Seadrill Ltd's (SDRL +0.00%) stock has been absolutely crushed this year. A falloff in capital spending by oil producers has caused a slowdown in the offshore rig market at a time when Seadrill and many of its competitors are flooding the market with new rigs. However, the company's sell-off has really accelerated over the past few months due to plunging oil prices.

Those negatives aside, Seadrill has gone on record to say that its current dividend is sustainable through at least 2015. Further, it sees the current slide in oil prices being eerily similar to the days preceding the last time oil prices skyrocketed, suggesting oil prices could surge again. So, while Seadrill's stock could still have further to fall, I'm taking advantage of the company's sagging stock price to buy more for my portfolio.

Why I think Seadrill stock is a buy

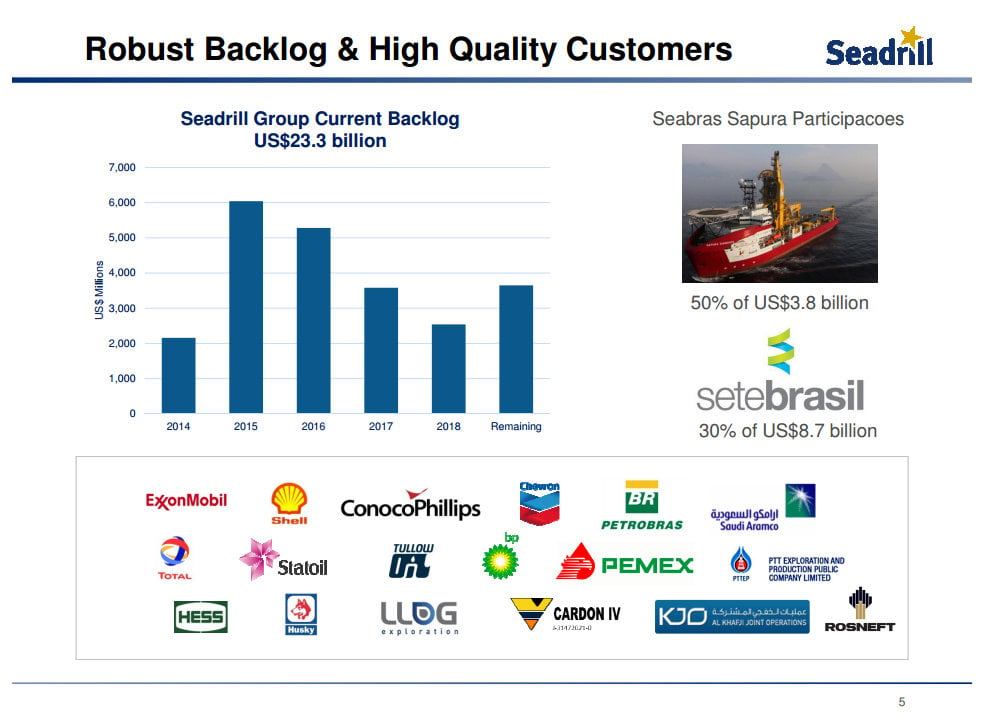

Despite the current storm in the offshore rig market, Seadrill has enjoyed a number of solid contract wins this year. The company's West Jupiter drillship recently secured a 5-year $1.04 billion contract with Total (TOT +0.00%) while its West Saturn drillship won a two-year $0.46 billion contract with ExxonMobil (NYSE: XOM). These contract wins along with the Rosneft deal signed by its publicly traded subsidiary North Atlantic Drilling (NYSE: NADL) pushed Seadrill's group wide backlog to $23.3 billion across a strong set of high quality customers as noted on the following slide.

Source: Seadrill Ltd Investor Presentation

From that slide we can see that the company has $6 billion in revenue contracted for 2015 and well over $5 billion contracted for 2016. This firm contract backlog for next year and well into 2016 is why Seadrill went on record in its second quarter earnings release to say:

The Board had communicated earlier that this dividend level is sustainable until at least the end of 2015. With the recent contract announcements and the solid execution on the financing side, the Board is pleased to report that we feel increasingly comfortable that this period can be extended well into 2016 without any significant recovery in the market. As future units are introduced into the fleet, operating results are likely to show strong growth.

