It is no secret that offshore oil drillers have had a tough year. Shares of Transocean (RIG +1.02%), Seadrill (SDRL +0.00%), Ensco (ESV +0.00%), Noble (NE +0.00%), and Diamond Offshore (DO +0.00%) have all badly underperformed the market in the last 12 months.

RIG Total Return Price data by YCharts.

Oil companies have cut exploration and production budgets and pushed off new drilling projects later into 2015 and 2016.

This weakening demand is being met with a flood of new rig deliveries that threaten dayrates and have resulted in shorter contracts that reduce cash flow predictability in an industry known for two things: being severely capital intensive and paying sky-high dividends.

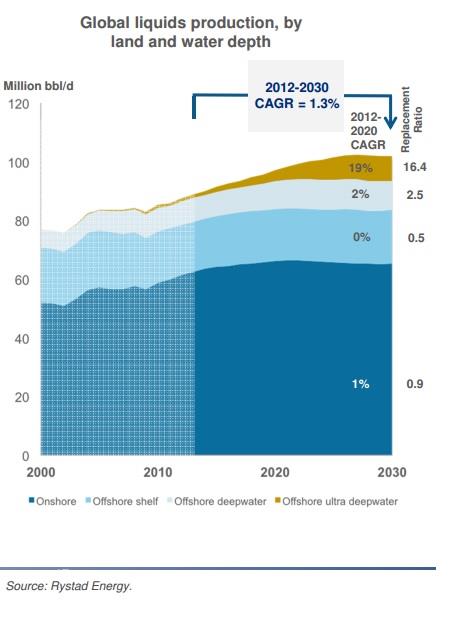

However, ultra-deepwater drilling, or UDW, is still projected to be one of the hottest energy trends of the coming decades, with production growing 19 times faster than conventional onshore oil output.

Source: Seadrill 2014 Howard Weil Energy Conference presentation

As with any cyclical industry, the best time to invest is when Wall Street is most pessimistic, so now we'll look at Transocean and its peers to see whether this is the right time for long-term investors to cash in on one of the hottest trends in energy.

Deep discounts available

| Company | Historical Operating PE | Current Operating PE | Historical Discount (based on PE) | Historical P/CF | Current P/CF | Historical Discount (based on P/CF) |

| Transocean | 43.5 | 8.8 | 79.80% | 14.4 | 5.8 | 59.70% |

| Seadrill | 18 | 13 | 27.80% | 10.6 | 9.2 | 12.20% |

| Ensco | 20 | 8.5 | 57.50% | 11.2 | 6 | 46.40% |

| Diamond Offshore | 25.9 | 12.1 | 53.30% | 13.3 | 6.4 | 51.90% |

| Noble | 19.5 | 9.4 | 51.80% | 10.9 | 4.2 | 61.50% |

Sources: Yahoo Finance, S&P Capital IQ.

As the above table shows, the entire offshore industry offers deep valuation discounts in terms of historical operating earnings and cash flows. So now is indeed the time for long-term income investors to buy. But which company should you invest your hard-earned money in? That is where long-term analysts come to a conclusion that I must disagree with.

Shocking long-term forecasts

| Company | Projected 10-Year Annual Earnings Growth Rate | Projected 10-Year Annual Dividend Growth Rate | Projected 10-Year Annual Total Return |

| Transocean | 9.63% | 12.62% | 16.40% |

| Seadrill | 2.73% | 0.49% | 11% |

| Ensco | 2.33% | 1.79% | 10.90% |

| Diamond Offshore | 14.54% | 12.09% | 19.00% |

| Noble | 7.93% | 10.59% | 16.20% |

| S&P 500 | 9.20% |

Sources: Fastgraphs, Moneychimp.com.

As shown in this table, analysts expect the entire offshore drilling industry to beat the market over the next decade. While that's not in and of itself surprising, what I find shocking is that Transocean, Diamond Offshore, and Noble -- companies with the oldest rigs and highest numbers of contracts expiring within the next two years -- are expected to be the superstars of the industry.

