canada. Still, the company is under new management now, and the business is starting to show faint signs of a recovery that could drive a rebound in the stock.

With that bigger picture in mind, here are a few key highlights from management's recent conference call with analysts.

Focusing on digital sales growth in the U.S.

New CEO Brian Cornell. Source: Target.

CEO Brian Cornell officially took over the retailer's top spot in August, giving him just a few months to get settled before the holiday season selling crush. His strategic review of the business isn't complete, but it's far enough along that investors can see outlines of the new direction that the executive team is taking.

For example, management is looking at better integrating Target's online business with its physical store footprint in the United States. "We need to build capabilities focused on satisfying the wants and needs of our guests and ensuring that our digital and store operations operate seamlessly to provide a single superior solution," Cornell said. That might be enough to kick sales growth back into firmly positive territory again. Comparable-store sales were flat last quarter, but started trending slightly higher in the month of July.

Revamping the product assortment in Canada

In Canada, where the sales growth shortfall is much worse, bigger changes are in the works. In fact, the stores are going through a sort of relaunch between now and the holiday season, which is good news considering that the segment has lost more than $400 million so far this year. Here's how Executive VP Kathee Tesija described the new strategy:

We are adding product lines that our guests told us were missing from our everyday lineup. We are adding more newness to our stores and we are adding more exclusive items and designer partnerships what we are known for in both the U.S. and Canada. Putting all these changes together means that of the 70,000 items in a typical Canadian Target store, about 30,000 items will be new between now and the holiday season.

Ending the profitability dip

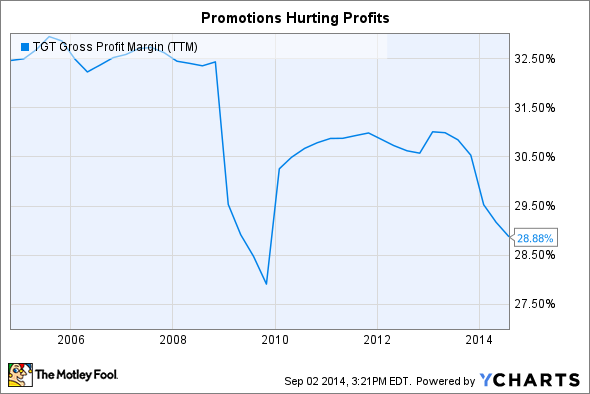

Price cuts have been hurting profitability for most retailers, including Target, which saw its profit margin slip a full percentage point last quarter, to 30% of sales.

TGT Gross Profit Margin (TTM) data by YCharts

But that trend could be turning positive again as customers are showing signs of shopping with a bit less caution. Here's Chief Financial Officer John Mulligan:

We are working to moderate our promotional intensity to a level we believe is more appropriate in the long run. We are encouraged with the recently improved U.S. comparable sales trend, in particular because our promotional intensity over this period was not as elevated as earlier in the year.

Still no share buybacks

Target's profitability may be set to recover, but the business isn't nearly strong enough to support capital returns in the form of stock repurchases. Those won't resume until management sees steadier growth in the U.S. and a much stronger operation in the Canadian market.

In the meantime, Target will be marshaling its resources with the aim of strengthening its balance sheet. "We expect to continue to suspend cash investments in share purchases until operating performance improves," Mulligan said.

A (slightly) improving outlook

Management sliced its overall profit forecast for the year on account of the underperformance in its business these last six months. That outlook includes a steadily improving profit picture in the U.S. and some recovery in the Canada segment.

However, the company expects to book a brutal profit margin of -25% in Canada along with sluggish sales growth of between 0% and 1% in the United States. "These expected results are clearly not where we expect to perform over the longer term," Tesija said.