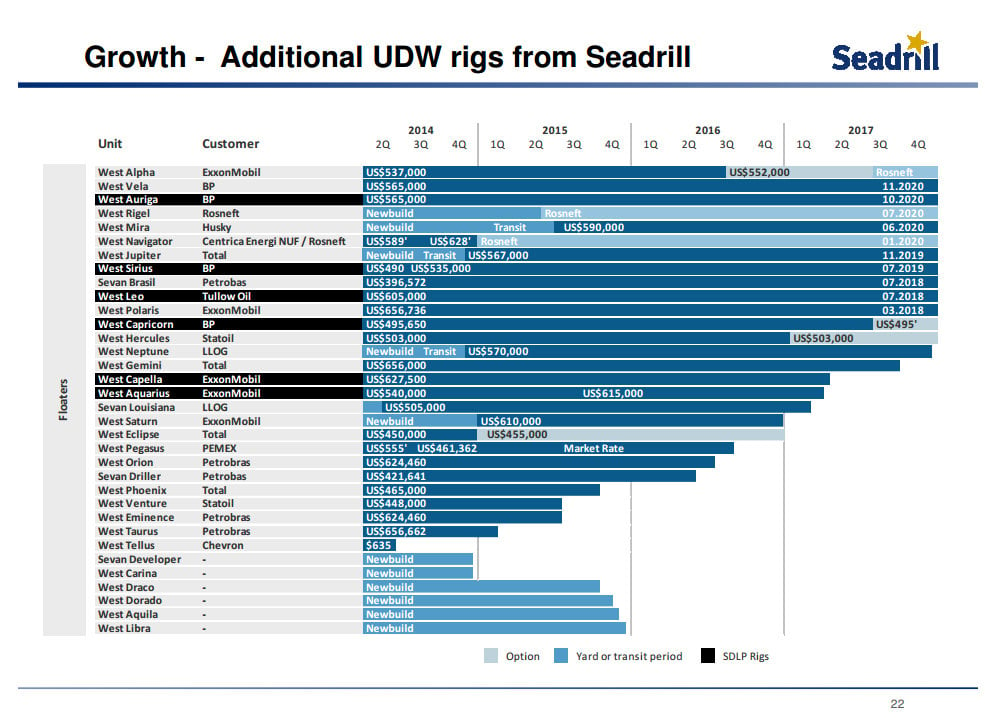

The reason Seadrill is growing more confident in its ability to sustain its dividend is found in the strength of its contract backlog and its fleet. As the following slide shows, most of the company's rigs are under contract for next year already, and those that aren't under contract are mainly brand new rigs, which have a greater chance of winning a contract over an older rig because drillers prefer the safer, more technologically advanced newer drilling rigs.

Sources: Seadrill Ltd Investor Presentation

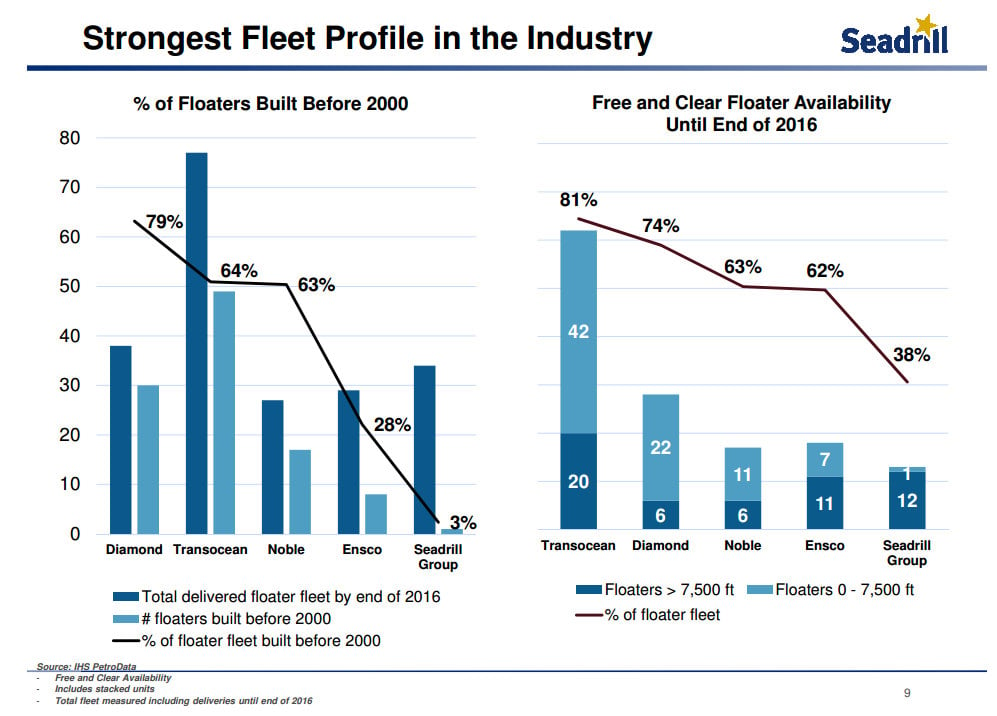

In fact, unlike most of its peers, Seadrill only has to worry about finding contracts for 38% of its fleet through the end of 2016, while also offering drillers one of the youngest fleets on the market as we see in the following slide.

Sources: Seadrill Ltd Investor Presentation

Because of this, Seadrill should have a much easier time than its competitors to find contracts for its fleet at solid day rates. This will allow the company not just the ability to sustain its dividend, but potentially give it the capacity to grow the payout even further in the future.

Investor takeaway

There is no guarantee that Seadrill will be able to find contracts for its uncontracted fleet. However, the company is in a better position than any of its peers because it has the fewest vessels lacking contracts as well as some of the newest vessels on the market. That's why I'm taking advantage of the current sell-off in Seadrill's stock to add to my position in this top dividend stock.