It's been a confusing year for investors in Johnson Controls (JCI 0.85%). The company is best known for its automotive products (mainly batteries and car interiors), and the automotive industry has been an outperformer recently within the industrial sector. In turn, the company has outperformed its peers, and its own expectations, with its automotive experience (car interiors and seating) segment. However, the stock is down nearly 7.5% year to date. Clearly, management needed to explain a few things during its third-quarter conference call, and here is what they said.

Cautiously optimistic on building efficiency

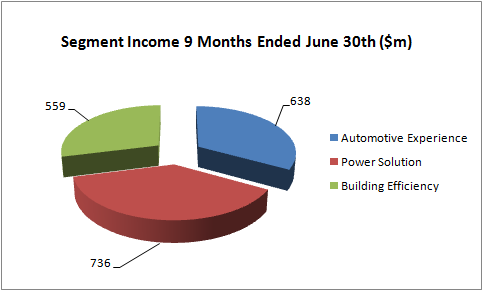

Before diving into the conference call, let's take a look at this chart, which depicts Johnson Controls' three segments by income for the first three quarters of its fiscal year.

Source: Johnson Controls company presentations.

Automotive experience (seats and interiors) and power solutions (automotive batteries, of which roughly three-quarters go to the aftermarket) make up the bulk of profit, but the company is investing in its building efficiency (heating, ventilation, and air conditioning, or HVAC) segment in order to diversify its income stream. More on that later.

Essentially, the company has disappointed in fiscal 2014 because its power solutions business came in with growth lower than expected earlier in the year, mainly due to a warmer winter in Europe reducing aftermarket demand for car batteries. In addition, the expected pickup in the HVAC market hasn't happened yet. In short, despite income from continuing operations before income taxes rising nearly 20% in the first nine months, results have disappointed.

All of which leads to the first takeaway. Management's commentary on the building efficiency segment could be described as cautiously optimistic. For example, CEO Alex Molinaroli described the building efficiency environment as follows:

We are seeing pipelines that are improving, but I would like to be able to see that a little bit more, so maybe next time we get on the call we will be able to talk about that. We just have been burned a few times, so I just want to make sure we don't kick that can again. But we are seeing underlying orders improved.

Building efficiency performance better than headline numbers suggest

It wasn't a good quarter for the building efficiency segment on a headline basis. Net sales declined 4% and segment income was down 3%, with third-quarter orders coming in 8% lower than last year. However, management cited two reasons that the underlying performance isn't as bad you might think.

First, excluding the impact of divestitures and its facility management business, global workplace solutions sales were only down 1%. Second, last year's third quarter included some abnormally strong activity -- making this year's comparison a lot harder -- including a "$70 million hospital job" and "two very large airports, infrastructure airports in Brazil, and also some stadium work," according to Molinaroli.

Diversifying end markets

The automotive market has always been cyclical, and management is trying to de-risk the overall business by chasing growth in its building efficiency segment. Indeed, Johnson Controls signaled its intent with the recent agreement to acquire air distribution and ventilation company Air Distribution Technologies for $1.6 billion.

Moreover, the acquisition helps Johnson Controls to diversify away from its core institutional exposure in the building markets. According to Molinaroli:

[W]ith the ADT acquisition we have doubled our exposure on the light commercial side ... the light commercial ex-residential we have probably quadrupled it. And so that part of the market is showing the most signs of life. And so we have gone from having say $300 million or $250 million exposure there to now versus here at about $1.3 billion of exposure there.

In addition, an announced joint venture with Hitachi Appliances will give exposure to "a midmarket light commercial" market, according to Molinaroli.

Auto experience continues to outperform

The fourth takeaway is that the automotive experience segment continues to positively surprise management and investors. At the start of the year, management cited roughly 1%-2% full-year revenue growth for the segment, but in the first nine months it came in at 9%. In addition, segment income was up 36% in the first nine months. And the outperformance in Europe -- where the biggest surprise has come from -- seems to be continuing. CFO Bruce McDonald said:

So, if you look at the vehicles that we're on, they have done well on the market generally speaking, the customers that we have high exposure to have done well, particularly in Europe on the premium side.

The segment's net sales were up 7% in the third quarter.

Free cash flow improving

The final takeaway relates to free cash flow generation, an area in which management has previously conceded improvement was needed. The good news is that McDonald predicted free cash flow would improve to $1.6 billion this year. A quick look at free cash flow generation in recent years demonstrates the improvement.

| Metric | 2011 | 2012 | 2013 | 2014 Est. |

|---|---|---|---|---|

| Revenue (in billions) | 40.83 | 41.96 | 42.73 | 43.18 |

| Free cash flow (in millions) | (249) | (272) | 1,309 | 1,600 |

| Conversion into free cash flow | N/A | N/A | 3.06% | 3.7% |

Source: Johnson Controls company presentations.

The Foolish takeaway

All told, management tentatively suggested there were signs of improvement in the building efficiency segment, and the company's diversification beyond the automotive markets is ongoing. Meanwhile, the automotive experience segment continues to perform strongly and the power solutions unit remains solid with 6% sales growth in the quarter. Free cash flow generation is improving, and Johnson Controls is well placed to benefit from any pickup in institutional and commercial construction markets. Johnson Controls is a stock to watch.