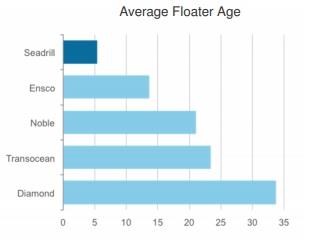

Source: Seadrill 2014 Howard Weil Energy Conference presentation

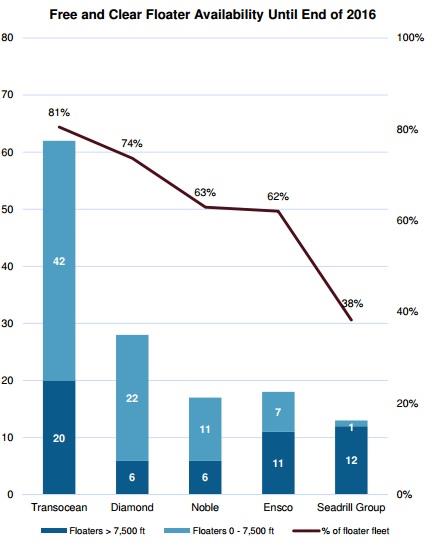

Source: Seadrill Q2 Earnings Presentation

As the above images show, when it comes to deepwater and ultra-deepwater drill ships (the most profitable ships in the industry) Transocean, Diamond Offshore, and Noble have the oldest, least advanced fleets. They also face enormous pressure with vast numbers of contracts expiring within the next few years, just when dayrates are expected to be weakest.

For example, according to Deutsche Bank, over 70% of Transocean's fleet is going off contract by the end of 2015. Many of those rigs are obsolete, and the bank projects weak utilization that will result in plummeting dayrates or even Transocean scrapping the rigs entirely.

Why the analysts are likely wrong

The updated long-term analyst forecasts are vastly different than just a few weeks ago, which showed Seadrill and Ensco dominating their older competitors over the next decade. I can think of three reasons that those forecasts have now been flipped on their head.

First, Seadrill's latest quarterly report, which saw a 63% earnings drop, were disheartening, with management citing "fierce" competition for new contracts and announcing it would halt ordering new rigs until market conditions improved.

Second, Transocean has had some success with securing excellent dayrates for its newly built ultra-deepwater drill ships. For example, its two newest rigs, the Deepwater Invictus and Deepwater Asgard, just secured respective three-year contracts at $595,000 and $600,000 per day.

However, none of Transocean's seven UDW newbuilds are set for delivery prior to the first quarter of 2016, meaning that 70% contract cliff it faces over the next year or so will not have the benefit of such lucrative contracts. Rather, Transocean will have to rely on rigs such as the CSF Celtic Sea and Jack Bates, which are 32 and 28 years old, respectively. The contracts for these rigs expire in October and December of this year, and their subsequent dayrates are likely to decrease from the current $328,000 and $420,000.

The third and final reason I think the analysts' long-term forecasts are wrong regarding Transocean, Noble, and Diamond Offshore, is that they are based on the assumption of massive multiple expansion, to operating P/Es of 16, 15, and 16, respectively.

This represents 82%, 32%, and 60% expansions of these companies' operating P/E ratios. For that to occur, the entire offshore drilling market would need a very solid recovery, with demand outstripping supply and allowing companies to secure the kind of dayrates Transocean acquired for the Invictus and Asgard, but for longer periods of time.

While Seadrill's management and analysts fully expect the offshore drilling market to recover in 2015 and 2016, this market recovery would help Seadrill more than Transocean, since Seadrill has 11 UDW rigs set for delivery through 2016, while Transocean has just two (and seven total UDW newbuilds under construction).

The bottom line

Right now is the time for interested long-term income investors to buy offshore oil drillers that are trading at deep historical discounts to operating earnings and cash flows, and yielding far more than the market in general. However, I would recommend investors select younger, more nimble companies such as Seadrill or Ensco, over competitors such as Transocean, Diamond Offshore, and Noble. While long-term analyst forecasts currently show those last three companies doing the best over the next decade, these projections are prone to change, and I feel that Seadrill and Ensco have superior company fundamentals that are likely to prove the analysts wrong. When it comes to dividend sustainability, I believe Seadrill and Ensco offer superior safety and better long-term growth prospects, which are likely to result in market-crushing total returns over the next decade.