There are an endless number of metrics one can use to pick a bank stock. But none is more important than the efficiency ratio.

Calculated by dividing operating expenses by net revenue, this ratio tells you how much it costs to produce each dollar of revenue. A ratio of 45% means it costs $0.45 to produce $1 in revenue. A ratio of 75% means the same $1 in revenue costs $0.75 to produce.

Another way to look at it is that the efficiency ratio tells you how much revenue will be left over to pay taxes and distribute to shareholders via share buybacks and/or dividends. A lower ratio means that more revenue flows through to the bottom line. A higher ratio means less is available to pass onto shareholders.

It's probably obvious that the objective is to avoid banks with high efficiency ratios. And it's with this in mind that I created the following list, which sorts the nation's biggest publicly traded banks according to how inefficient they were in the latest quarter:

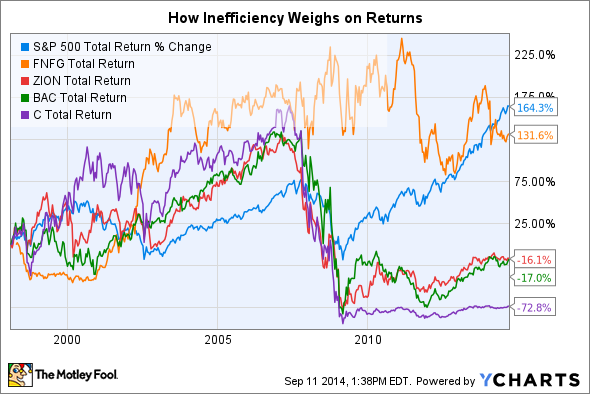

The five least efficient banks on the list are Bank of America (BAC +1.86%), Citigroup (C +1.80%), Zions Bancorporation (ZION +0.59%), City National, and First Niagara Financial. Not coincidentally, with the exception of City National, all of these banks have underperformed the broader market over the past roughly two decades.

Since the mid-1990s, Citigroup is down by 73%, Bank of America is lower by 17%, Zions Bancorporation is off by 16%, and First Niagara Financial is up by 132%. Meanwhile, over this same period, the S&P 500 has advanced by 164%.

It's worth noting, moreover, that the relationship between low returns and a high efficiency ratio goes beyond the obvious. Namely, because banks with higher efficiency ratios are innately less profitable than their more efficient peers, the former have a greater incentive to stretch for yield by underwriting dubious loans.

As Columbia business school professor Charles Calomiris explained in relation to the financial crisis (emphasis added): "Given an environment in which risk-taking with borrowed money was considered normal, it is easy to understand why some bankers, particularly those who were having trouble competing against more efficient rivals, decided that the right strategy was to throw caution to the wind."

The point here is that the efficiency ratio, while it may be just one metric, may very well be the single-most important one when it comes to bank stocks.

Editor's note: In a previous version of this article, PNC Financial's efficiency ratio and total assets were misstated in the table. The Motley Fool regrets the error.