On March 1, 2013, Doomsday was supposed to arrive for the defense industry.

That was the day that Congress first officially implemented "the sequester" -- the absolute, honest-to-goodness, we're-really serious-this-time policy of curtailing defense spending to help get the federal budget deficit under control. But a funny thing happened on the way to sequester.

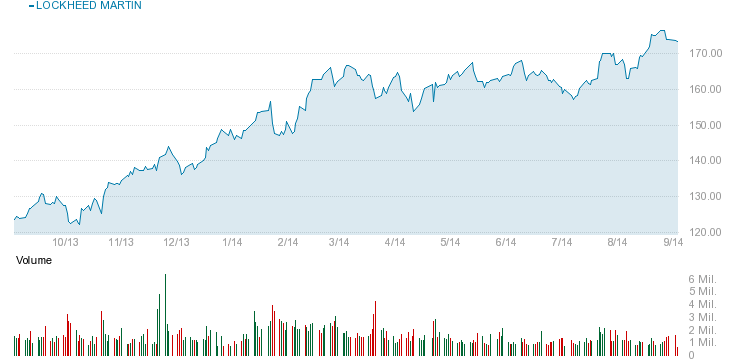

Congress implemented it, yes. Defense spending dropped precipitously, also yes. But no sooner had the sequester begun to bite than Lockheed Martin (LMT +0.65%) stock took off on a tear.

It hasn't looked back since.

Source: Motley Fool CAPS

For investors who took my advice, ignored the doom-and-gloom pundits saying defense stocks had no chance of outperforming in the face of reduced government spending, and added Lockheed Martin to their long-term portfolios regardless, this has been a great boon. Since I named Lockheed Martin stock my favorite idea for The Motley Fool's "10 Core Stocks for Your Portfolio" series four years ago, the stock is up more than 140%. That includes the 97% run-up since "Sequester Day," March 1, 2013.

And yet, gratifying as this profit may be, it does pose a difficult question for investors today: Has Lockheed Martin stock already run as high as it will go, or is there still time to buy the stock at perhaps ride it a bit higher?

That's what we're going to try to figure out today.

Valuing Lockheed Martin stock

Priced at almost precisely 18 times earnings today, but expected by most analysts to grow these earnings at barely 9% annually over the next five years, Lockheed Martin appears to be one pricey stock. If "value investors" prefer to buy stocks at PEG ratios of 1.0 or less, then Lockheed Martin's valuation of more than 1.9 seems a high price to pay -- but there are caveats to that quick-and-dirty analysis.

For one thing, Lockheed Martin is a lot more profitable than it looks. True, calculated according to generally accepted accounting principles (GAAP), the company earned only $3.2 billion in profit over the past 12 months. But Lockheed Martin's cash flow statement shows that actual cash profits at the company -- free cash flow -- were closer to $4.1 billion. Valued on free cash flow, therefore, the company's selling for a P/FCF ratio of only 13.3. That's a much more attractive number.

Cash is good. Cash in hand is even better

And let's not forget that Lockheed Martin pays its shareholders a tidy 3.2% dividend yield, either. One half of investing legend John Neff's total return ratio, a large dividend can go a long way toward closing the gap between a large P/E (or P/FCF ratio) and a smallish growth rate. Add Lockheed's dividend yield to its projected growth rate, and investors can probably expect to earn a "total return" (earnings growth plus dividend checks) of about 12.6% annually on Lockheed.

Relative to Lockheed Martin stock's P/E ratio, that still seems low. But relative to the stock's more important P/FCF ratio of 13.3 -- well, a 12.6% total return seems pretty fair to me. It's not cheap exactly, but it is fair.

Caveats and provisos

There is one thing that defense investors should be aware of, though: Historically, aerospace and defense stocks in the U.S. tend to sell for valuations of roughly 1 times sales. (That's not a hard-and-fast rule -- just something I've picked up on from following this industry during the past decade or so). Fast growers, which are projected to grow at better than 10% annually, tend to fetch somewhat more than 1 times sales. Strong profit producers -- greater than a 10% net profit margin -- likewise receive higher valuations.

Now here's the thing: Valued on its sales, Lockheed Martin sells for more than 1.2 times sales, which puts it above the historical average. And Lockheed Martin isn't growing at 10% -- and doesn't earn a 10% net profit margin, either! (Its actual net: about 7.1%).

Foolish takeaway

How to sum up my read on Lockheed Martin? Let's put it like this: At 13.3 times free cash flow, the stock looks like it might be fairly priced. It actually looks to be just on the wrong side of fairly priced. Valued on P/E, however, the stock seems to sell for a significant premium, and valued on P/S, the stock is trading above historical norms for the aerospace and defense industry.

Long story short, I see more arguments against buying Lockheed Martin stock today than arguments in favor of it. While the stock is not a clear sell -- and it does pay a hefty dividend yield, which is another argument for just sitting tight and letting the checks roll in -- I see no compelling reason to rush right out and buy it today. Feel free to wait for a pullback before diving in.

Lockheed Martin stock is flying high. But when will the bomb drop? Photo: Lockheed Martin